Every year Inc. Magazine releases a list of the 5,000 fastest growing companies in the country. They call it the Inc. 5000 and it is a celebration of the entrepreneurial spirit. You have to be a fast growing company to make the list.

The 2019 list was announced this morning, but before we get to the successful companies on the list, here is a look at the criteria Inc. set for the entrants:

- Have generated revenue by March 31, 2015

- Have generated at least $100,000 in revenue in 2015

- Have generated at least $2 million in revenue in 2018

- Be privately held, for profit and based in the U.S.

- Be independent (not a subsidiary or division of another company).

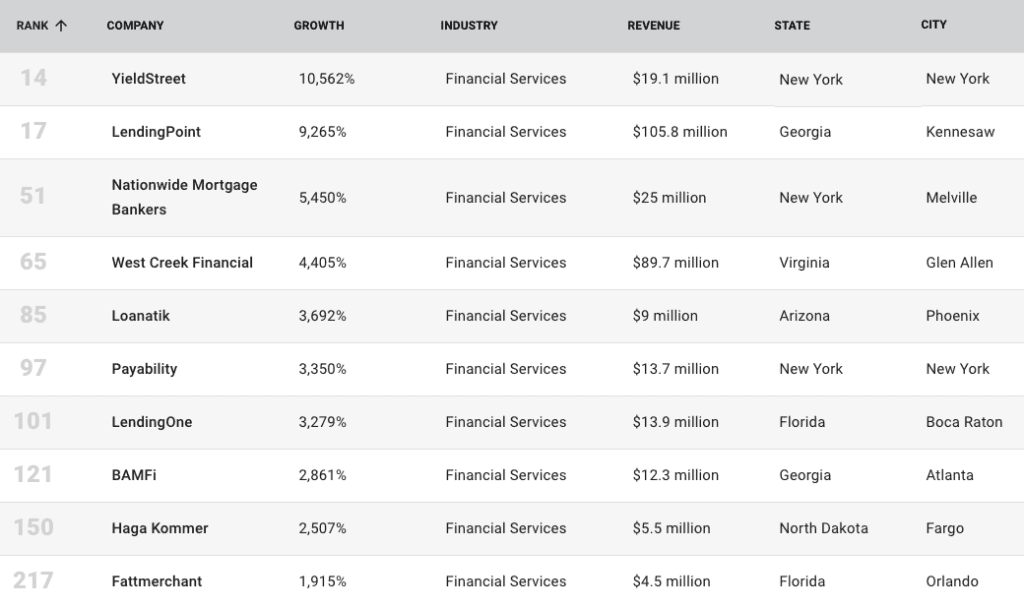

There were 239 companies that made the list in the financial services industry. Leading the pack was YieldStreet, who came in at #14 overall, closely followed by LendingPoint who was at #17.

In a statement on the YieldStreet website, CEO Milind Mehere said:

We’re proud to be named by Inc. as the 14th fastest growing private company in the United States, capturing the #1 spot in both the New York and Financial Services categories. We owe so much of our success to our incredible community of dedicated Investors.

LendingPoint CEO and Co-founder, Tom Burnside, had this to say about their achievement (more here):

Our platform saw more originations in 2018 than in 2015, 2016 and 2017 combined and at the same time our credit performance improved allowing us to facilitate more financing for consumers online and at the point of sale. We are incredibly grateful to our customers and proud of the LendingPoint team.

If you filter the list for financial services companies there are dozens of fintech companies that most of you would recognize. Here is the top 10 in the category that shows their growth percentage as well as their 2018 revenue.

Update: After I published it was pointed out that FundThatFlip also ranked highly on the Inc. 5000 (at #42) but were classified in real estate, not financial services. Honorable mention to them as well.