Upstart, the millennial focused p2p lender today announced a huge deal with Victory Park Capital. This commitment raises Victory Park’s investment from $100M to $500M in Upstart loans. This isn’t Victory Park Capital’s first big deal in 2015 as they announced a $420M investment in Funding Circle this past February.

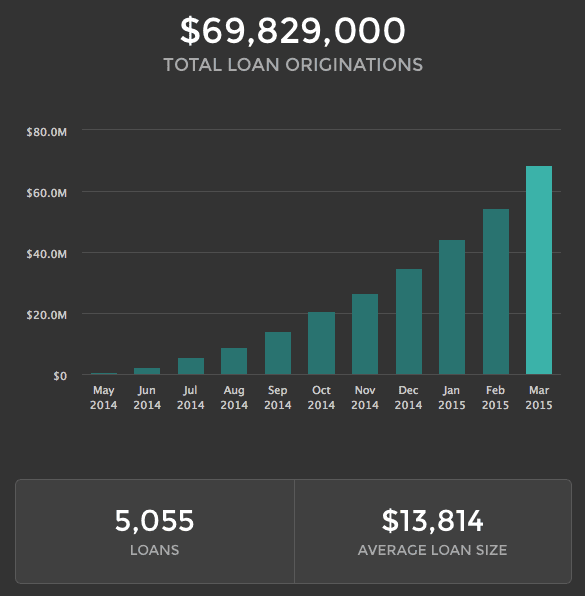

We reached out to Paul Gu, co-founder of Upstart to learn more about this deal. Paul had several interesting things to say about the events that lead to this commitment from Victory Park, one being their growth. In just their first 11 months of originating, they have originated $70M worth of loans. They hope to do at least twice that in the remainder of 2015 as growth in loan originations remains strong month to month. Although this is a large commitment, Paul stated that diversity of capital is still very important to the Upstart team and they continue to be open to other investors.

Secondly, Upstart continues to stay focused on the niche of younger borrowers, with most borrowers being in their late twenties. They do also have some more traditional prime borrowers as well. Regarding returns, the yield is slightly decreasing as Upstart offers more attractive rates for borrowers and Victory Park is satisfied with their loan performance. Average return for investors across all loan grades is 7.63% as noted in their investor portal.

Lastly, we asked about borrower acquisition. A majority of their advertising is digital, which is not surprising given the demographic they are after. He did note that they have been very successful in acquiring borrowers via mobile channels, which is interesting given the marketing channels that Lending Club and Prosper focus on.

This is no doubt a great accomplishment for the team at Upstart as they have been originating loans for less than a year. It will be interesting to watch them as they operate a marketplace focused on a more niche demographic than many other platforms.