There has been a lot of news recently with regards to interest rates and loan performance on the Lending Club and Prosper platforms. While some may argue that these concerns are unfounded, investors are clearly taking an increased interest with the changes going on and the recent market volatility. In this post, I’ll address interest rate increases and then delve into vintage performance at both Prosper and Lending Club, which is the best gauge of performance.

Below are stories that received a lot of press, leading to additional speculation of poor loan performance:

- Santander recently sold nearly $1 billion of Lending Club loans to JP Morgan.

- Several articles were released stating that the Lending Club models had “misfired”. This report was addressed by Lending Club directly who stated that the chart in question was misinterpreted. The truth is that while some pockets of loans out-perform and some under-perform, general performance is in line with expectations.

- This past week, news broke that Moody’s may downgrade bonds sold by Citigroup which included loans originated by Prosper citing slower repayment and increased charge-offs.

- Today the Financial Times came out with this article discussing possible worrying signals from p2p lending platforms.

Increasing Interest Rates at Lending Club and Prosper

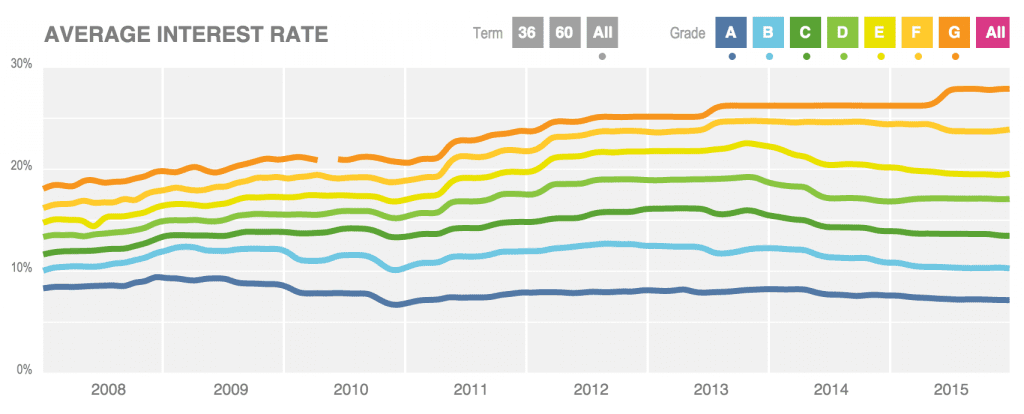

Increasing interest rates at Lending Club started back in December when the Fed increased interest rates by 0.25%. Lending Club responded immediately and raised interest rates by the same amount and subsequently increased rates again in late January. In Lending Club’s Q4 2015 earnings call CEO, Renaud Laplanche cited concerns in the global economy for increasing interest rates. The increase gives investors coverage if we experience an economic slowdown. As Renaud stated, one of the benefits of a marketplace model is pricing equilibrium. If there is any sign of degradation, they will act accordingly.

The increasing interest rates on Lending Club is a reversal of what we have seen since the beginning of 2014. The below chart taken from Lending Club’s statistics page shows the steady decline of interest rates across a majority of loan grades on the platform. Renaud stated several times throughout 2015 during earnings calls that investors were willing to accept lower yields given the confidence in past performance. The sentiment has now changed, but it’s important to understand the historical trend of interest rates over the last few years.

We reached out to Prosper for this article, who also announced increased interest rates this month. According to Prosper:

The recent move to increase risk-adjusted returns is a continuation of moves we began making in August of 2015. The move highlights our dedication to running a balanced marketplace that provides fair rates to borrowers and investors alike. Since 2013, the cumulative loss of our book has remained very stable (as indicated by the charts later in this post).

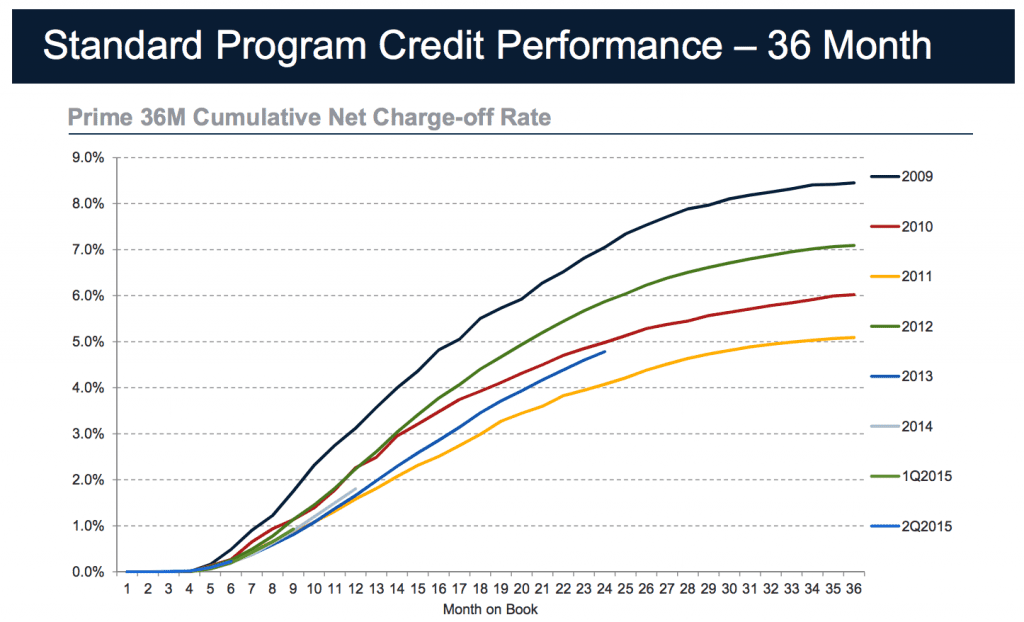

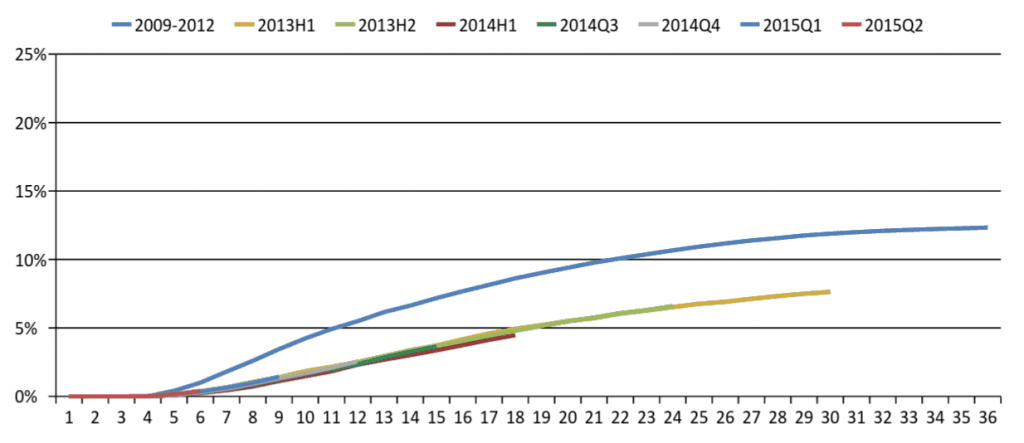

Lending Club Loss Curves

Below are Lending Club charge-offs by vintage for both 36 and 60 month loans taken from their earnings presentation. While it is still very early for the 2015 vintage loans, they appear to be tracking with other vintages that have experienced lower charge-offs.

In the case of 36 month loans, there is a clear difference from the worst vintage in 2009 compared to more recent vintages. If you’re interested in a more detailed look at performance by vintage you can view the cumulative charge off rates in spreadsheet format at additionalstatistics.lendingclub.com.

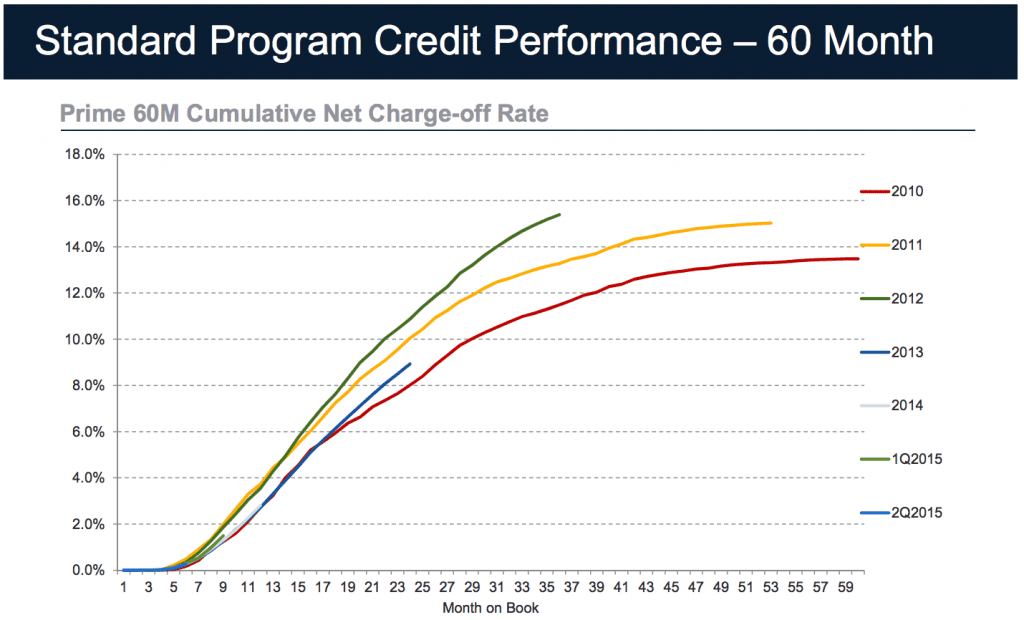

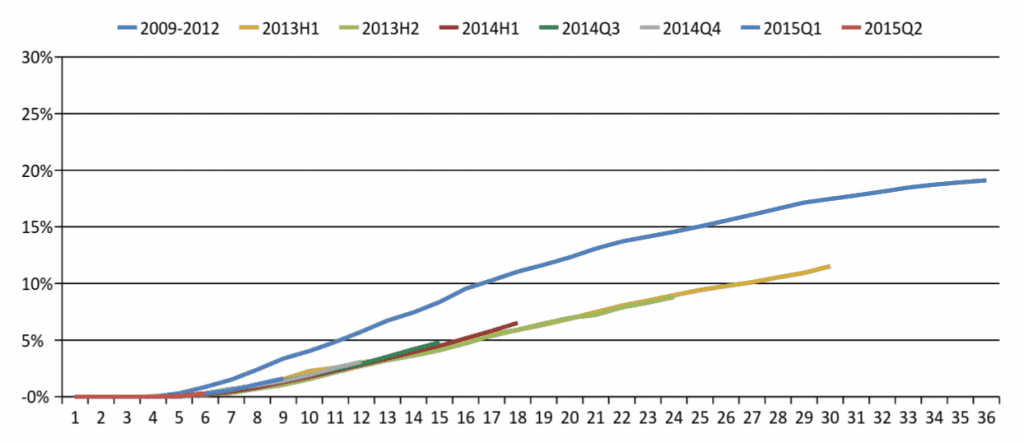

Prosper Loss Curves

Prosper’s loss curves paint a similar picture to that of Lending Club’s. It appears that all vintages are tracking on a similar course at this time with losses remaining far below the performance we saw from 2009 through 2012.

Independent Analysis from PeerIQ

Over the weekend PeerIQ released this excellent analysis on the potential Moody’s downgrade of Citi’s bonds noted at the beginning of this article. They have confirmed what we have shown above. Loss rates remain relatively steady with a mild increase in delinquencies in the second half 2015 loans compared to the previous year. Based on their analysis, concerns of some media pundits are overblown.

While we should be paying close attention to delinquencies, and it is certainly possible they will increase, we as investors are being compensated for that risk by the increasing interest rates being charged to borrowers. PeerIQ concludes that the level of delinquencies we are seeing are still at multi-decade lows according to Fed data.

Conclusion

From the data above, it appears as though there isn’t any meaningful deviation from the performance we’ve seen in recent years. While some investors may have seen some under performance in their portfolios, overall performance appears to be in line with expectations of each platform.

It’s important to remember that Lending Club and Prosper are continually monitoring performance and continue to improve underwriting. There will likely always be some pockets that out-perform or under-perform an indexed portfolio. The increased interest rates on each platform should give investors confidence in the platforms to react to uncertainty. Although there are not any red flags at this point, as an investor in this asset class it’s important to be prudent and monitor vintage performance and other economic data points such as unemployment closely.