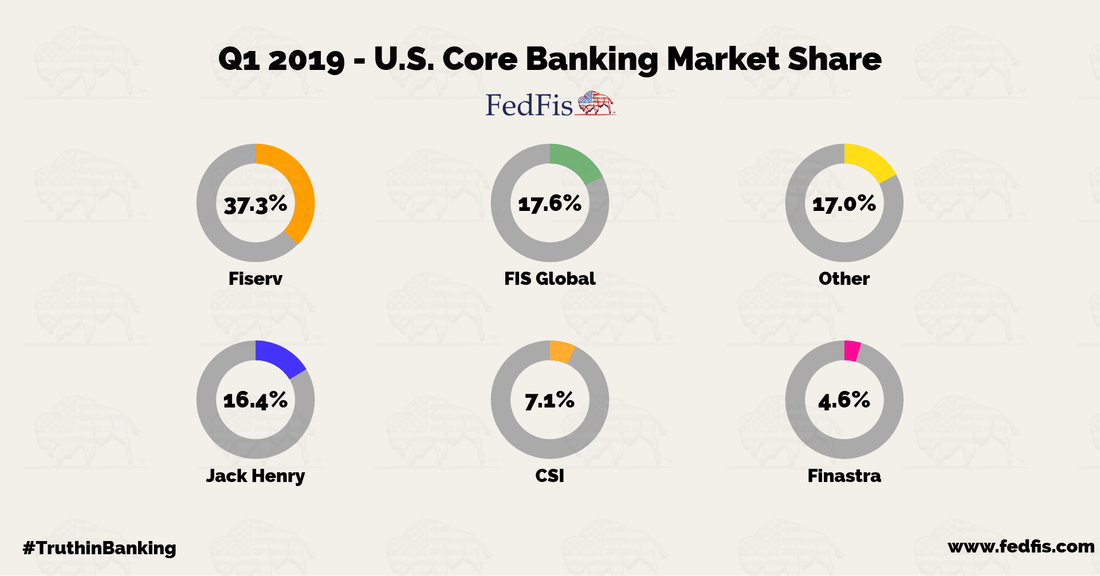

Back in 2013 four core banking providers dominated the U.S. market owning a 96 percent share, that market share is now 76 percent as new players with fresh technology have entered the market. Banks and credit unions rely on core technology to process all deposits, payments, loans, most bank transactions and customer data.

With the advent of new technology there has been a growing group of companies looking to provide banks and credit unions with better options. Just in the past few weeks there were big investment rounds made into Alkami for $55mn and Synapse for $33mn.

The top four banking providers that dominated the market were FIS, Fiserv, Jack Henry and D+H (now Finastra). These providers have also started to innovate and provide new products in an effort to compete with new providers. Besides having a relationship with banks or credit unions for years these core providers have learned how their customers operate. This knowledge can help them to service customers and build a product set in a way that a new technology provider could not.

New firms like Alkami and Synapse have started to make inroads due in part to core providers providing technology that is not nearly as innovative. These new providers are, in many cases, not replacing core providers just yet, they are instead building tools that banks and fintechs can implement via API.

Banks have started to use more of the new technology because they feel a customer need to provide the best products or else risk losing them to bigger banks or digital only banks. For the better part of the last 30 years banks have been building new technology on top of legacy technology which has created a mess of systems.

This points to a wider trend in banking where traditional banks are being disintermediated by a group of smaller, more specialized companies. This trend also holds true in bank technology where fintech firms have started to provide certain technology that can help a bank or credit union provide a better experience and become more efficient

Even the bigger banks who are able to spend billions on technology use about half of their budgets to upkeep technology they feel is dated and does not work efficiently.

We have not yet reached the point where core providers are being completely replaced, especially as they are also innovating in an attempt to stay ahead. Losing 20 percent market share in 5 years is something they need to grapple with.