There has been a lot of anticipation for SoFi‘s banking product. Not only does it round out SoFi’s product set nicely, but it also marks an important milestone for the fintech industry the US. After scrapping plans to pursue a federal charter, the company sought out state licenses. They strategically pursued state licenses in states which were important for them to reach scale. SoFi Money officially launched in beta yesterday with a nice write up in Fast Company.

With the addition to current accounts, SoFi now offers a majority of the financial products that customers seek including wealth management, insurance, personal loans, mortgages and of course, student loans. The reason for using the term current account is because the new offering isn’t explicitly a savings account or a checking account. SoFi has decided to roll up these historically two products into one account which includes a debit card, but also pays a higher interest rate than most banks.

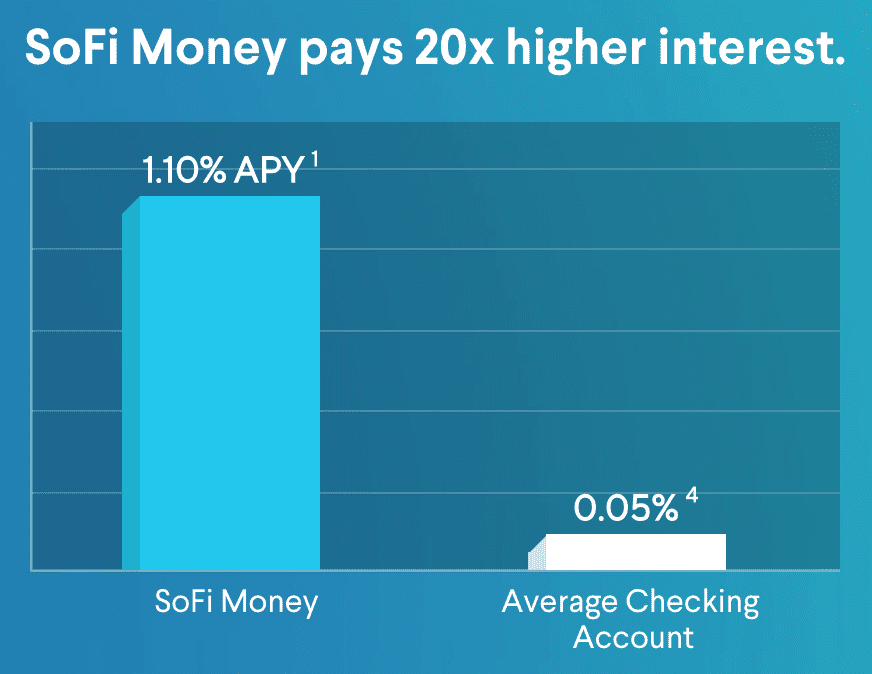

At time of writing, SoFi is paying 1.1% on their account which is a competitive rate when you consider that it is a hybrid account. Other banks who continuously offer the highest rates available on the market such as Goldman Sachs’ Marcus are currently paying around 1.7% on savings accounts. The largest banks in the US such as Bank of America, Citi and JP Morgan Chase pay between 0.01% and 0.1% on savings accounts which varies depending on deposit amounts and current promotions.

Many of the features you’d expect are also available such as peer to peer payments and mobile check deposit. The full list from their website is included below.

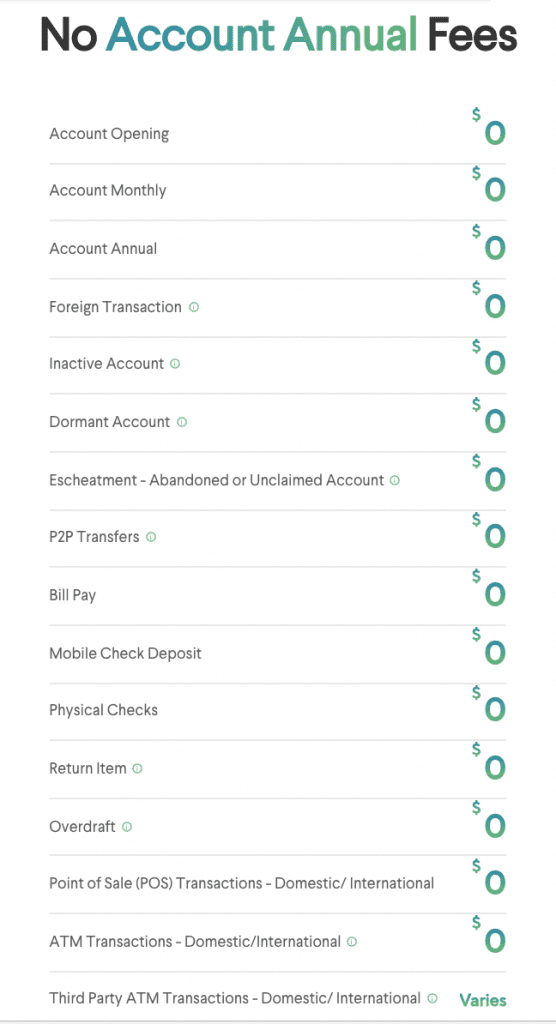

Keeping with the theme of simplicity, SoFi charges no account fees. Looking through SoFi’s pages dedicated to their new product I found a laundry list of everything they don’t charge for. The only fees you can incur are service fees which include an additional replacement card (after you’ve used up one free replacement card), charges related to wire transfers, stop payments, “statement & research – legal processing” and ATM fees (after being reimbursed up to six times per month for ATM charges).

Conclusion

SoFi is a trailblazer when it comes to innovation in financial services. Over the years the company has built up a huge member base of 500,000 users. With SoFi Money, SoFi will become even more entrenched in the financial lives of their users as they interact on a daily basis. This is just the initial launch of SoFi Money and access will be open to all members later in the year. Noto hinted that they plan to use machine learning and data analytics to benchmark users to their peers and also provide recommendations to their member base.

Below is the official promo video for SoFi Money Beta: