LendingClub reported Q4 earnings today and their recovery from the depths of the pandemic continues. Loan originations were up 56% from the previous quarter although still down dramatically from Q4 2019. They also provided an update on their new marketplace bank. In fact, they had separate investor presentations, one for financial results and one focused on LendingClub Bank.

Here are some of the highlights from the earnings report:

- Loan Originations – Loan originations in the fourth quarter of 2020 were $912.0 million, down 70% compared to the same quarter last year and improving 56% sequentially.

- Net Revenue – Net Revenue in the fourth quarter of 2020 was $75.9 million, down 60% compared to the same quarter last year and improving 2% sequentially.

- GAAP Consolidated Net Income (Loss) – GAAP Consolidated Net Loss was $(26.7) million for the fourth quarter of 2020, compared to GAAP Consolidated Net Income of $0.2 million in the same quarter last year and $(34.3) million in the third quarter of 2020.

- Adjusted EBITDA – Adjusted EBITDA was $3.9 million in the fourth quarter of 2020, compared to $39.0 million in the same quarter last year and $4.3 million in the third quarter of 2020.

- Adjusted Net Income (Loss) – Adjusted Net Loss was $(22.1) million in the fourth quarter of 2020, compared to Adjusted Net Income of $7.0 million in the same quarter last year and Adjusted Net Loss of $(23.1) million in the third quarter of 2020.

- Contribution – Contribution was $47.2 million in the fourth quarter of 2020, compared to $101.3 million in the same quarter last year and $53.4 million in the third quarter of 2020, with Contribution Margin of 62.1% compared to 53.7% in the same quarter last year and 71.5 % in the third quarter of 2020.

- Earnings Per Share (EPS) – Basic and diluted EPS attributable to common stockholders was $(0.29) in the fourth quarter of 2020, compared to basic and diluted EPS attributable to common stockholders of $0.00 in the same quarter last year and $(0.38) in the third quarter of 2020.

- Adjusted EPS – Adjusted EPS was $(0.24) in the fourth quarter of 2020, compared to Adjusted EPS of $0.08 in the same quarter last year and $(0.25) in the third quarter of 2020.

- Cash and cash equivalents – As of December 31, 2020, Cash and cash equivalents totaled $525.0 million compared to $243.8 million as of December 31, 2019 and $445.2 million as of September 30, 2020.

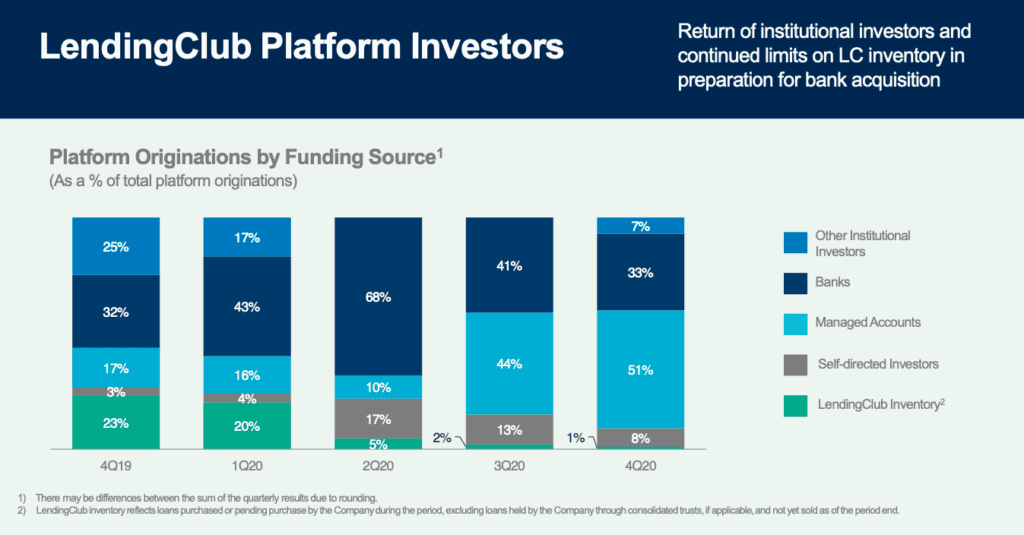

Above is the slide we often share with LendingClub earnings reports, the breakdown of the investors on their platform. You can see that institutional investors have returned but now managed accounts make up the majority of LendingClub originations. Self-directed investors will go to zero from now on since they have closed their retail investor platform.

In his prepared remarks Scott Sanborn, CEO of LendingClub, focused his comments on the bank acquisition. But he did say this about their loans first, “The pandemic has demonstrated that their borrowers prioritize LendingClub loans over other loan payments, even credit cards.” He claimed that LendingClub has advantages over both traditional banks and other fintechs, adding, “Their marketplace bank begins today with industry leading loans and deposit products, a strong brand and loyal customer base, considerable technology and data advantages, and a differentiated offering that allows us to better serve an expanded addressable market.”

LendingClub CFO, Tom Casey, said “they intend to hold prime loans representing 15-25% of their originations on their balance sheet while selling the rest through the marketplace.” This gives them the best of both worlds and it aligns their interests with investors. Interestingly, he said that LendingClub’s borrowing costs will fall 90% from 3.3% to 0.35%. Radius Bank brings with it $2 billion in deposits and will reduce funding volatility.

Overall, this was a mixed earnings report. While they beat analysts expectations in earnings per share by $0.11, they did miss slightly on revenue. But there was a real sense of optimism from both Sanborn and Casey. You could hear the enthusiasm in their voices, that they are very much looking forward to the implementation of their digital marketplace bank.