A recent post on the Lend Academy Forum spurred a discussion about the potential future of LendingClub, particularly as it relates to the types of borrowers they serve. While we don’t have insight into what LendingClub’s plans are, there are several things that have happened over the last two years that help us hypothesize that LendingClub’s strategy may be shifting.

LendingClub recently sent an email titled “How LendingClub Notes May Help You Generate Long-Term Wealth”. In it, they tout returns in the 4-6% range, a far cry from the returns some investors saw in LendingClub’s early days. The 4-6% range they present is footnoted, clarifying that this includes only grades A-C. LendingClub may be being conservative in presenting returns given recent performance trends, but it also may be a sign that the company is shifting to serving higher quality borrowers. Some investors believe LendingClub is intentionally leaving off the performance of the worst performing loan grades.

One forum member “Rawraw” provides his perspective on this forum thread:

I see it much differently, largely due to my time on this forum. I think they realized attracting investors who are just chasing high returns is not very valuable. Banks long ago learned this lesson, but I think LendingClub is catching on.

Rawraw is right, many of the early investors were attracted by prospect of double digit returns in the early days. The Lend Academy forum user base still has a higher concentration of investors who are chasing yield and as a result, some have moved on to other investments as returns have fallen. It was one of the reasons that I was first attracted to the industry.

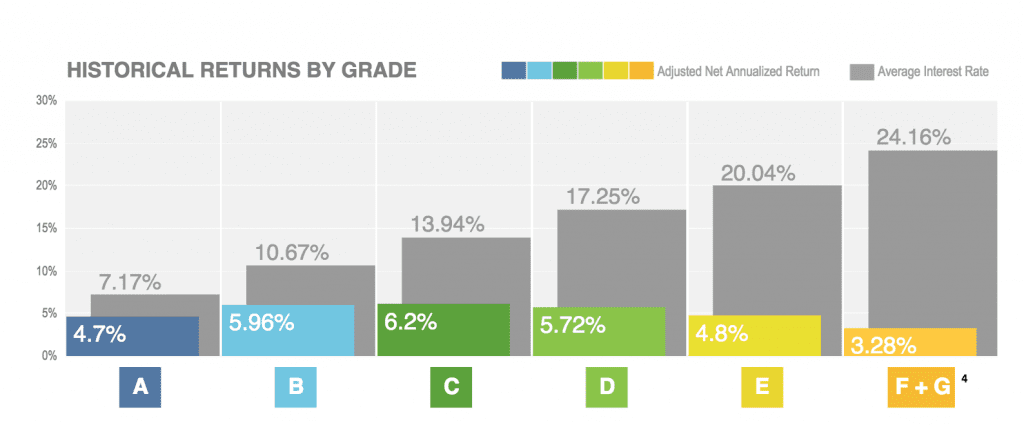

No More F and G Loan Grades at LendingClub

After I began writing this article LendingClub coincidentally announced in their recent earnings call that loan grades F and G would no longer be available to investors These loans have an average interest rate of 24.16% on LendingClub’s platform. Moving forward, the loans will be brought in house as part of a test portfolio for LendingClub. I was personally not surprised by this move. These loans have had a long history of not producing returns that compensate for the additional risk, which is why I hold very few of these loans in my own portfolio. They also make up a small portion of loans originated by the platform.

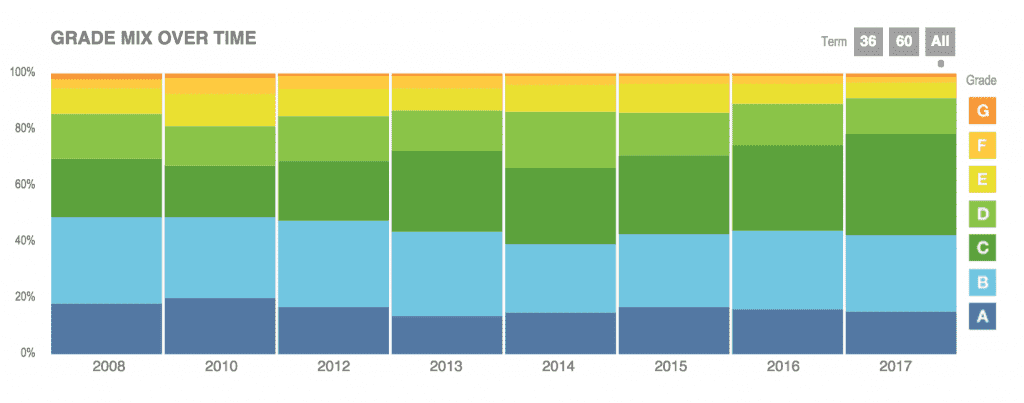

Going back to the trends of loan grades over time the below graph was taken from LendingClub’s statistics page, where you can further filter by 36 and 60 month loans and also view each loan grade as a percent of the total. You can clearly see the expansion of C grade loans, which has increased to 36.09% of total originations in 2017, the most ever.

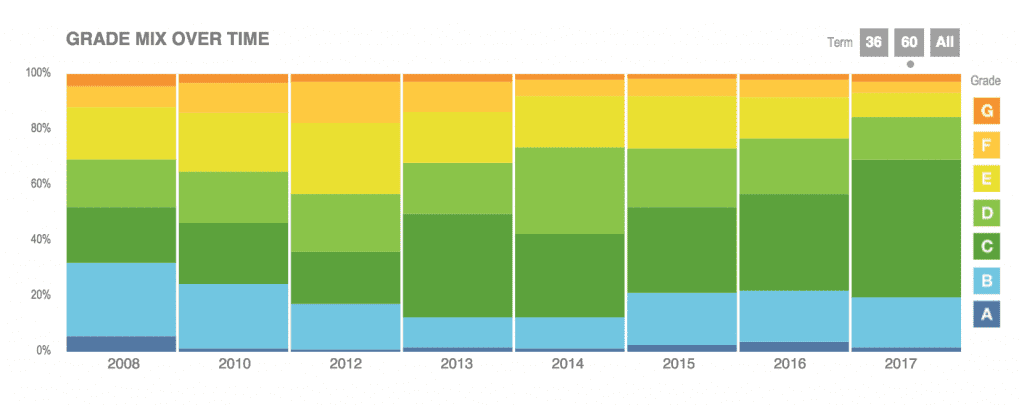

What is more interesting is the noticeable shifts for 60 month loans. C grade loans currently make up just shy of 50% of 60 month loans. The decrease of both E and D grade loans is also more apparent. It’s worth noting that it’s hard to draw any conclusions when it comes to A and B grade loans as the percentages of total loan originations appear more stable. Remember: borrowers pay higher interest rates for longer term loans.

One other thing that may be a contributing factor to this trend, especially recently, is bank participation. Banks tend to be more conservative in their investing approach. Now that banks make up a significant portion of the buyers on LendingClub’s platform (42% as of Q3 2017), they need to have more of the lower risk loans to serve them.

Finally it’s worth looking at the returns by loan grades. Below is a screenshot again from LendingClub’s statistics page which reflects historical returns as of Q3 2017. This echoes what we have seen in our own portfolios and what we have heard anecdotally on the Lend Academy forum and speaking with other LendingClub participants.

Conclusion

As I wrote earlier it’s hard to draw a definitive conclusion given there are so many things in play. But what we do know is that higher risk loans are becoming a smaller part of LendingClub’s offerings. Since Q4 2015, LendingClub has tightened their credit criteria and also increased interest rates several times. Both of these things would have a direct effect on borrowing, specifically in the higher risk segments. Regarding returns there are also other broader economic factors that could come into play such as the beginning of a weakening credit market.

What do you think? Do you expect LendingClub to focus more on high quality borrowers instead of serving a broader segment of borrowers?