The long time secretive bank is now opening up on future plans in an effort to win over investors. Today, they held their first ever investor day and the bank was not shy about sharing their ambitions.

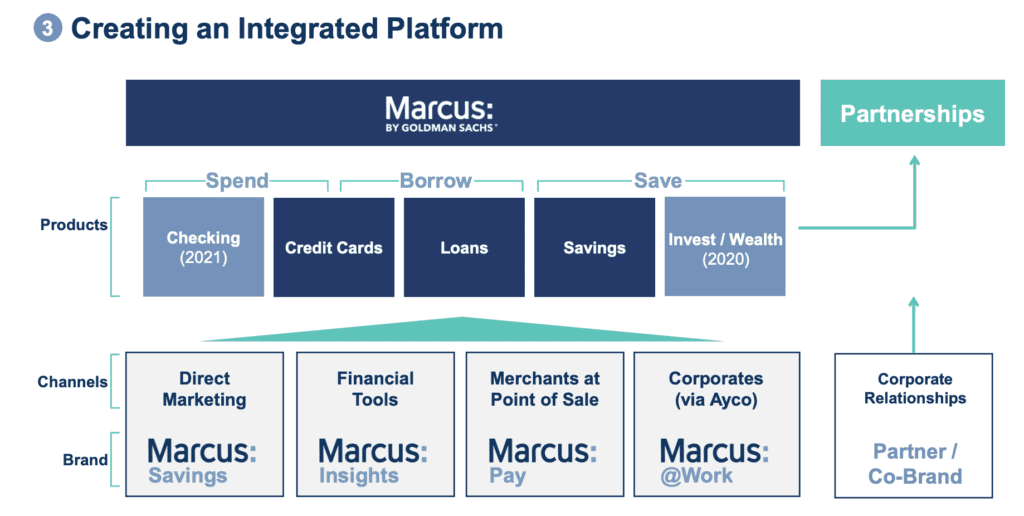

Goldman executive Eric Lane stated, “We aspire to be the leading digital consumer bank…We’re starting with loans, we added savings and cards, and we’re working to build out the balance of the digital products suite, including wealth and checking.”

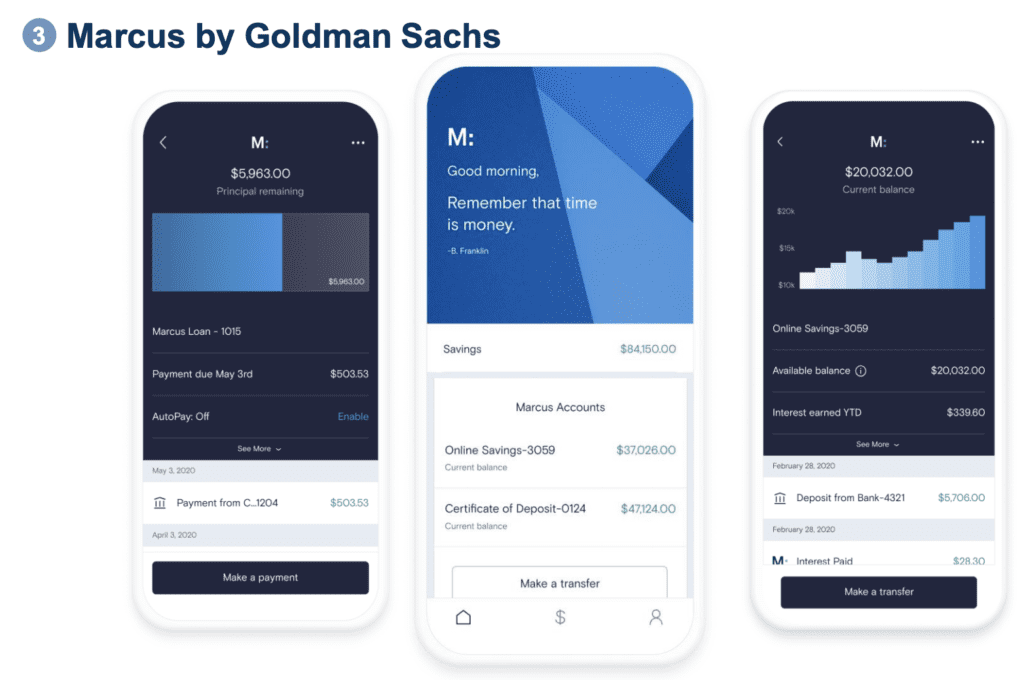

It was only a few weeks ago that Marcus launched their app which was developed by the team that joined Goldman when they acquired Clarity Money. To some it is surprising that the app came so long after Marcus first launched in 2016. Though Goldman Sachs shared that they took a careful approach and spent the better part of 2019 to create it. American Banker recently interviewed Adam Dell, previously the CEO and founder of Clarity Money about the Marcus app and traditional financial institutions.

The bank expects their digital wealth management tool to launch this year with a checking account in 2021. Currently, Marcus offers a simple savings account which offers a competitive interest rate. Below is the vision for an integrated platform.

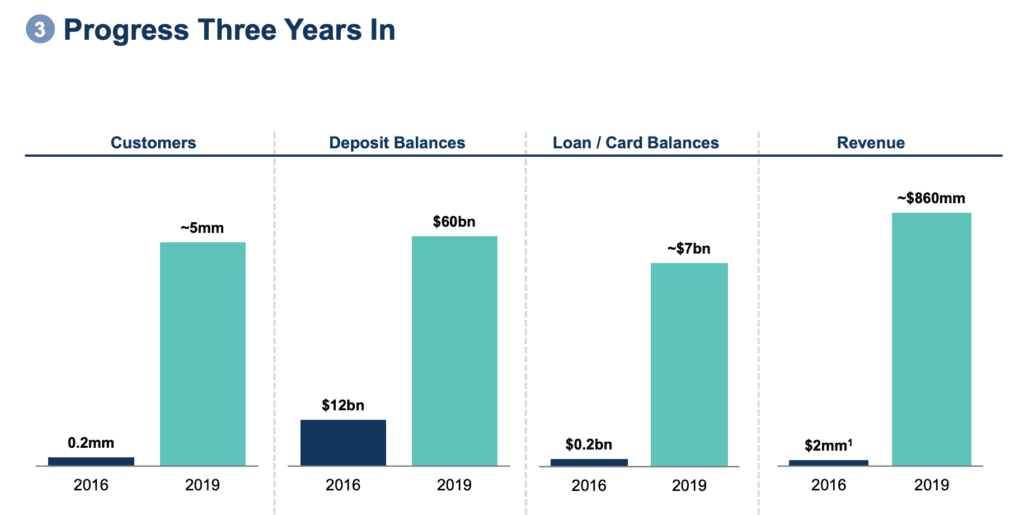

Lane went further to describe that they plan to deliver a retail bank branch through your phone. While banks such as JPMorgan Chase have been opening new branches in select cities it seems that Goldman Sachs is continuing to go in the opposite direction. Goldman aims to double their consumer deposits to $125 billion over the next five years. The investor day presentation shared that Marcus had $60 billion in deposits, 5 million customers and $7 billion in loan/card balances at the end of 2019. They hope to generate between $700 to $900 million in pretax income.

It is fascinating to get a look into detailed plans of Goldman Sachs and where they plan to go with the consumer bank. They clearly have ambitions to be a full service bank for consumers in the US and beyond. If you want to learn more from Goldman Sachs’ investor day you can download all of the presentations.