We’ve been hosting virtual content sessions for the past few months in order to help our community stay ahead of the rapidly changing environment. The webinars have informed and engaged our audience each week. Next week is no different, we have put together some really compelling sessions that will examine the mortgage financing market and the underlying technology that is help to change the way loans are originated.

These webinars are happening outside LendIt Fintech Digital and are open to everyone.

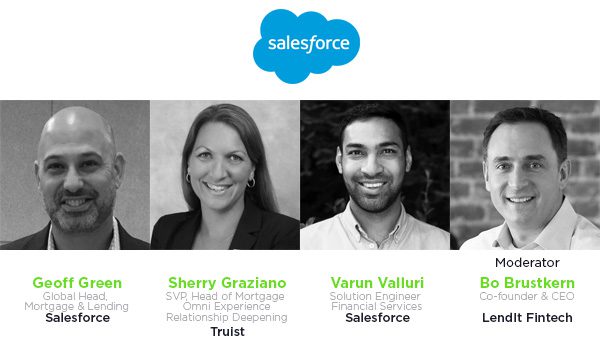

How to Accelerate Mortgage Relief and Refinance Volume for Borrowers

Tuesday, June 30 • 2:00 PM ET

Lenders today are under a massive amount of stress as many borrowers are feeling economic pain. Lenders are immediately discerning who might need a loan to bridge a gap, or who is most at risk of becoming delinquent on a loan. Also, historically low interest rates have caused a massive demand for refinancing and new mortgages.

In this webinar, you will hear from industry leaders at Salesforce and Truist on how they are managing demand volumes, relief requests and production operations in our new normal. Learn how lenders are leveraging technology to solve for the challenges of today through:

- Streamlining the application process

- Connecting all borrower information

- Analyzing risk areas

- Putting borrowers on an education journey

- Enabling self-service for volume deflection

- Providing servicing for complicated forgiveness and restructuring cases

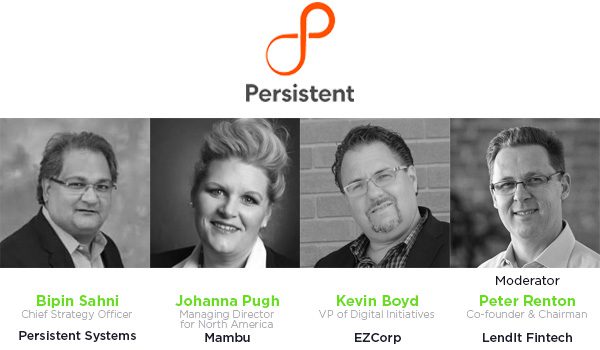

Innovative Loan Offerings and the Tech That Drives Them

Monday, June 29 • 1:00 PM ET

Innovative fintech lenders and traditional financial institutions are growing their lending portfolios by offering specialty consumer and small business loan programs that address specific customer needs. Learn how lenders are utilizing a cloud based core banking system and services as a fully integrated lending platform, or extending their existing systems to quickly launch niche lending programs. Topics covered include:

- Trends in Consumer and Small Business Lending

- Challenges to offering specialty / personal loans

- Technology strategies for specialty / personal loans