When I first started working for Lend Academy and LendIt I saw the massive opportunity for fintech companies to change the way consumers interact with companies in financial services. A good litmus test at the time for gauging awareness was asking friends and family if they’ve heard of Lending Club or Prosper. Most had not.

Now that the the industry has evolved, it’s a much broader question than that with fintech firms operating in almost every aspect of financial services. To this end, EY recently published a free report titled “EY FinTech Adoption Index 2017 – The rapid emergence of FinTech” which shares detailed information on consumer adoption rates across the world. The yearly report was first launched in 2015 and aims to look beyond the hype and dig into actual consumer usage.

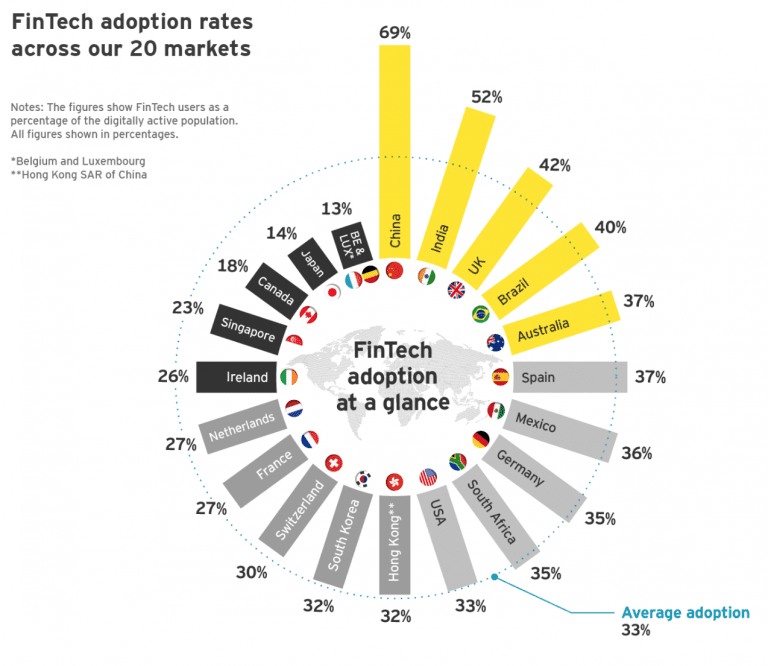

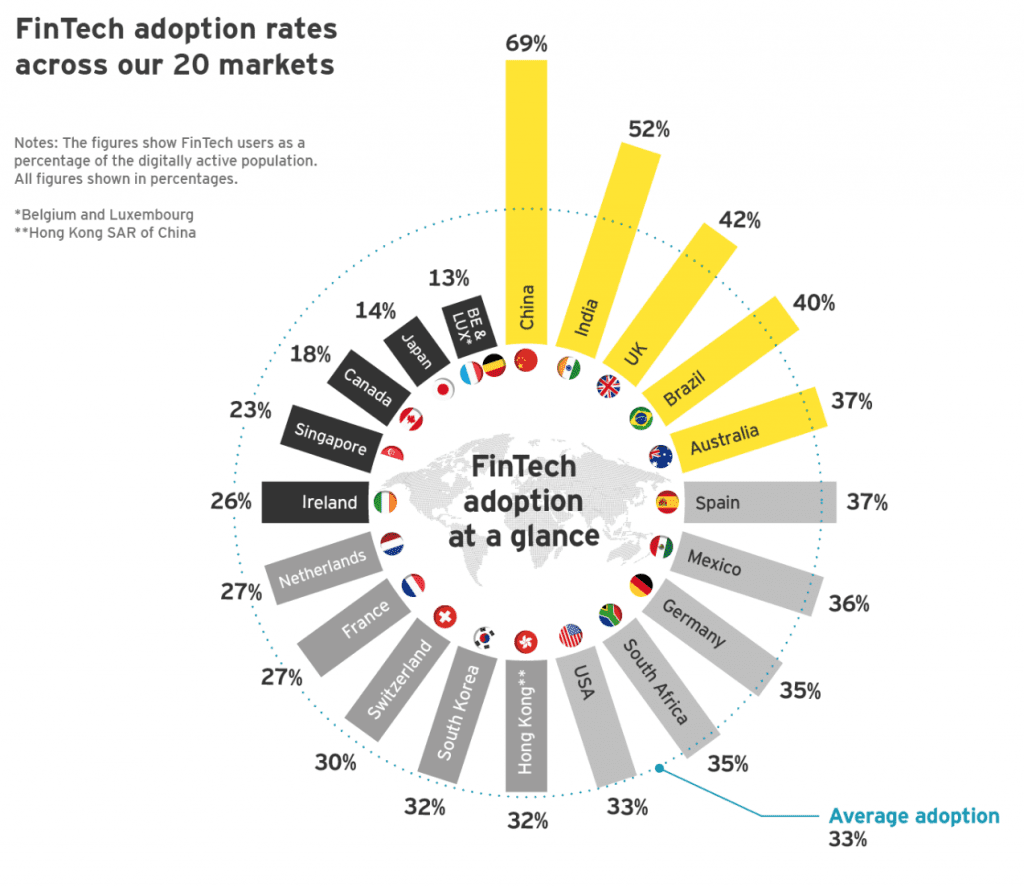

They surveyed 22,000 digitally active consumers in 20 markets across the globe. One highlight is the below graphic which shows an overview of adoption across the markets. Average adoption across all consumers was 33%, defined as consumers using at least two fintech services. The report shares that in the theory of innovation adoption, fintechs have reached the key milestone of “early majority” adoption.

Not surprisingly, China and India both came in at the top of adoption rates. We’ve written many times about the Chinese market and it was clear that even in the early days China was leading the way when it came to fintech. The survey also cited increasing awareness in Australia, Canada, Hong Kong, Singapore, the US and the UK., with 84% of customers being aware of fintech services compared to just 62% in 2015. The entire report is worth a closer look, but here are a few other key takeaways:

- Average adoption rates across emerging markets is 46%

- Money transfer and payments are the most popular category, used by 50% of consumers in the last 6 months

- Insurance is experiencing growth, reaching 24% adoption across markets

- Age segments with greatest fintech usage: 25-34 (48%) and 35-44 (41%)

- Fintech “super-users” (adopting 5+ services): 13% of all consumers

- Markets with highest usage intent: South Africa, Mexico and Singapore

- Services with highest expected increase in demand: borrowing and financial planning

Conclusion

While the survey is generally good news for companies in the industry there is still room for growth especially in the US which comes in at the average adoption rate across countries polled. There are also other categories I believe that have more growth potential. For instance only 10% of digitally active users have borrowed using a p2p or online lending platform. Same goes for the potential on the investment side with only 20% of consumers using p2p platforms, crowdfunding platforms, online investment advice and online stockbroking. Adoption rates for services such as online budgeting and financial planning tools also came in low at just 10%. In addition there is more potential in emerging markets as more consumers become digitally active.