Out of all the service providers in the marketplace lending industry Orchard has the broadest set of data on online lenders here in the US. Orchard serves as a platform to connect originators looking for capital with institutional investors who are seeking opportunities in the space and they have data feeds to many of the leading originators. Today, they released their Q2 industry report focusing on consumer unsecured lending. Although Orchard doesn’t break down the originators included, the report should serve as a view of market level trends as opposed to trends by any one originator.

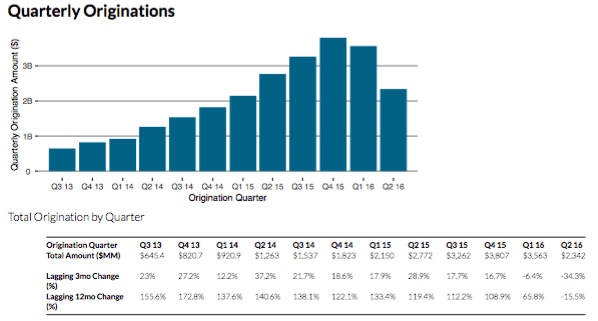

Originations has been the hottest topic as of late as Lending Club and Prosper shared their Q2 results. More broadly the report highlights originations down approximately 34% from Q1 2016 and down 16% from Q2 2015. Below is a chart of quarterly originations since Q3 2013.

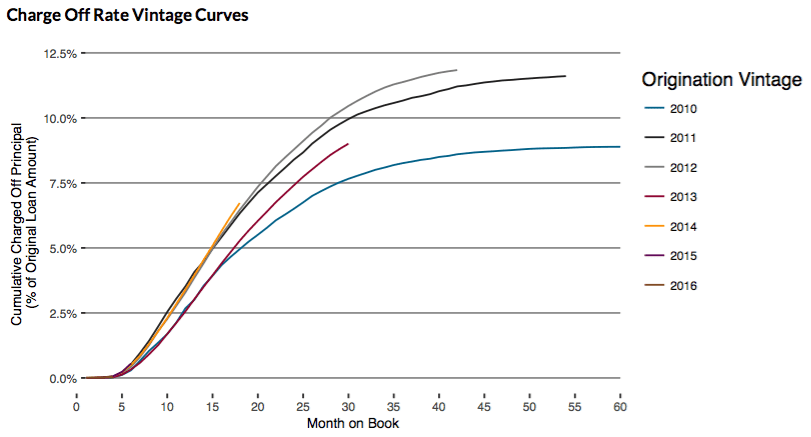

Orchard also shared that 2014 vintage charge offs have increased compared to some previous vintages. Although we saw some pockets of underperformance last year with Lending Club, Orchard also notes that this trend is also in part due to the increase of subprime loan origination platforms.

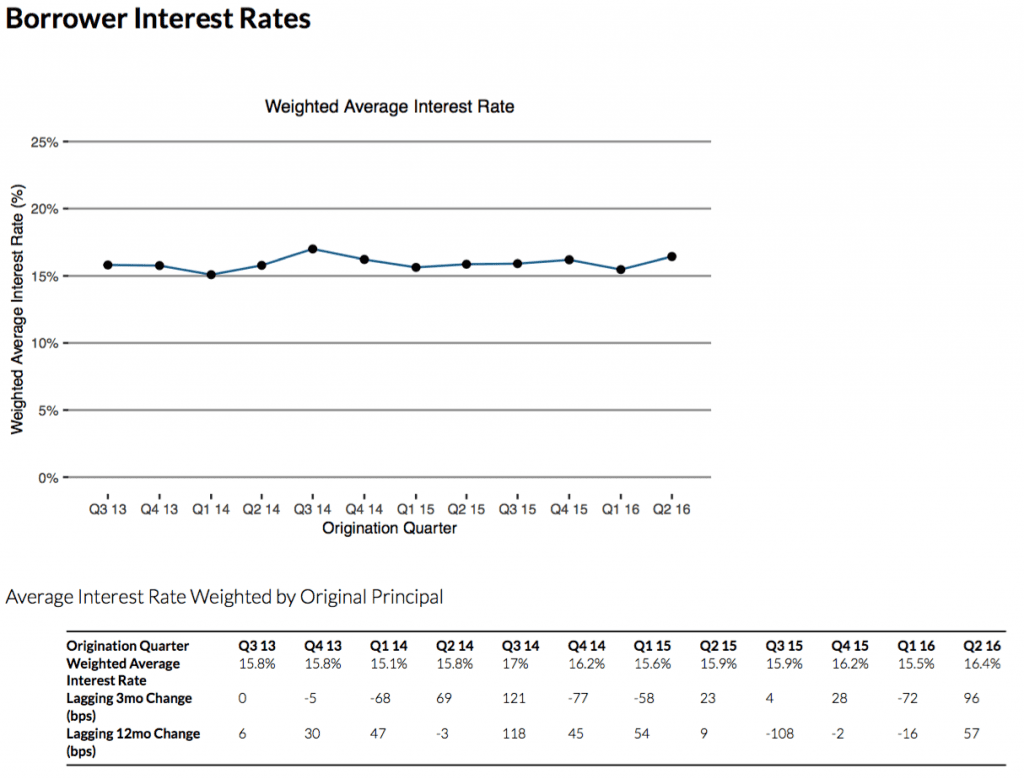

The final piece of the report shares data on interest rates, both average interest rates and interest rates by loan size. Q2 2016 saw a significant increase in average borrower interest rate to 16.4%, up from 15.5% in Q1 2016. The increasing average interest rate is not surprising given the fact that both Lending Club and Prosper have raised rates several times over the last few quarters and we can assume some other lenders are doing the same to attract investors. However it is surprising to see a 72 bps drop in average interest rates in Q1 2016. We see the trend of increasing average rate first begin in Q2 2015 and continues to increase quarter over quarter until the drop off in Q1 2016.

Conclusion

We are well aware of trends from leading originators Lending Club and Prosper. Lending Club is a public company so we have insight into their operations and Prosper files quarterly with the SEC even though they aren’t public. However, there are many other originators who are private companies and do not share information publicly. This report from Orchard gives us a broader perspective of what trends are happening in the unsecured consumer lending market. You can view the full report on Orchard’s website.