Many (perhaps most) small businesses are not well served by their bank. This was made clear during the Paycheck Protection Program where many big banks refused to work, at least initially, with some of their own small business customers because they were not big or profitable enough for the bank.

For the smallest of business, those with less than 25 employees, they were left waiting and wondering if they would receive a PPP loan at all. This led to some understandable frustration to say the least.

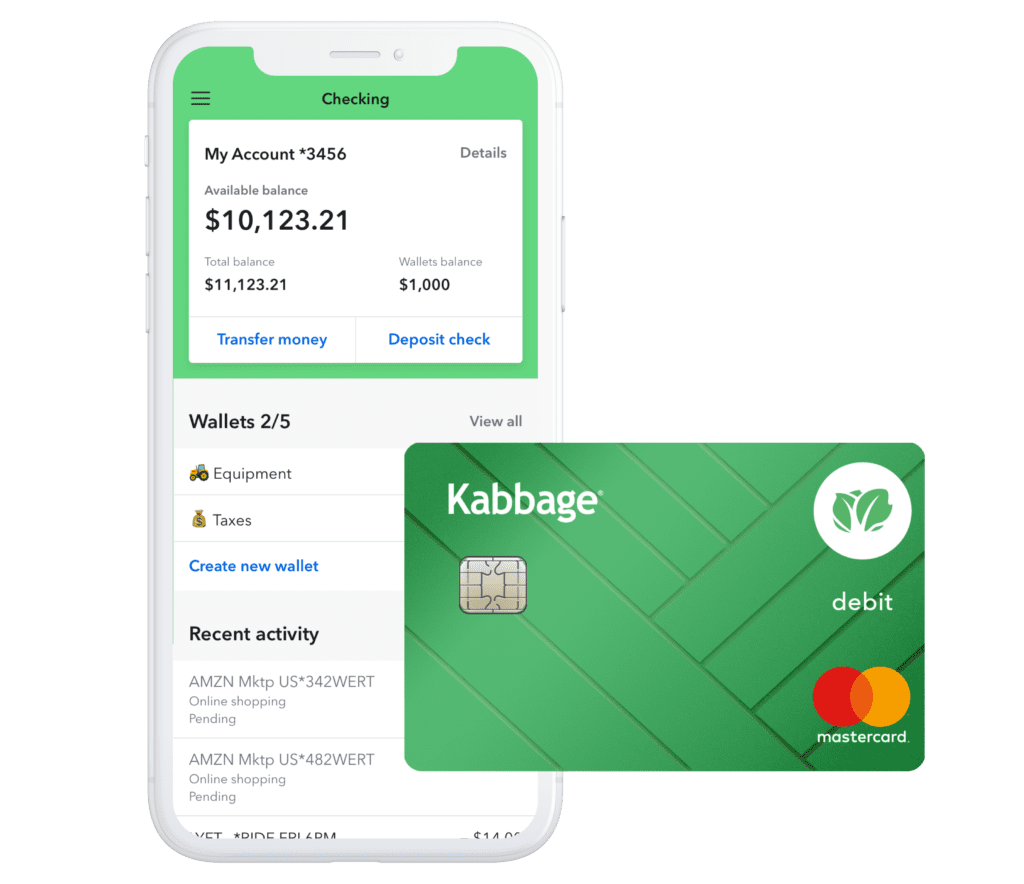

Today, into this mix, Kabbage has announced they have created a unique checking account targeted at small business. But this isn’t just any vanilla account that you could get at your local bank, they have some pretty compelling features.

Kabbage Checking will have a rich feature set for a small business bank account:

- Earn 1.10% paid monthly on your account balance.

- No minimum opening deposits.

- The ability to deposit cash at one of 90,000 locations nationwide.

- Free ATM access at one of 19,000 in-network ATMs nationwide.

- Wallets: Create up to five Wallets to track savings goals or manage your cash flow.

- Bill pay: Set up your vendors, organize your bills and issue payments electronically.

- Kabbage Debit Mastercard

- No overdraft fees.

I caught up with Kathryn Petralia, co-founder and President of Kabbage, yesterday to get some background on this new initiative. I asked her whether this was created in response to the pandemic and she said that it has been in the works for a long time and the launch was initially planned for earlier in the year.

So, while the timing is great for Kabbage, as they now have 225,000 new customers courtesy of the PPP, that was not their initial intention. In fact, Kathryn said that many PPP customers were so thankful for Kabbage they asked what more services they had. When they mentioned they would be offering a bank account many said they cannot wait to leave their bank.

“There is a reason banks do not serve their small business customers well,” Kathryn said. “It is because they can’t make money on small business checking accounts so they are pushing customers into other fee-based products.”

At Kabbage, they will have much lower costs than a typical bank and they will earn revenue from the interest, even though they will be paying a higher rate than most savings accounts. But Kathryn was also quick to point out that by providing a bank account they will deepen the relationship with their customers, and they will have better data which will help with underwriting on their core line of credit product.

Obviously Kabbage is not a bank so they will be partnering with Green Dot Bank to offer Kabbage Checking. For cash deposits they will work with a network of retailers including participating CVS Pharmacy, Rite Aid and Walgreens stores, together providing 90,000 deposit locations (by comparison Chase has just over 5,000 branches and 16,000 ATMS nationwide).

With their new checking account Kabbage will be able to offer small businesses a full suite of products. From the press release:

When paired with Kabbage InsightsTM, Kabbage Checking customers receive daily cash flow analyses and forecasts. When integrated with Kabbage PaymentsTM, customers can prevent cash flow gaps with faster settlements. Kabbage FundingTM helps prevent customers’ accounts from going negative, effectively eliminating costly overdrafts. The resulting solution gives small businesses access to unified cash flow tools in minutes with zero upfront costs or commitments.

You can’t open a Kabbage Checking account just yet. Today, they have opened the waitlist with an official launch happening later in the year. But when they do open applications Kathryn assured me that the entire process will take less than 10 minutes.

My Take

There has been so much innovation in digital banking on the consumer side of fintech but less so on the small business side. I would argue that we are yet to see a compelling offering for small business banking. And I realize Kabbage is not the only company offering a digital checking account for small business but Kabbage Checking compares very favorably with the likes of Azlo, Rho, Wise, NorthOne and Novo.

It is clear that Kabbage has thought long and hard about what a small business owner wants from a bank account. To me, Kabbage Checking is the way small business banking should be. While it is not a trivial thing to switch to a new small business checking account, I expect they will get a large number of signups. So many small business owners are frustrated with their existing bank.

We have come a long way from the days of monoline lending products. Kabbage now has a full suite of financial products for their customers which is a win for small business.

While it is a challenging time for many small businesses today, the innovation we are seeing with products like Kabbage Checking will help ease some of the frustration that many small business owners are experiencing.