It’s earnings season, and it’s a spooky one for some. Here are three public fintechs on the LendIt ticker that posted results this week.

Lending

On Thursday, online lender Enova International posted a $52 million profit on $320 million in revenue, up 57% from the same time last year. In addition, total originations increased 26% sequentially to a record $856 million. Despite the good news, the stock saw only a 4% rise before falling back toward its downward trend this month.

“We are pleased to again report a strong quarter of growth across all of our businesses,” CEO David Fisher said. “We continued to see rising demand, driven by increased spending as the economy recovers.”

The firm also reported it was cooperating with a CFPB Civil Investigative Demand for alleged issues with its loan processing.

“Working with our regulatory authorities like the CFPB is a critical part of the process of providing financial services, and we look forward to completing the investigation,” General Counsel and Chief Compliance Officer Sean Rahilly said.

Trading

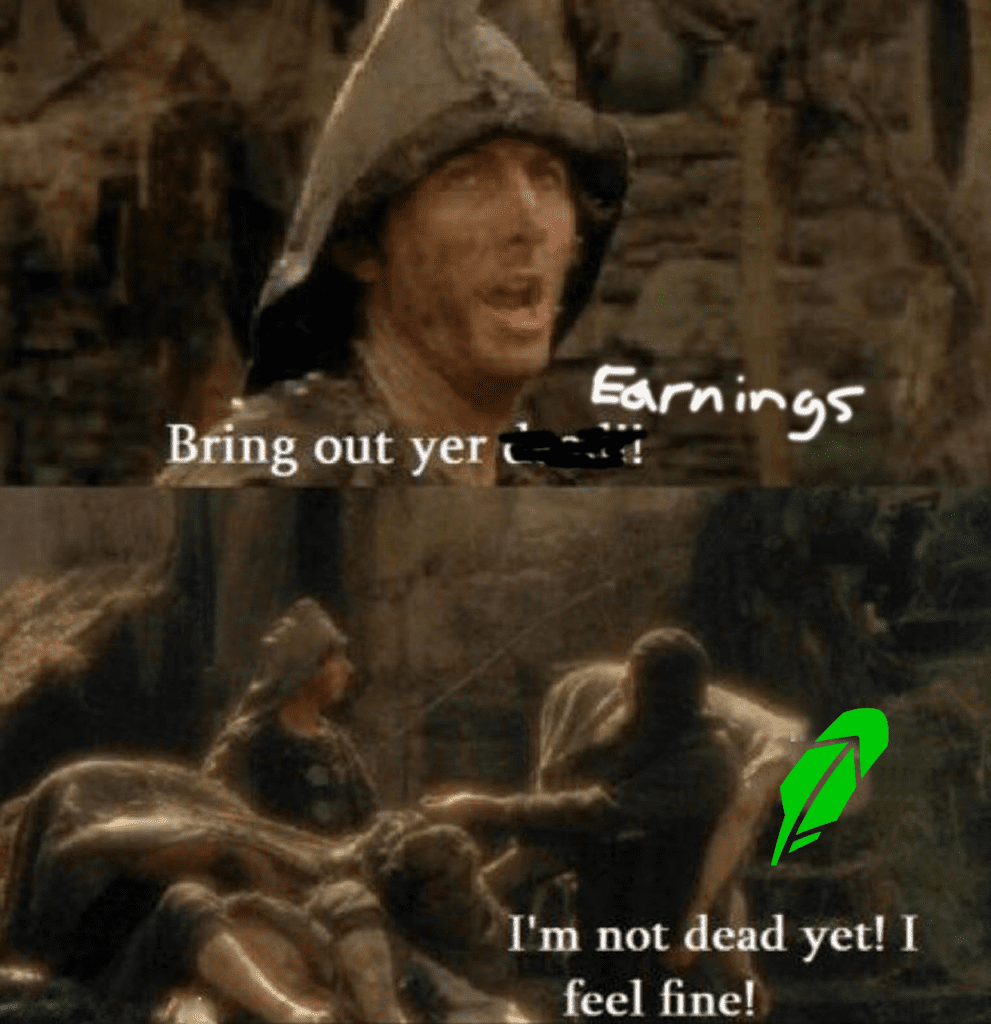

NYSE: “Bring out yer earnings!”

*Vlad brings out HOOD

NYSE: “That’s not earnings!”

Vlad: “Sure it is,”

Robinhood: “No, it’s not; I lost money. I didn’t earn a thing!”

NYSE looks back and forth

Vlad: “could you…”

*NYSE cracks Robinhood on the back of the head, dropping the price 12% in seconds

Vlad: “… thanks… “

*NYSE throws HOOD on the back of his cart, with all the other earnings

The payment for order flow mobile brokerage app Robinhood dropped in value immediately after posting a $1.32 billion loss on Tuesday. Retail investors that use the app watched as the HOOD stock price dropped 12% in minutes.

“This quarter was about developing more products and services for our customers, including crypto wallets,” CEO Vlad Tenev said on the earnings call. “More than one million people have joined our crypto wallets waitlist to date.”

It was not enough for Q3: Investors have soured on the platform despite driving investing madness through GME options trading and a Dogecoin price explosion. Cryptocurrency trading was down significantly, the company reported, compared to Q2.

For example, while the carbon crypto copy Shiba skyrocketed, Robinhood users were out of the loop: the firm has not added the meme coin.

Banking

Wednesday, the online bank Lending Club announced record-breaking revenue of $246.2 million, growing 20%. In addition, the firm’s non-PPP loan portfolio grew 25% since June and saw deposits grow 12% to $2.8 billion. Lending Club’s profit came in at $27.2 million, $0.26 per share, up 190% since Q2.

“Our strong revenue and earnings growth trajectory has become evident following our transformation into a digital marketplace bank,” CEO Scott Sanborn said. “Our success continues to be driven by our competitive advantages, including our growing base of 3.8 million members, our exceptional data science capabilities, and our proven marketplace model.”