On Friday after the market close, Amazon announced it would partner with Affirm for future buy now pay later options.

The e-commerce giant joined the ranks of Square, Apple, and PayPal, with a BNPL option as the space heats up to a boil this summer.

Certain customers will be able to use an Affirm pay later option at checkout, Amazon said in a press release. The AFRM stock shot up more than 46 per cent on Monday.

“By partnering with Amazon, we’re bringing the transparency, predictability, and affordability that Affirm provides today to the millions of people who shop on Amazon.com in the U.S.,” Eric Morse, Senior V.P. of Sales at Affirm said. “Offering Affirm’s alternative to credit cards also delivers more of the payment choice and flexibility consumers on Amazon want.”

The partnership puts Affirm’s tech on the rails to capture 150 million U.S. prime customers. In the Morgan Stanley analyst newsletter written by James Faucette and team, researchers reported that Affirm’s consumer base might grow to 18 million this year, with the possibility of expanding outside of the U.S. at a greater pace.

The news comes as competing tech brands fight for the dominant seat in the BNPL space. At the beginning of August, Jack Dorsey’s Square announced it was buying Australian BNPL Afterpay for a whopping $29 billion. According to Squares Q4 earnings, 48% of Square’s total revenue in 2020 was from bitcoin and bitcoin trading. Additionally, 85% of all value added in 2020 was bitcoin-related.

Klarna, a Swedish-based BNPL popular in Europe, collected $639 million in a June funding round, valued at about $46 billion. The firm has reported over 90 million active users worldwide, and though doing better abroad than in the U.S., reported last week, its stateside client base grew from 3 to 20 million in the past year.

Apple announced earlier in August that it would be partnering with Affirm for payments in Canada after making it clear, they would be sticking with Goldman Sachs to process BNPL services in the states.

Friday after market close is usually reserved for bad news, so why launch a big story? As Nik Milanovic mentioned on Twitter, some customers may have seen the move coming. And who else but the meme stock betting r/wallstreetbets members.

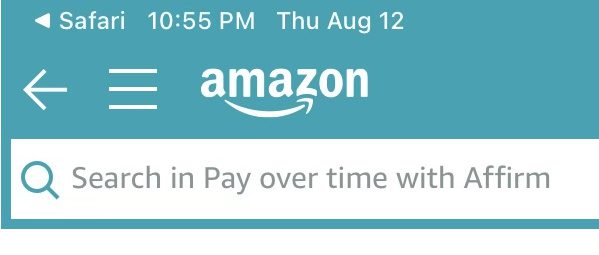

Fifteen days ago, user u/RossPG posted due diligence”(DD) on why he would bet on Affirm and Amazon making moves together soon. He found that strange misdirected links like amazon.com/affirm would lead to new tabs with the title “Pay over time with Affirm” in the tab or in the search bar on the mobile app. The URL also showed an “id node” that he said Amazon uses for specific Amazon product landing pages, like the Kindle store. Other users commented, noticing a line for options next to Amazon’s in-house credit card BNPL option.

“So what could all this mean? It could be something as simple as Amazon will promote Affirm’s upcoming debit card on their website, but why would they promote a competing card? At the moment, Amazon only offers its own cards. Or it could be a full-blown partnership or buyout. We don’t know, but something is going on,” u/RossPG said in the post. “Also, don’t question why I was routinely visiting error message URLs. I have no life and was hoping one day I’d find something, and I did.”

The research the user conducted is now blowing up on Twitter, proving to be an event of near insider trading brilliance that could have made the most bullish investor millions through call options.

The BNPL fintech company went public on the Nasdaq at the beginning of the year, with an $11.9B valuation. The firm was founded by former “PayPal mafia” entrepreneur Max Levchin to eliminate late and overdraft fees. In the company’s S-1 public filing, Levchin wrote about his plan to go after traditional finance institutions. He said that it was clear they operated by hiding what purchases will actually cost you in the fine print.

“With most of the payments industry deriving profits from late fees, overdraft charges, and gimmicks like deferred interest, it’s not hard to agree that there has to be a better way; it’s time to evolve payments again,” Levchin wrote. “More than eight years ago, we set out to take on credit cards and change the way we pay. We built Affirm from the ground up to align with the needs of consumers and merchants and to succeed when they succeed.”