On Monday, Visa announced a $149,000 purchase of a CryptoPunk, a digital Non-Fungible Token (NFT) artwork featuring a pixel woman with a mohawk.

One of the world’s biggest payment processors, Visa made a clear statement: like credit cards and online banking before, NFTs and blockchain are the waves of the future.

“Sixty years ago, when Visa was founded, a world beyond cash and check seemed unimaginable. Moving money instantly and electronically was a radical concept,” Visa said in a blog post announcement. “Fast forward to the early days of the internet. Many were skeptical about the utility of the World Wide Web, and entering your credit card on a website was a leap of faith. These experiences now happen so routinely that most people take them for granted.”

In a blog interview, Visa Head of Cryptocurrency Cuy Sheffield said that the firm was taking part in the original NFT project, showing their support of NFT Commerce. Visa is willing to adapt and build infrastructure toward what Sheffield said is the future of retail, social media, and entertainment.

Their work exploded into a staple of the crypto community; the digital pieces traded thousands of times through the website Larva Labs. Though anyone can right-click to download the art like any other picture on the internet, “actual” ownership of punks is stored on the blockchain. Enthusiasts trade the title to ownership. Moreover, because each design is unique, punks are non-fungible, unlike crypto tokens like bitcoins that are interchangeable and identical.

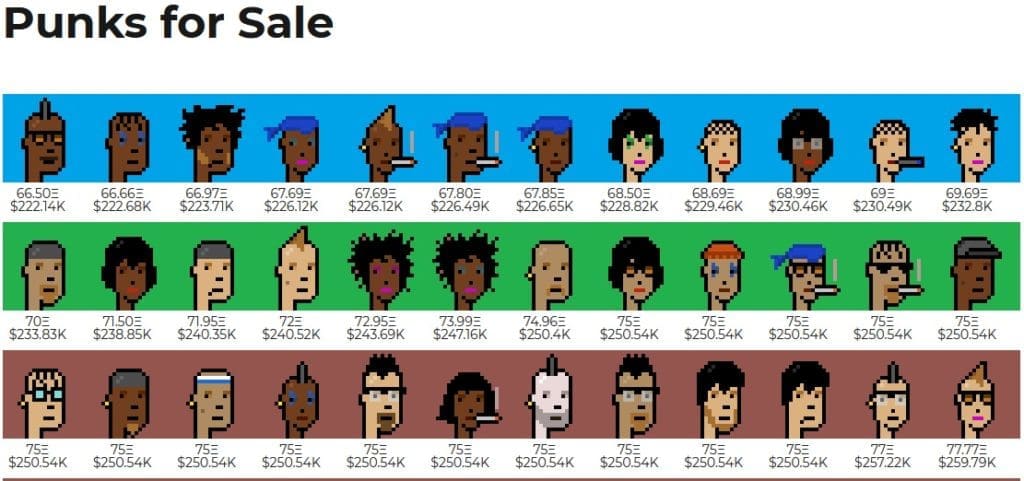

The rarest designs, featuring zombies, aliens, and apes, go for upwards of $1 million. In May, a bundle of rare Punks caught a price tag of $17 million when sold at auction with Christie’s..

Visa purchased CryptoPunk 7610 for about $149,000 and now Sheffield said that no CryptoPunk is for sale below $150k. The larva labs marketplace features a lifetime sales total of $1.21 billion.

According to CryptoSlam, an NFT price and volume tracker, 90 NFTs from CryptoPunks were sold off the hour after the Visa purchase for a total of $20 million. By 5 pm on Monday, the volume had risen to $87.9 million for the sale of 238 punks. According to CrpyoWisser, by April 2021, it was unknown if Larva Labs makes money through processing fees, though most contemporary NFT creators profit from a percentage of each art sale.

Though Visa moved to promote that they were “with it,” they reportedly settled the purchase in cash through newly licensed bank Anchorage. The OCC granted Anchorage approval to be the first national Crypto bank in January, and now the firm holds Visas private key to a CryptoPunk behind a digital vault.

Sheffield wrote that NFTs had seen a trading volume of $1 billion in the last month alone, after only getting up to $100 million in 2020.

“To help our clients and partners participate, we need a firsthand understanding of the infrastructure requirements for a global brand to purchase, store, and leverage an NFT,” Sheffield said in the post. “Enabling secure commerce is what we do — we’re the network working for everyone — and that extends to new forms of digital commerce that unlock access. So, it’s not surprising that we’re thinking deeply about this space and how we can apply our expertise in enabling seamless and secure digital payments to make NFT-commerce accessible and useable for buyers and sellers.”