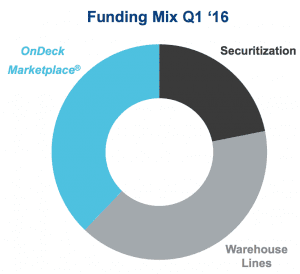

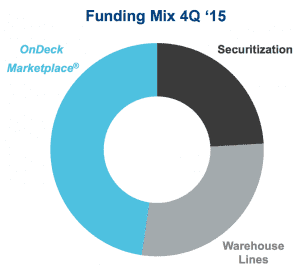

Yesterday, OnDeck released their Q1 2016 earnings. The company is facing headwinds that are affecting the entire industry as investor demand has weakened. According to their earnings presentation, this has required the company to hold more loans on its own balance sheet instead of selling them to institutional investors. According to CEO Noah Breslow, they will see greater financial benefits of this decision beginning in 2017 but in the short term this change has a negative financial impact. Below are screenshots taken from the quarterly presentation which show the transition of funding mix over the last 2 quarters.

In a more positive light, originations continue to remain strong, totaling $569 million in the first quarter, up 37% over the same period last year. They reported revenues of $62.6 million in Q1 2016, up 11% from a year earlier. Although operating expenses were up 33% from the same period in 2015, OnDeck stated that some of this cost was due to their partnerships with companies like JPMorgan Chase. We learned at LendIt USA 2016 in a presentation from CEO Noah Breslow that their partnerships with Chase has officially launched. Despite what may be happening on a quarterly basis this partnership, which is one of the most significant deals ever done in the industry, could be huge boon for OnDeck.

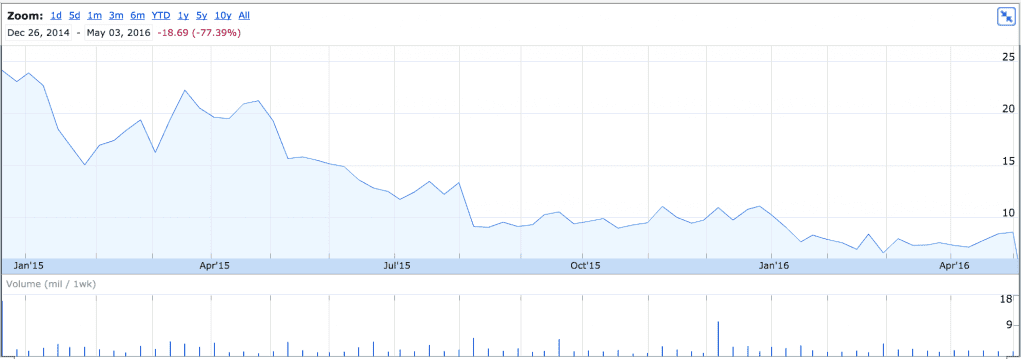

OnDeck reported a quarterly loss of $12.6 million which was more than analyst estimates. This compared to a $5.3 million loss in the first quarter of 2015. They subsequently adjusted revenue projections for the rest of the year with guidance for the full year to fall between $278 and $288 million, down from between $320 and $328 million. Not surprisingly, the stock price is being hammered and as of writing is currently down 34% at $5.46. The stock price chart since they went public in December of 2014 is shown below.

Conclusion

This is certainly a challenging time for OnDeck and other companies in the industry who are finding it more difficult to attract investors today. The good news is that the industry is still showing promising growth as borrower demand remains strong. Whether or not these headwinds should be looked at as more of a speed bump instead of a significant downward trend remains to be seen. But clearly equity investors on OnDeck today think this is more than just a speed bump.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, owns ONDK stock.