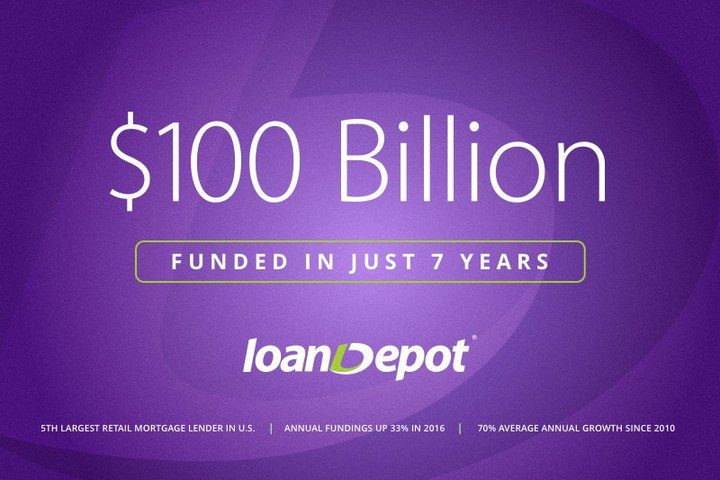

Since 2010 non-bank lenders have been slowly increasing their market share of mortgage originations. loanDepot is a company that has played a big role in this transition and announced last month they had originated $100 billion in mortgages.

This is a huge number and to do it in just seven years is quite impressive. According to a recent Inside Mortgage Finance report, loanDepot is the nation’s fifth largest retail mortgage lender. Familiar names such as Wells Fargo, Quicken Loans, Bank of America and JP Morgan Chase round out the top four slots which makes loanDepot the second largest nonbank lender in the United States.

The company started originating loans in 2010, growing on average by 70 percent annually since inception. Last year loanDepot funded $38 billion in loans, a 33 percent increase from 2015. One of the numbers that stuck out to me was that loanDepot acquires more than half a million potential borrowers every month which is up 25 percent from a year ago. From a marketing perspective this is huge feat and they have continued to grow this even off of a large base.

Anthony Hsieh, loanDepot’s CEO wrote a post on LinkedIn looking back at the last 7 years. I first heard Anthony speak at LendIt China 2016 and learned a lot about the US mortgage market. If you’re interested in learning more about loanDepot and the mortgage origination landscape in the US I recommend watching his speech “Startup to Stardom” from last year.

On the ability for loanDepot to grow at such a staggering rate, Anthony stated:

Unlike most lenders, loanDepot isn’t burdened with legacy issues that impede advancements in building proprietary technology, product delivery systems that bring greater efficiency to the lending process, or regulatory compliance. Our diversified origination platform is purpose built to pivot quickly in fast-changing market conditions. This philosophy empowers us to further penetrate purchase, refinance and consumer loans. This is an ideal time for loanDepot to gain greater market share as the leading solution to satisfy consumer demand for a highly efficient, tech-based lending experience that’s easy to navigate and supported by world class customer care.

Conclusion

I think what’s interesting about non-bank lenders such as loanDepot is that, in such a short amount of time, they have taken such a large share of the market from the incumbents. This represents a radical shift to how mortgage lending has been done in the past and it is certainly an area to keep an eye on. Other verticals of lending aren’t quite there yet but I think it proves that the major lenders of tomorrow won’t necessarily be the big banks. At LendIt coming up next month we’ll hear from loanDepot, Better Mortgage and others on the shifting mortgage origination landscape.