Recovery, Re-Boot, Resilience: Roadmap Back to Growth

August 25th at 2:00 PM ET: Register Today

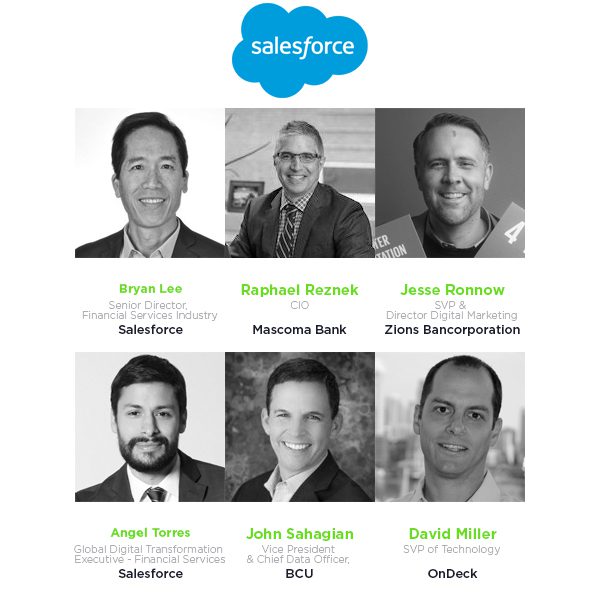

Banks, Lenders and FinTechs have spent the last months responding to the crisis. From office closures, the CARES Act and resulting economic impact, it feels like we have been in a constant state of reaction to market events. When will the shift from reaction to proactively accepting this new normal happen? What does the path back to growth look like? In this webinar, you’ll hear from a panel of industry leaders at Mascoma Bank, BCU, Zions Bank, Upstart and Salesforce how they are prioritizing and accelerating their roadmap to grow in the next normal.

Every Company is a Fintech Company

August 26th at 3:00 PM ET: Register Today

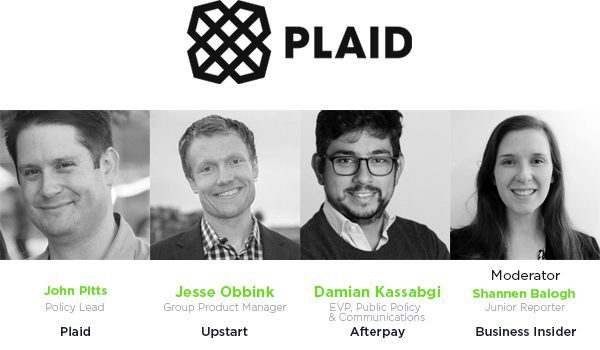

There has never been a more important time to build financial products that are fair and have the customers interests in mind. Fintech has come a long way in the last decade and it is now delivering on its promise.

This panel will examine opportunities for companies and lenders to create new products that utilize financial data to help underbanked people in the U.S.

How to build resiliency against credit losses – Intelligent strategies for Debt Collection in the new normal

August 27th at 11:00 AM ET: Register Today

With the ongoing crisis affecting delinquency rates, banks and financial institutions cannot rely on conventional methods to improve collections without affecting customer experience. Can banks make existing debt collection processes more intelligent with AI?

This webinar will discuss how collections teams can be empowered with AI enabled risk segmentation, early prediction of delinquent accounts; and suggested treatment plans based on risk segment, which helps them improve efficiency and customer experience.