Even the average returns from p2p investing are appealing to many investors, especially in a low interest rate environment. However, one of the great things about investing in peer to peer lending is the availability of historical data. If you’re a self directed investor there are a few simple filters that could potentially outperform average returns over time. In this post, we’ll outline simple filters for both Lending Club and Prosper.

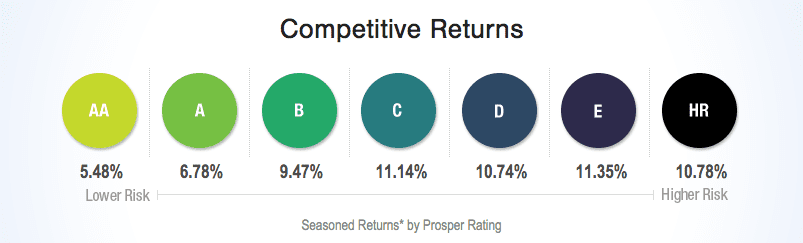

We are backtesting data on each platform using the beta version of NSR Platform’s new code base (version 3.0), which will officially launch in the first quarter of 2016. These filters are an update from our 2012 post and take into consideration recent loan performance. It’s important to note that Lending Club and Prosper adjusts interest rates over time so while these strategies have performed well in the past, this may not be the case in the future.

Simple Lending Club Filter Strategy

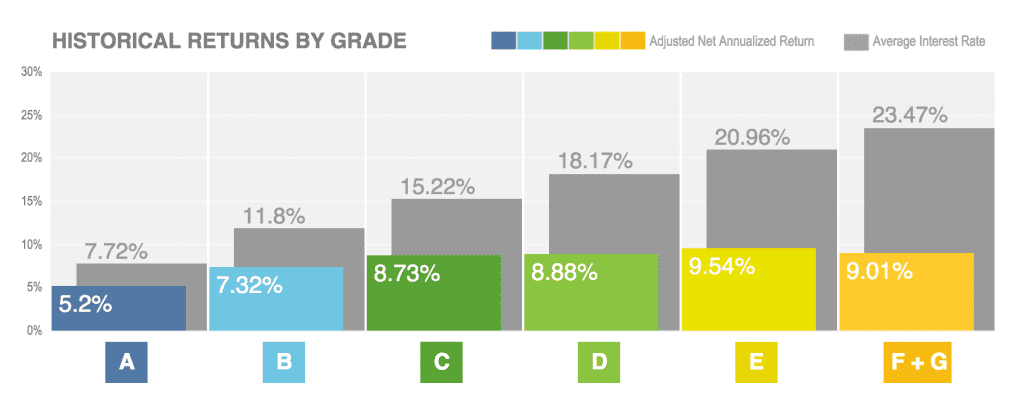

To start, take a look at the below chart which outlines the average returns from Lending Club.

Since we are targeting higher returns, we’ll focus on the higher loan grades: C, D, E. Grades F and G have higher returns, though the risk trade-off is too high for this exercise.

- Grade: C,D,E

- Inquiries in the last 6 months = 0

- Loan Purpose: Debt Consolidation, Credit Card Refinance

- Optional: Home Ownership: Mortgage or Own

- Optional: Annual Income over $45,000

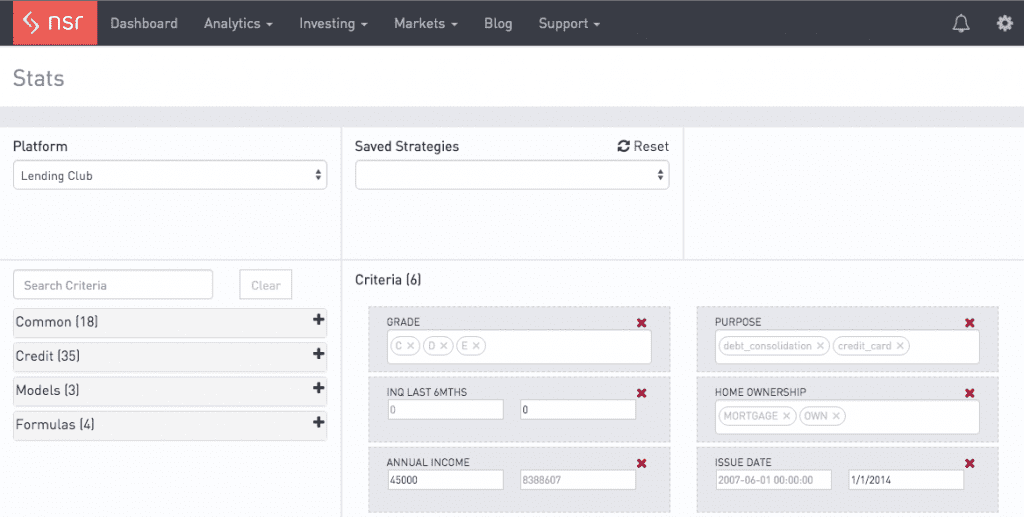

According to the NSR back-testing tool, loans that were originated before January 1, 2014 generated an ROI of 10.00% using this strategy. Over the same period, grades C, D and E with no additional filters generated an ROI of 8.08%. Looking at data from 2014 and 2015 these simple filters generate an ROI of 10.20%. This compares to an ROI of 8.65% without additional filters. This shows that this strategy continues to provide alpha even in recent years. Note that returns shown for 2014 and 2015 are likely overstated since these loans have not yet seasoned.

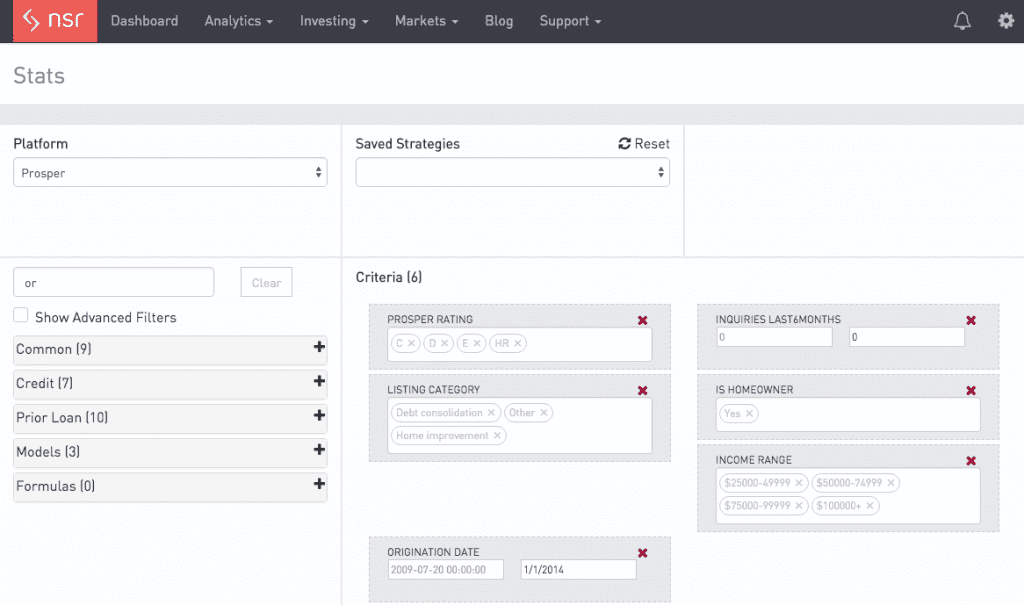

Simple Prosper Filter Strategy

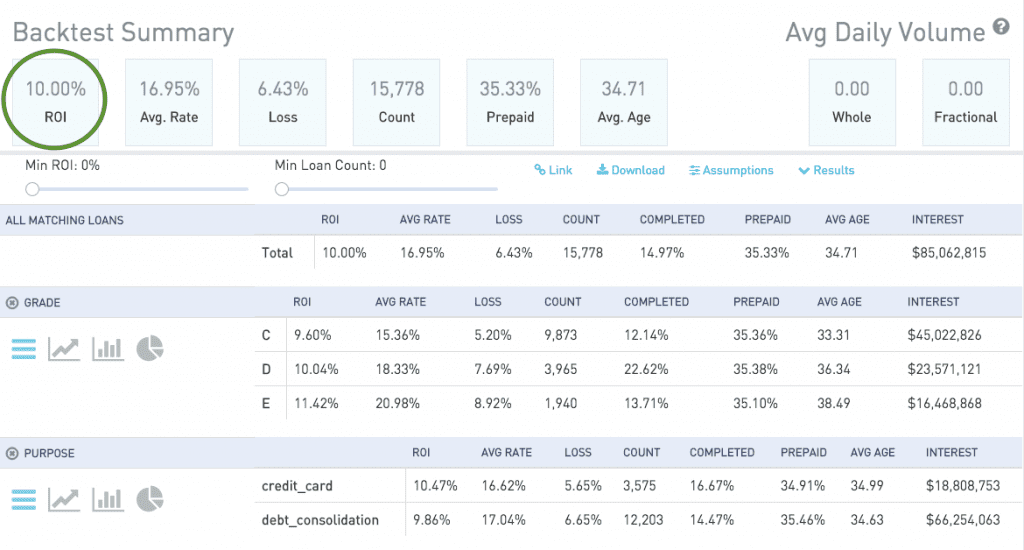

Below are Prosper’s average returns by loan grade. Keep in mind that their loan grades appear similar to Lending Club’s, but the interest rates differ.

For our simple filters with Prosper, we’ll focus on grades C through HR, which include loans that carry the highest interest rate — and the highest risk — with Prosper.

- Prosper Rating: C,D,E,HR

- Inquiries in the last 6 months = 0

- Listing Category: Debt Consolidation, Other, Home Improvement

- Optional: Is Homeowner = Yes

- Optional: Income Range > $25,000

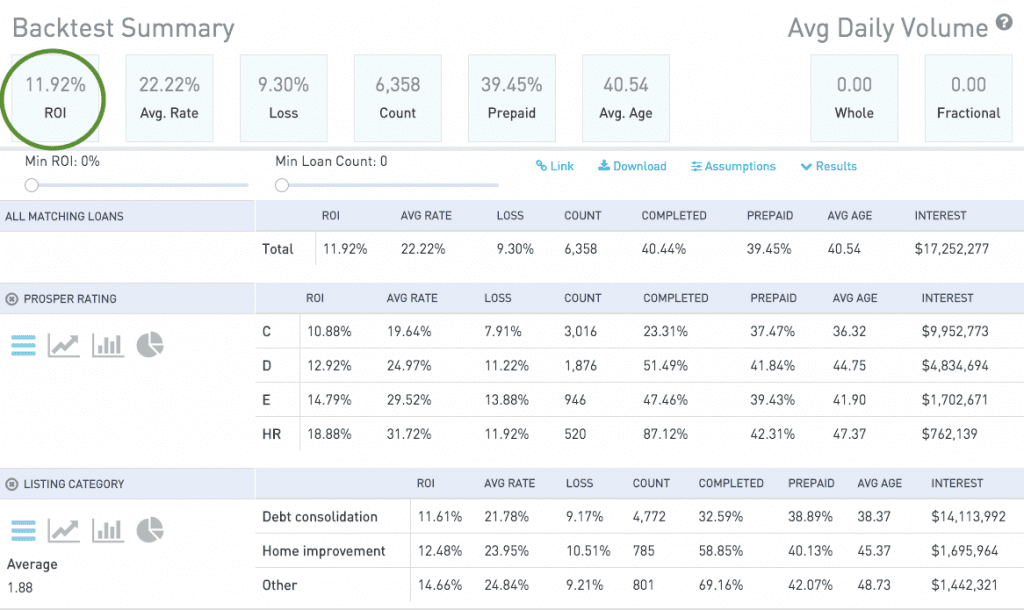

According to the NSR back-testing tool, loans that were originated before January 1, 2014 generated an ROI of 11.92% using this strategy. These results are on around 6,000 loans due to the date restriction, but Prosper has had significantly more volume in 2014 and 2015. The total count of loans now meeting this criteria since 2009 is over 23,000 loans. Over the same period, grades C, D and E with no additional filters generated an ROI of 10.48%. Looking at data for 2014 and 2015, these simple filters generated an ROI of 9.88%. Without additional filters, the ROI is 8.15%. Again, we see that these filter criteria continue to produce alpha.

Conclusion

While investors can continue to add filters to incrementally increase returns, these simple filters provide a base with substantial loan volume. Investors should ensure that with whichever filters they select that their cash is always invested, as cash drag will have a negative effect on returns. NSR Invest offers limited free backtesting using their online tools at NSR Platform. If you sign up as a Self-Directed user, you get unlimited back-testing. NSR Invest also offers proprietary credit algorithms through a “Fully Managed” service for 0.6% per year.

Full Disclosure: NSR Invest is majority owned by Cardinal Rose Group LLC, a company that also owns Lend Academy and LendIt.