The world is on fire with talk about Uber going public. The company is raising around $8 billion, is valued at over $80 billion, and is minting a wave of SV millionaires who will keep the private company start-up party going by angel investing. I wonder how many of them will buy Bitcoin! Rather than focus on the deal particulars, which you can get from Bloomberg, the Guardian, Business Insider, and Forbes, I want to think through some corollaries of an event like the digital-first transportation company hitting the retail markets.

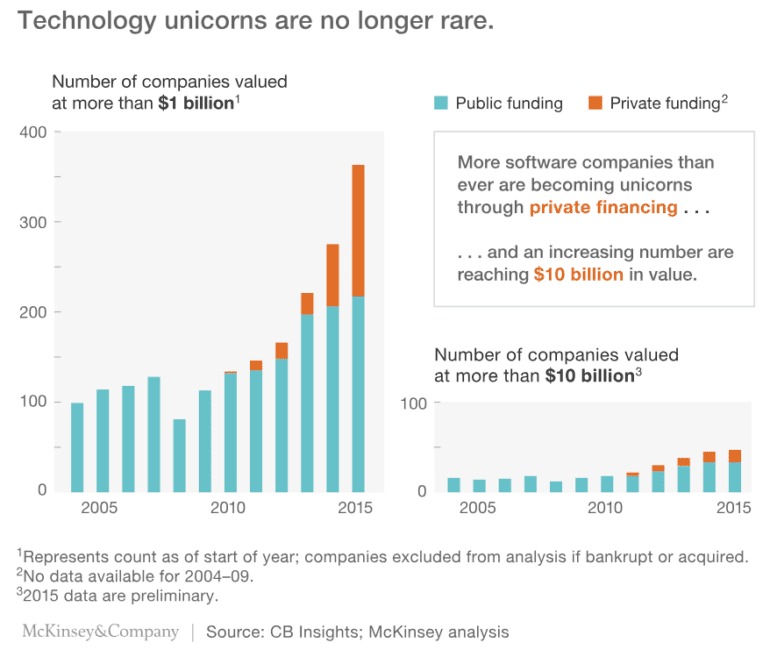

First, let’s talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers — not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment’s index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.