This earnings season started strong but turned uneven this week. Even firms that showed outsized growth saw their stock prices level: a year of absurd price increases can only go so far before good results start to look lackluster.

On Wednesday, the U.S. Labor Department reported prices had inflated more than 6% in a year, sending the market and fintech in a tailspin. Some stocks, like Upstart, were down upwards of 20%. However, some firms still rallied despite posting losses per share: performance doesn’t always correlate with price in the fintech world.

SuperApps, Investing, and Crypto

Paypal

Paypal’s Monday earnings started the week off on a bad note, showing a 13% rise in year-to-date net revenue, at $6.18 billion; it was still below Wall Street expectations. Worse yet, on the earnings call, the companies reps said it might not make earnings goals for this quarter, even with holiday shopping sprees to come.

Despite earning $1.11 a share, the stock dropped 6%. Paypal also announced a partnership with Amazon to enable Venmo users to checkout with the peer-to-peer payment app, but beginning in the new year, so missing out on the holiday season.

“Our third-quarter results show solid growth on top of a record year. The strength of PayPal’s two-sided platform and ubiquity in our core markets has set us up to grow at scale, expand our work with existing merchants and attract new partners,” CEO Dan Schulman said. “We’re thrilled that we are teaming up with Amazon to enable customers in the U.S. to pay with Venmo at checkout.”

Coinbase

On Tuesday, Coinbase showed growth, but overall, cryptocurrency buying trended downward, causing the price to drop. In addition, the firm showed revenue of $1.31 billion, but investors were hoping for $1.57 billion. Even so, CEO Brian Armstrong had high hopes for the upcoming Coinbase NFT platform releasing toward the end of the year, saying on the earnings call it may become the biggest part of their entire business.

“We are very excited about NFTs, this is going to be a very large area for crypto in the future, and it already is today,” Armstrong said. “We’ve had another solid quarter, and this is amidst the volatility happening out there in the cryptomarket. We never know exactly what’s going to be happening this quarter in crypto, but we are seeing a really strong and accelerating pace of crypto adoption globally.”

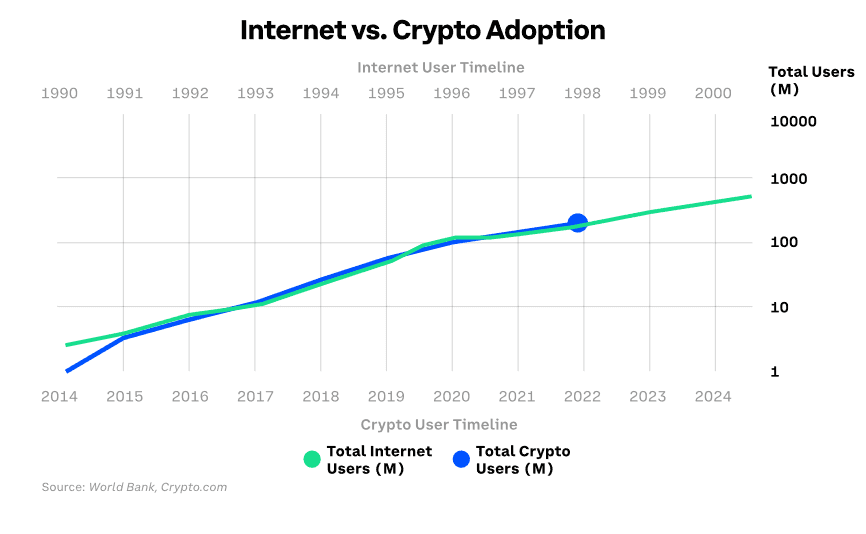

Coinbase also argued it was only a matter of time before crypto takes over everything, comparing a crypto growth map to the early growth of the internet at the turn of the century.

SoFi

The “one-stop-shop” for digital financial services, SoFi reported better than expected results. Revenue grew to $251.4 million, and total product use doubled year over year to 4.3 million. Even so, the firm posted an overall five-cent loss per share: but it didn’t stop the stock price from soaring 12%.

“I believe we’ve accomplished more at SoFi across our uniquely diversified platform of mobile-first financial products over the past year than many other companies will achieve in a lifetime,” CEO Anthony Noto said. “Our strategy to build the first digital one-stop-shop that meets our members’ financial needs for every major event in their lives, and all of the days in between, continues to pay off.”

MoneyLion

After a SPAC IPO in September, automated investing and advising app MoneyLion posted revenue that broke company records. Net income grew 91% to $44.2 million, nearly doubling from the same period last year. In addition, the firm’s customer count grew to 2.7 million, up 131%, and personal loan originations jumped 135% to $274 million.

“MoneyLion is delivering on our vision of building a fully-digital private bank for the working middle class,” said Dee Choubey, MoneyLion co-founder and CEO. “Our platform of financial products, which now includes full-featured banking, investing, credit, crypto, and rewards, along with personalized insights and advice, is resonating with millions of Americans as evidenced by our strong third quarter and year to date results.”

BNPL and Payments

Affirm

BNPL company Affirm showed outsized results for their uniquely scheduled Q1 2022 results, even for the hot BNPL market. They posted $269.4 million in revenue, outpacing expectations, and the stock popped 21% despite an overall loss of $1.30 a share. Affirm was helped by news of an exclusive multi-year partnership with Amazon for BNPL options.

“Our strong quarter once again demonstrates the continued momentum across Affirm as more people embrace the transparency, flexibility, and value our solutions provide,” CEO Levchin said. “Over the last year, we expanded our network by increasing the number of active merchants on our platform to over 100,000 and more than doubling the number of active consumers.”

Payoneer

Payments firm Payoneer showed a year-over-year increase in revenue of 35% to $122.7 million. Transaction costs through the platform made up 20% of revenue, and overall volume jumped 16% to $13.6 billion. Overall last year, the firm only saw $11.7 billion.

“Our global team executed really well this quarter as we continue to focus on delivering unique high-value services to our fast-growing and increasingly diverse customer base, “CEO Scott Galit said. “We acquired a record number of new customers and drove adoption of services like B2B AP/AR, Bank Partnerships, our Commercial Card, Merchant Services, and Working Capital.”

Banking and Services

Marqeta

Card issuing platform Marqeta posted a 56% jump in net revenue year over year to $132 million and a total processing volume of a whopping $27.6 billion. The stock price jumped over 20% to $25 on the good news before correcting downward.

“Modern card issuing is at the heart of today’s digital economy, and our third-quarter results put that on display,” CEO Jason Gardner said. “Both with the growth we’re seeing, and the way our platform is bringing to life unique new payments use cases for an incredible array of innovators.”

PagSeguro

Brazillian fintech service provider PagSeguro showed a Q3 increase of R$321.5 million, at R$0.97 per share. Revenue increased more than 55% year over year to R$2.776 billion, beating expectations by $10 million.

During the earnings call Thursday, the CEO Ricardo Dutra commented on the harmful effects of the pandemic on the Brazillian economy, still underway and causing inflation to pump 10% as “the pandemic is not fully behind us.”

“Our quarterly results, one more time, consolidate our winning strategy to continue to invest in technologies to make clients’ lives simpler,” Dutra said.

Blend Labs

On Wednesday, Nov. 10, cloud banking software provider Blend Labs posted a loss of $0.38 a share, worse than the market predicted. Shares dropped 14%. The company said it was experiencing losses after adjusting from the acquisition of Title365 insurance due to stock price changes since the IPO in July 2021.

These results were despite growing banking transaction volume and platform “segment revenue” by a quarter over last year. The firm makes money selling software to banks to build better customer experiences, recently adding 17 accounts, including the whopper $37 billion Prosperity Bank.

“Our Blend Platform segment achieved record quarterly revenue in the third quarter, and we built on our business momentum by adding new customers across verticals, innovating to expand our existing customer relationships, and launching and selling new products,” CEO Nima Ghamsari said. “On the new product front, we successfully launched our Blend Income Verification product in the third quarter, and to date, we have signed over 50 customers.”

Lending and Insurance

Upstart

Tuesday, Nov. 9 A.I. consumer lender Upstart posted excellent results but still dropped nearly 20%. Total revenue was $228 million, up 250% from last year. Originations were up 244% from last year, at $3.13 billion, and earnings per share was $0.30.

Still, the stock tanked, possibly because it has grown nearly 1,000% in a year and raised its end of year earnings prediction by $50 million. But, unfortunately, it was not enough for eager fintech investors. The price began in 2021 at around $30 and had ballooned as high as $390 in October before leveling to about $246 at the time of writing.

“Since Upstart’s IPO a year ago, we’ve more than tripled our revenue, tripled our profits, tripled the number of banks and credit unions on our platform, and tripled the number of auto dealerships we serve,” CEO Dave Girouard said. “With that many 3s, Upstart is becoming the Steph Curry of the fintech industry.”

OppFi

Fintech subprime banking service OppFI beat earnings expectations, showing an adjusted $0.21 per share and total revenue of $92 million. The stock jumped 13% on the Thursday release but fidgeted around with high volatility. The firm showed $164 million in loan volume and automated loan approvals up from the last quarter to 58%. The firm expects to make $360 million in total revenue this year.

“We continue to invest heavily in our platform, particularly in talent, product, and technology, including our artificial intelligence and machine learning tools,” CEO Jared Kaplan said. “Automation creates less friction for our customers. In this quarter, we continue to make strides in automating the credit approval process on behalf of our bank partners.”

Hippo

Homeowners insurance provider Hippo showed positive growth, sending the stock up about 2%. The firm generated $162 million in premiums, and retention on accounts rose to 89%. As a result, Hippo upgraded their yearly projection more than $40 million, up to $600 million.

“The third quarter was incredibly strong for Hippo,” CEO Assaf Wand said. “Our results demonstrate exciting progress in the areas of our business that matter most. We delivered robust growth, improved our loss ratio, and made a number of investments which will strengthen our foundation for the future.”