What a day. Everyone is still trying to digest the big news from Lending Club this morning. More details are slowly coming to light but it is fair to say we do not have the full story and we will probably never know all the details. But we do know more than we did this morning. There are really three different pieces to the puzzle all of which contributed to the extremely negative sentiment.

First, we had the issue of the non disclosure of an investment from Lending Club CEO Renaud Laplanche. Bloomberg is reporting that one of the catalysts for Renaud’s resignation was his failure to disclose a personal investment in a company where Lending Club subsequently made an investment. This failure to disclose his investment along with Lending Club was a catalyst for his resignation according to Bloomberg. John Mack also made an investment but he has been cleared of any wrongdoing.

Second, we have the $22 million in loans that were reportedly sold to Jefferies that were against their express instructions. This one is a little confusing because the original press release from Lending Club stated that it was a non-credit and non-pricing issue. When you look at a loan the majority of the data pertains to credit or pricing. In reality this a moot point – the fact that it actually did go against the wishes of a major investor, whatever those wishes were, is the story here.

Third, we have the date change issue. This one is related to the previous issue. An internal investigation at Lending Club found that the loan application date was changed on $3 million of the aforementioned $22 million in loans. This seems to be have been the work of one or more senior executives within Lending Club who have since been let go. In some ways this last issue is the most damaging to Lending Club.

People today have been questioning the data integrity on all Lending Club loans – what else might have been changed? And if investors don’t trust the data in the loan history they will be very reticent to invest. Now, it should be pointed out that internal audits found no other problem with the data and you can be sure that many people will be combing over the new Q1 downloadable data that was made available today.

Any one of these three issues would have been headlines given Lending Club’s previously unblemished record and their oft repeated focus on transparency. To have all three items come to light today was nothing less than staggering. There is a lot of sadness and anger around the industry today – Lending Club has let us all down. And it is going to take a long time for them to earn back the trust we had.

With such big news I decided to reach out today to many industry leaders to get their comments. Some people declined to share their thoughts but below are comments from some of our industry leaders:

Matt Burton, CEO of Orchard:

We are saddened by today’s news surrounding Lending Club, and the resignation of Renaud Laplanche. Mr. Laplanche has been a central figure for marketplace lending and has done a lot to transform the industry. We believe this is a learning moment for marketplace lending and an opportunity for all participants to set the bar even higher in order for our industry to thrive.

We believe that marketplace lending, as a business model, is here to stay and that events like this — unfortunate as they are — present an opportunity for everyone to demonstrate that they provide a safe, responsible, compliant and sustainable model that is built for success during up times and down.

Al Goldstein, CEO of Avant:

At Avant, our goal is to transform the online lending industry for good. We strive to be the most transparent from a customer, capital markets and regulatory perspective. We don’t charge our customers origination fees, so what they see is what they get. This philosophy carries through to our approach to institutional investors: loans that are already originated and owned by Avant are sold to investors on a weekly basis. Operationally investors receive a file with the loans designated for sale for their review and approval before a specified sale date. We have over 50 employees dedicated to regulatory and compliance and we recently added former FDIC Chair Sheila Bair to our board.

We see a bright future ahead and we remain committed to delivering the most innovative, compliant and creative solutions for our customers and investors.

Ram Ahluwalia, CEO of PeerIQ:

The pace of institutional investment is well ahead of the quality of institutional infrastructure. Increased transparency and independence is necessary to re-build investor trust. The industry needs to invest in enhanced disclosures, asset review tests, second-level verification, and independent pricing and valuation.

This was true before the unfortunate news from Lending Club and remains true after.

Don Davis, Managing Partner at Prime Meridian Capital Management:

The loan performance on our LC book (as well as Prosper) remains strong. The firm has a ton of cash on hand making current valuation quite attractive and a candidate to go private. The internal controls and audit process at LC actually worked successfully in this case as this was caught and resolved fairly quickly. We believe the industry will continue to strengthen and grow as a result.

Lost in the News: Another Strong Quarter from Lending Club

Overshadowed by all this news was the fact that Lending Club released their Q1 earnings today. Despite the negativity Lending Club actually had a good quarter. Ryan has put together an analysis of the numbers below.

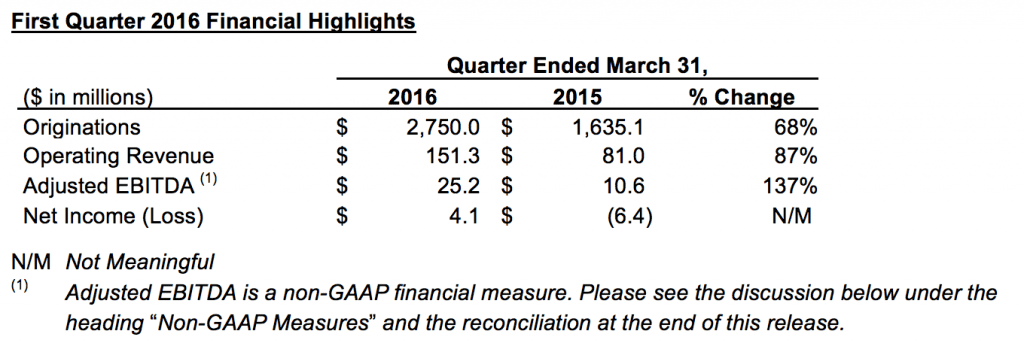

Revenue for Q1 2016 was $151.3 million which was an increase of 87% from the same period last year. Adjusted EBITDA was $25.2 million, an increase of 137% from last year. They reported a net income of $4.1 million compared to a loss of $6.4 million last year. The table below taken from the press release breaks down their recent performance.

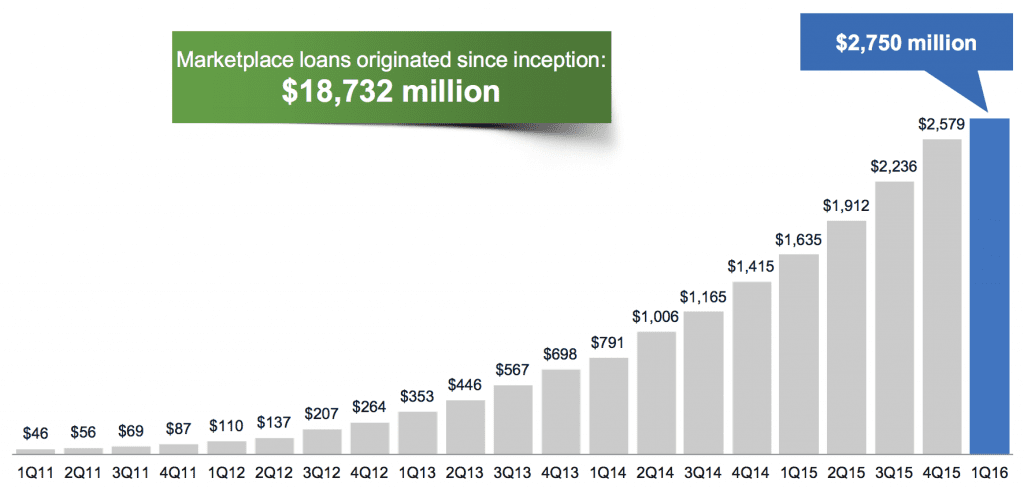

Loan origination growth at Lending Club continued as they originated $2.75 billion in the quarter. This compares to $1.64 billion from the same period last year and $2.5 billion for Q4 2015. They are now approaching $19 billion in total originations. Lending Club also announced that they had their first month with over $1 billion of originations with two days at or above $99 million in originations. Despite these numbers it is apparent that growth isn’t as strong as it has been in previous quarters.

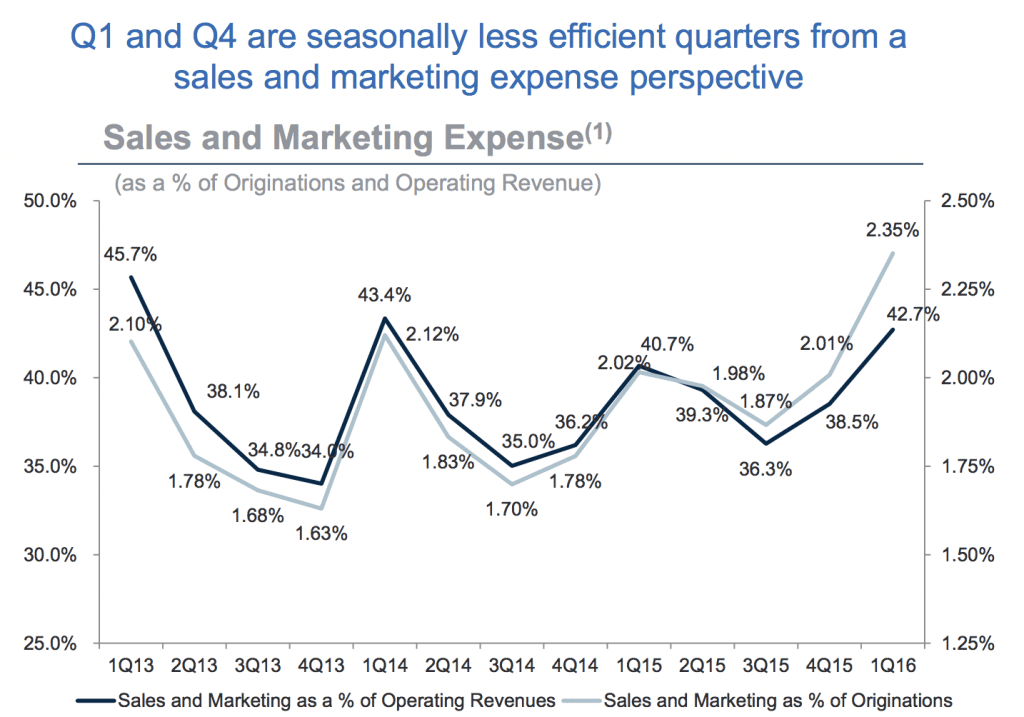

Many investors also look at Lending Club’s sales and marketing costs as a percent of originations which came in at 2.35%, the highest since they became a public company. Lending Club noted that this is in part due to seasonality as depicted in the chart below.

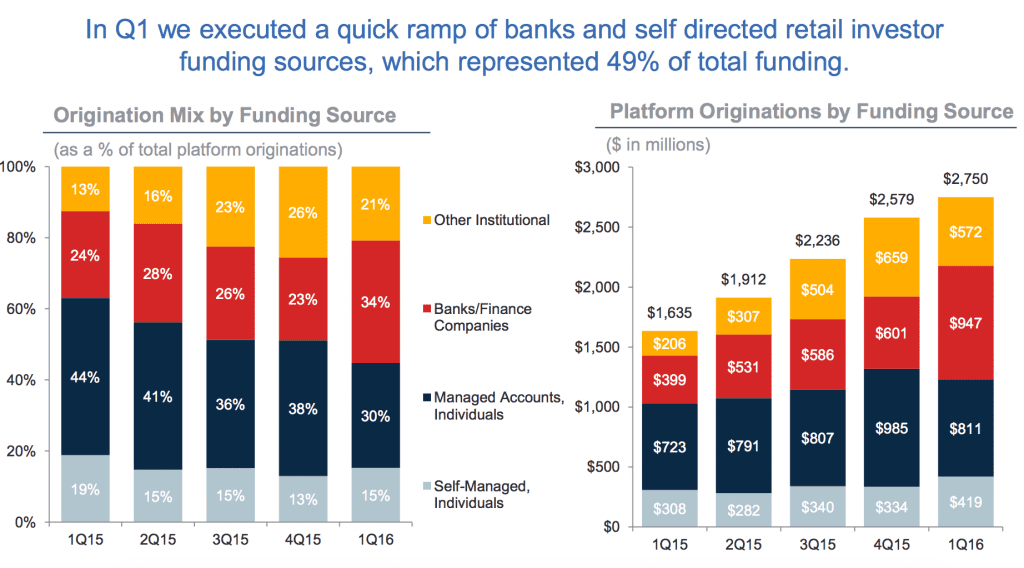

Beyond financials, the impact of softening interest from investors is on many minds. Below is a screenshot from Lending Club’s earnings presentation. As expected, there is a drop in “Other Institutional”. “Managed Accounts, Individuals” also saw a decrease from the previous quarter while “Banks/Finance Companies” saw a tremendous increase and “Self-Managed, individuals” saw an incremental increase. It seems as though Lending Club was able to bring on additional institutional capital from banks at a time when other companies are having difficulty funding loans.

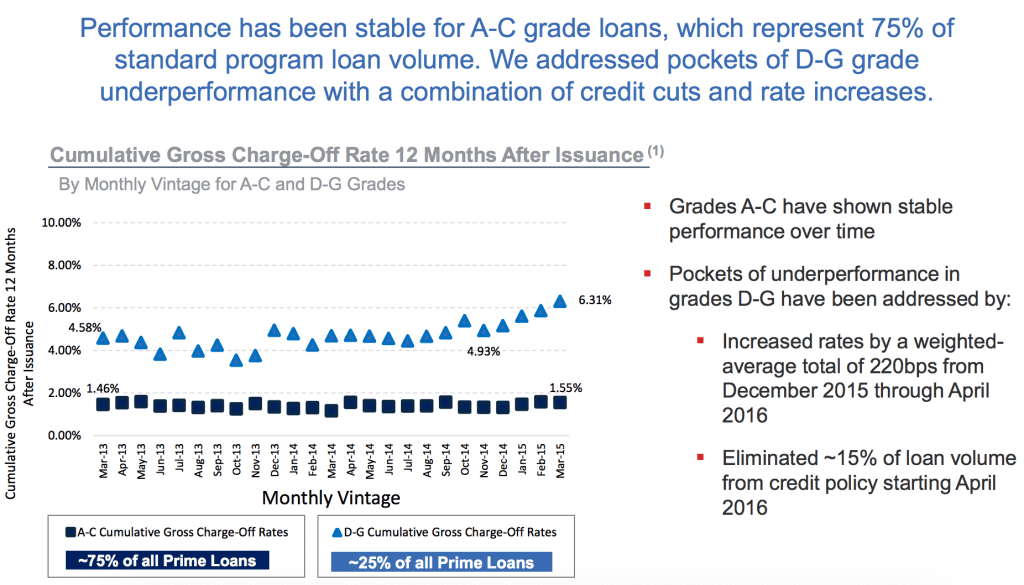

Also in the news as of late has been the increasing interest rates at Lending Club. Since December, interest rates have increased three times. According to Lending Club, the pockets of loans affected by lower performance have been in loan grades D-G which were addressed with credit cuts and rate increases. While we often hear about interest rates, Lending Club notes below that they have eliminated 15% of loan volume from credit policy starting in April 2016.

According to the release, Lending Club has repurchased 2.3 million shares of Lending Club stock for approximately $19.5 million. This leaves $130.5 million remaining to purchase shares after the board of directors approved a $150 million share buyback. Lending Club is not providing any future guidance at this time due to the recent news. Not surprisingly, Lending Club’s stock closed down 34% today.

The full earnings presentation including an audio of the earnings call can be found on Lending Club’s investor relations page.

Conclusion

While this will go down as the most challenging quarter for Lending Club in their history it’s important to note that despite the shocking news today Lending Club continues to grow profitably. The coming quarters are going to be especially telling as the company looks to put these issues in their past and move forward.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, Senior Writer at Lend Academy own LC stock.