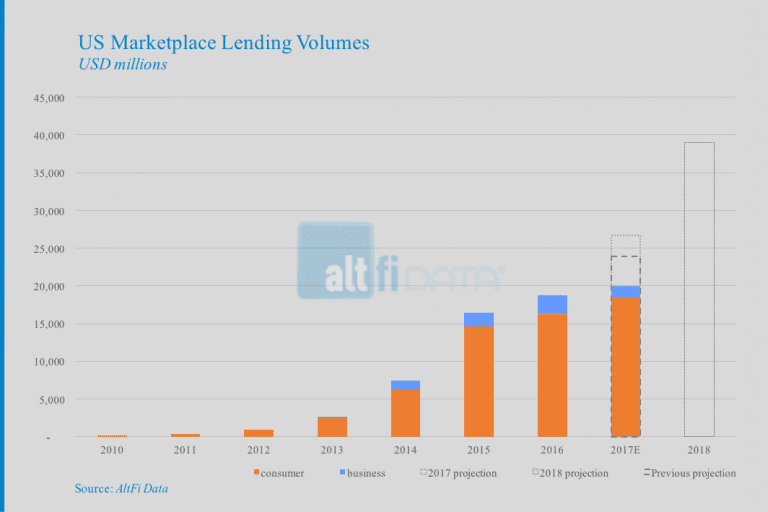

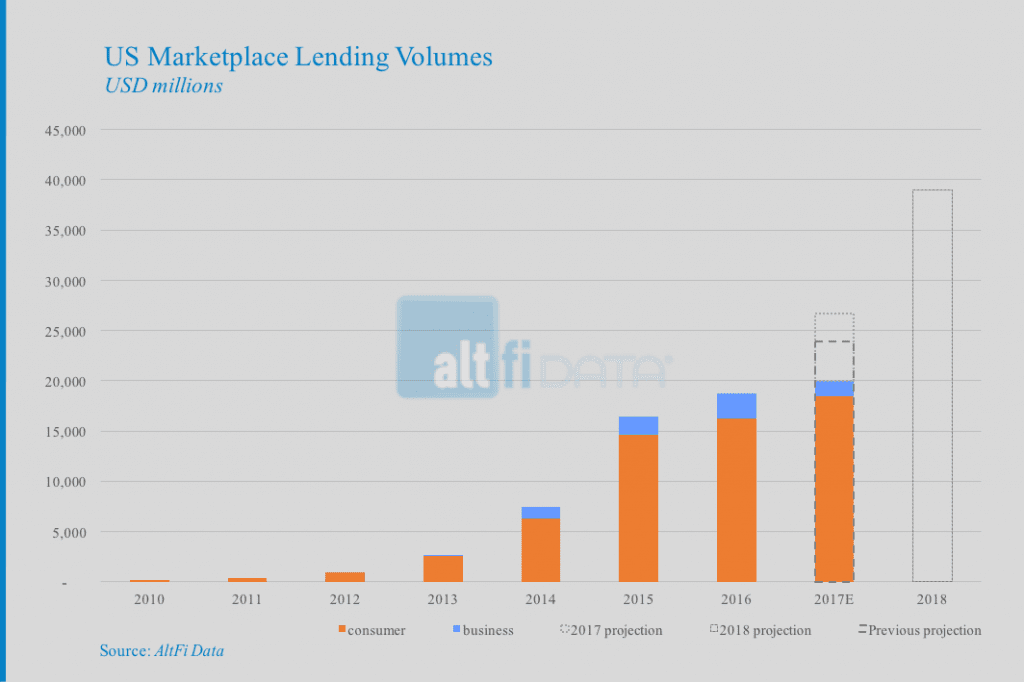

Today, leading data analytics provider for marketplace lending, AltFiData, released the total origination numbers for the UK, Europe and the USA. They are predicting solid growth for the industry in all three regions in 2018. The new loan volume for the USA in 2018 is expected be $38.9 billion, a year on year increase of 46%.

Now, we should point out this is not the entire marketplace lending industry in the US, it is only a subset. AltFiData is reporting aggregate numbers just for LendingClub, Prosper, SoFi and OnDeck. Companies like Upgrade, Avant, Square, PayPal, Funding Circle, Kabbage, Streetshares, Biz2Credit, Fundation, just to name a few, are not included. And there are no real estate platforms included.

Having said that the four companies they have covered are pretty much the largest lenders in the space. So, I think it is still interesting to see the growth in loan volume and in particular the aggressive growth in loan volume in the USA for 2018.

I don’t disagree with this assessment. This month I have visited both San Francisco and Atlanta and sat down with more than a dozen platforms. There is a renewed optimism in the space in 2018 with most companies looking at more aggressive growth for this year. We have all learned our lessons from 2016 and there is no longer a grow at all costs attitude but a sense of the need to grow responsibly. I have heard lots of exciting new projects that will be announced throughout 2018 that will contribute to this growth.

We have also noticed tickets sales to LendItFintech USA are up strongly over both 2016 and 2017. My sense is that people are more optimistic and are more willing to invest in their companies in 2018. Some of this could be related to the recent tax cuts as I am seeing business leaders in Davos continuing to praise the positive impact those cuts are going to have on economic activity.

Still, I think 46% growth is a little on the high side for the four companies covered here but I expect we will get close to those numbers. Interestingly, AltFiData is expecting the UK industry to grow at 43%, slightlty slower than the USA, and Continental Europe to grow at 73% off a much smaller base.