In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

- New LendingClub Account Performance – Q3 2018

- New LendingClub Account Performance – Q4 2018

- New LendingClub Account Performance – Q1 2019

- New LendingClub Account Performance – Q2 2019

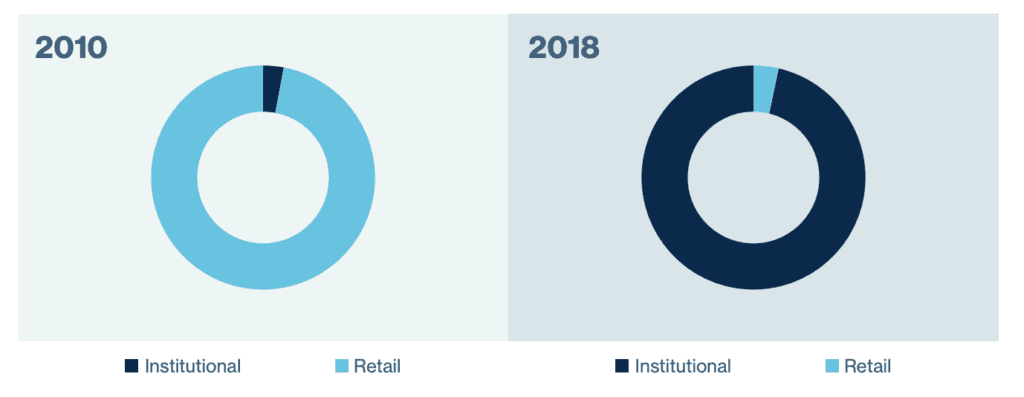

Before we get into the account performance for this quarter it is worth highlighting LendingClub’s communications to investors over the last quarter. One of them was titled “Marketplace Loans And Institutional Investors: A Match Made in Heaven?” and was geared towards how institutional investors think about investing in LendingClub’s loans. However, within the pdf there was a chart which showed just how much the investor base has changed from 2010 to 2018. The investor base by volume was pretty much flip flopped over that time period. An interesting point to reflect on from the early days of LendingClub.

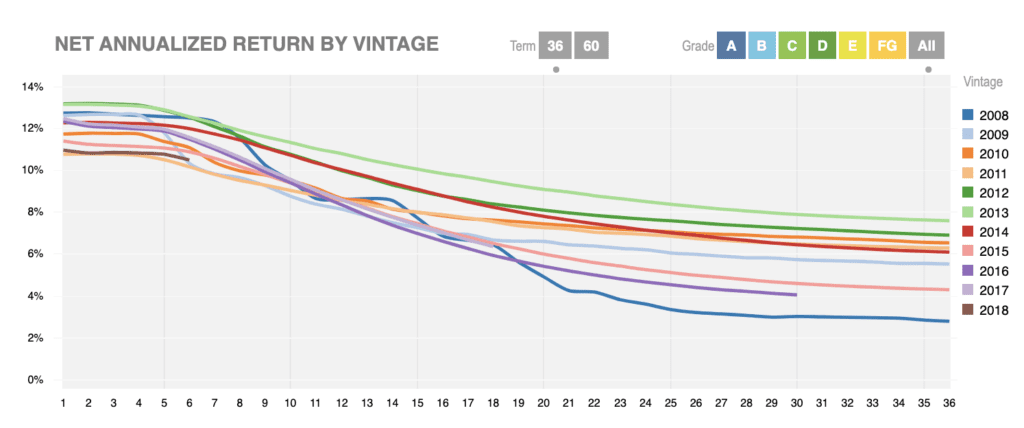

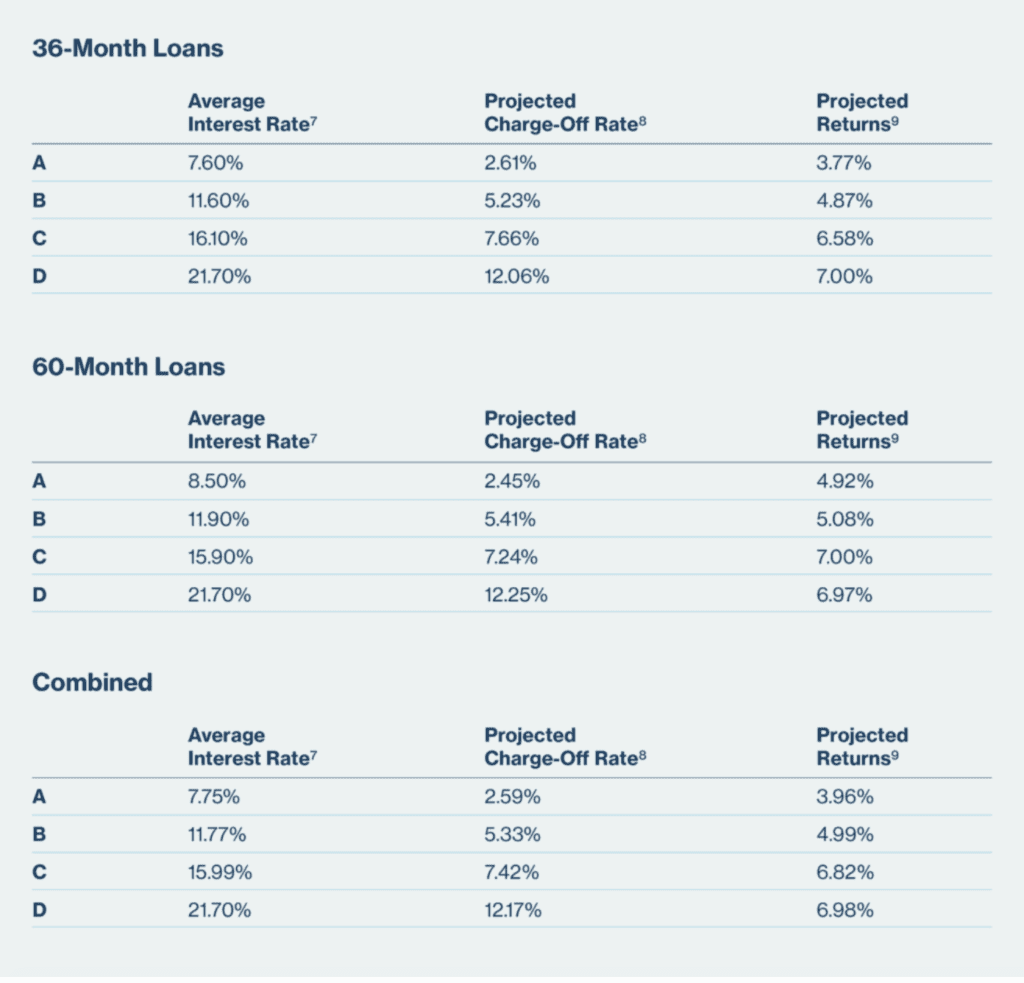

On the platform side, LendingClub shared their Q2 2019 LendingClub Platform Update, posted on September 16, 2019. LendingClub made adjustments on August 6, 2019, increasing rates for D Grade loans by 50 basis points on average. In addition LendingClub is selectively “trimming” in higher risk Grade A and B segments in order to meet the expectations of investors. They report ongoing benefits to loss trends as a result of their past actions of tightening credit. This is in line with what other lenders have decided to do. Although it is difficult to distinguish below, 2017 performance is trending above 2016 performance for 36 month loans.

On the economic front, jobs reports were strong in June after a disappointing April and May which plays a big factor in consumer health. LendingClub did note:

However, global industrial production is showing signs of strain, with sequential declines recorded in key measures of manufacturing output.

LendingClub also reported that they were expanding their balance transfer product which allows borrowers to consolidate or refinance credit card debt in a much more seamless way.

Finally, LendingClub provided guidance on returns, expecting a weighted average returns at a portfolio level to be 5.3% versus 5.4% in the previous quarter. This takes into account all of the changes mentioned above.

Recently we also learned that some investors have been locked out of investing in LendingClub loans. You can check out that story here.

LendingClub Account Performance

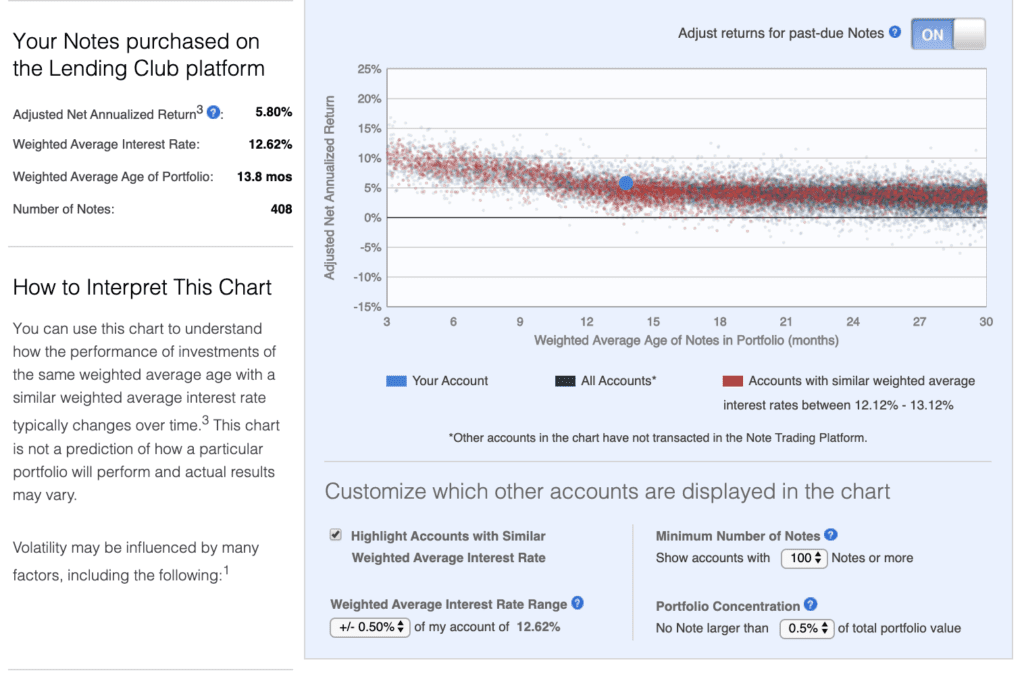

As of October 14th, the weighted average age of the portfolio is 13.8 months so we are nearing the point where most people would consider this portfolio seasoned. You can see below that LendingClub’s calculation of net annualized return is 5.80%.

The way we prefer to track returns is on a rolling twelve month basis using the XIRR formula. For the year ending June, 2019 I reported 8.45% and not surprisingly this has now fallen to 6.65%. The calculation can be easily done using a spreadsheet, taking the ending balances from the respective statements.

| Lending Club New | |

| 9/30/2018 | $5,273.48 |

| 9/30/2019 | -$5,623.98 |

| Formula: “=XIRR(E24:E25,D24:D25)” | 6.65% |

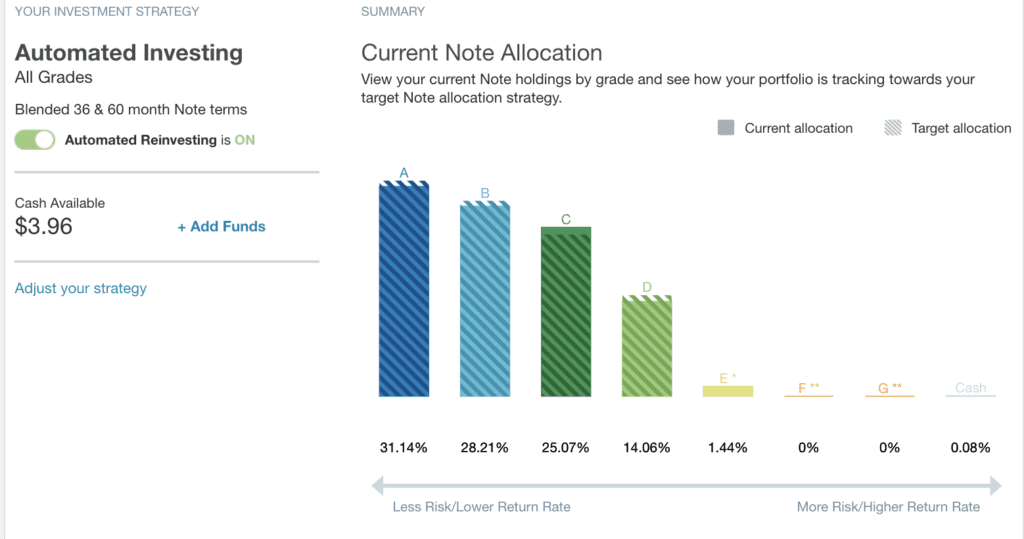

You can also see that my current note allocation closely resembles the one set out for me by LendingClub.

Conclusion

Investing with LendingClub will still be appealing to some at 6.65% as we continue to be in a low interest rate environment and it will be interesting to see where my returns ultimately level off. I personally am always keeping an eye on the spread between savings products at popular banks and LendingClub. Recently, my favorite bank Ally recently reduced rates on their savings product to 1.80%. Clearly investing with LendingClub is significantly more risky but it’s important to look at the alternatives as an investor.

Further reading: Check out Peter Renton’s full Q2 2019 marketplace lending results.