Many people don’t realize that small business lending lacks a lot of the protections for borrowers that currently exist in consumer lending. The Truth in Lending Act, designed to inform consumers about their use of credit, has been law since 1968. But there has never been an equivalent law for small business credit. There are companies who are looking to change this and Fundera is one of several companies leading the charge. Fundera has already been involved in the Small Business Borrowers’ Bill of Rights as a founding member.

As a marketplace for small business lending options they have now created a new disclosure box that allows small businesses to better compare and understand product offerings. We spoke to Brayden McCarthy, VP of strategy at Fundera to learn about their new disclosure box and how they aim to put the borrower first. The core principles of the new disclosure box are as follows:

- Conspicuous: Information for the loan should be conspicuous. It should be in bold at the top or on the front of the screen when viewing online. Borrowers should not have to dig for pertinent information regarding their loan.

- Clear: Loan documents should be clear, written in plain english to cut through complexities. There should be no hidden information or fine print.

- Comparable: Borrowers should be able to compare products side-by-side, showing the same metrics across products including APRs and total cost of the loan.

- Comprehensive: Information to the borrower should be comprehensive including total repayment, monthly/daily repayments, origination fees and prepayment penalty.

- Contemporary/Interactive: The process should be contemporary and interactive and go beyond the Schumer Box to allow borrowers to make informed financing decisions.

- Correct: Balance principles where needed to avoid oversimplifying or overcomplicating product terms to the point of inaccuracy.

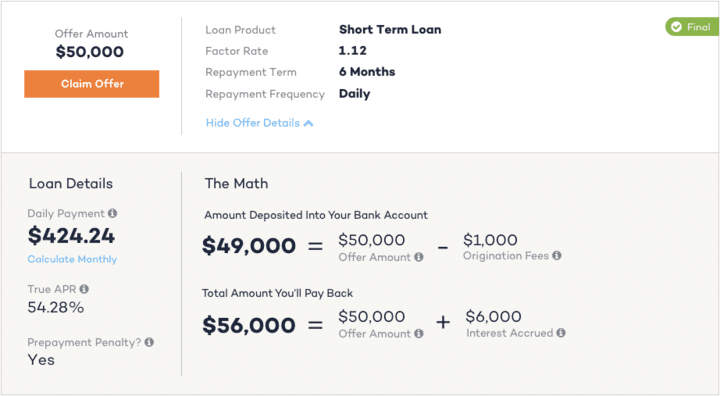

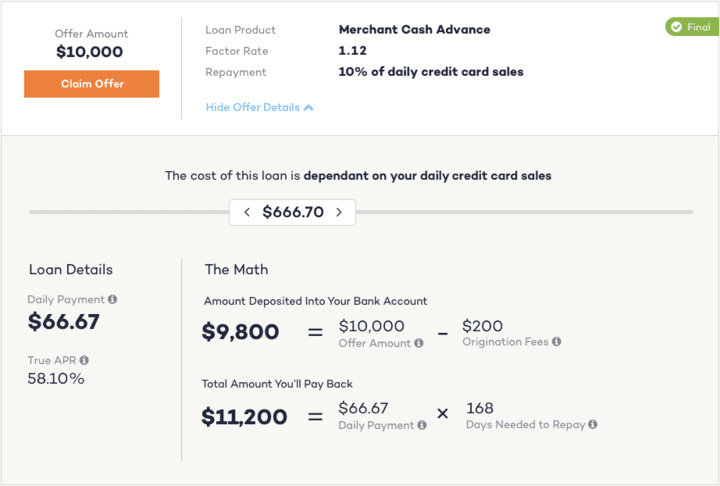

The Fundera team sent us two screenshots so we could get a look at what their disclosure box looks like and see how they have put these principles into action. As you can see below Fundera has made the loan terms extremely clear across different loan types.

Short Term Loan Example

Merchant Cash Advance Example

My Take

I think it is critical that small business lenders embrace an initiative like this. We have heard about the SMART Box initiative from OnDeck, Kabbage and OnDeck but have yet to see how it will be implemented. This simple disclosure box by Fundera certainly makes a good starting point.

In the Treasury report released back in May they specifically mentioned small businesses as an area that needs improved borrower protections. Kudos to Fundera for coming up with something that is comprehensive yet simple to read and understand. I think it is inevitable that something like this eventually becomes part of a new regulation protecting small business owners. It is good for the industry to get ahead of this to try to create a standard that is good for borrowers and small business lenders alike.