This fall, the big apple is holding a Financial Inclusion Challenge called NYC[x] Moonshot to help underbanked New Yorkers in the Bronx.

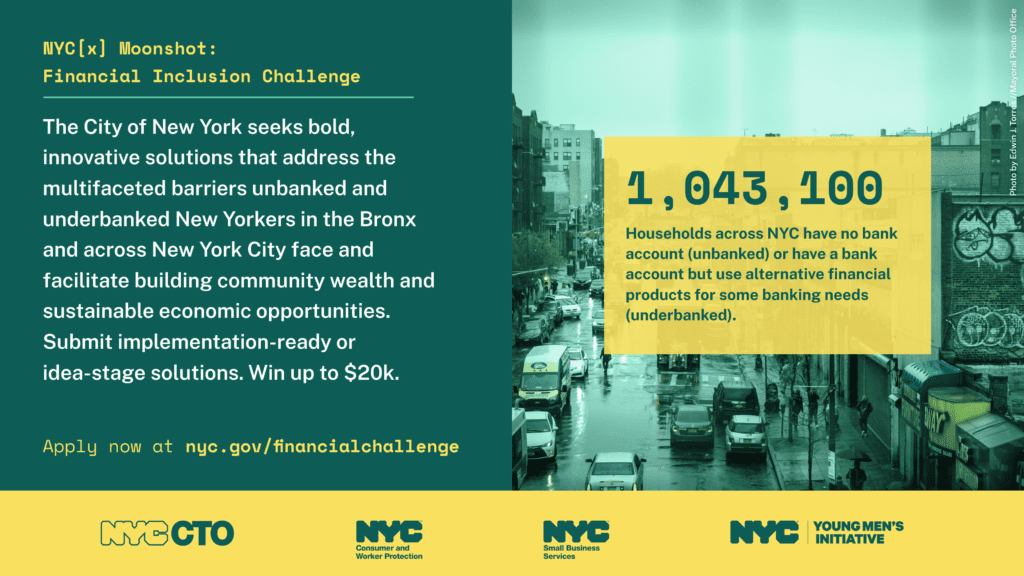

Organized by the Mayor’s Office of the CTO, the competition will judge submissions by fintechs, community groups, and youth entrepreneurs to apply to win up to $20,000 for their ideas.

The Moonshot Challenge

“How might we utilize breakthrough financial inclusion technology, innovative models, and culturally relevant approaches to build community wealth and sustainable economic opportunities for unbanked and underbanked communities in the Bronx and across New York City?”

The application deadline is September 6th. The office said it looks for implementation-ready and idea-stage solutions, like innovative business or government models that build community wealth.

Other categories include ideas that increase and preserve ownership in diverse communities, raise incomes, increase access to banks, education, and trust-building enterprises. The city is willing to shell out prize money for new ideas to build better communities, financial first.

According to the mayor’s office, there are 1,043,100 households with people who do not have bank accounts or who use alternative banking products for lack of access in the city.

The borough of the Bronx feels this problem disproportionately, with 49.2 per cent of households underbanked or unbanked compared to just 33 per cent in the rest of the city. Nationally, 23% of households share the same problems.

The city cites the World Bank when it said that “financial inclusion [is] a key enabler to reduce extreme poverty and boost shared prosperity.”

And yet, as the San Francisco Office of Financial Empowerment says, “the financial system is not designed to serve low-income consumers, and is rife with systemic racism that harms Black Indigenous People of Color (BIPOC) communities.”

Problems hit harder

After nearly two years of the pandemic, these problems hit harder, pronouncing systematic inequality that hit communities of color disproportionately, the office said.

“Decades of low incomes and structural barriers such as the lack of access to culturally competent brick and mortar financial institutions that offer safe, affordable, and accessible banking products and services, has combined with a lack of trust and enabled the proliferation of predatory and extractive alternative financial products.”

To address this problem, NYC is encouraging the fintech community to come up with ideas. Alongside the Mayor’s Office of CTO, the project is supported by other groups that hope innovative ideas can help catalyze change.

NYC Department of Consumer and Worker Protection Office of Financial Empowerment (OFE)

Within the Department of Consumer and Worker Protection (DCWP), the Office of Financial Empowerment (OFE) focuses on initiatives that support New Yorkers and communities with low incomes in building wealth and improving their financial health.

NYC Department of Small Business Services (SBS)

SBS helps unlock economic potential and create financial security for all New Yorkers by connecting New Yorkers to good jobs, creating more substantial businesses, and building thriving neighborhoods across the five boroughs.

NYC Young Men’s Initiative (YMI)

YMI was created as a public-private partnership to address increasing disparities among black and Latino men between the ages of 16 and 24 in education, employment, health, and justice.

The challenge encourages stakeholders from diverse backgrounds to respond, including fintech companies, community groups, and youth partnerships between different stakeholders.

LendIt Fintech will be following the competition as a supporter of inclusive fintech in our home turf of NYC.