After hundreds of applications, 15 startups entered the Startup Summit PitchIt semifinals last week.

Today, the eight finalists pitched virtually in front of several leading VCs, and one came out on top. At the finale of the pitch competition, Canny Co took the gold prize.

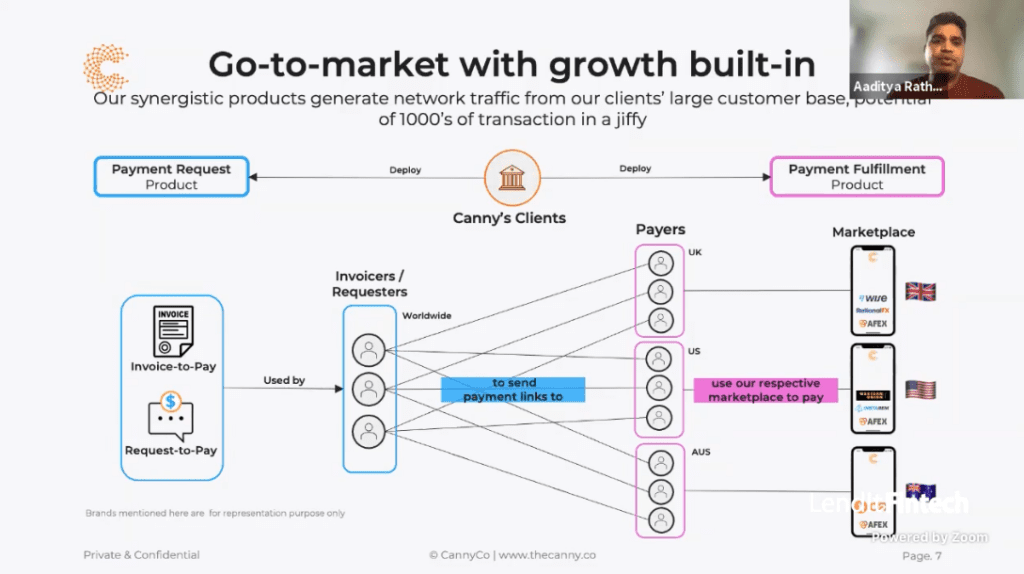

Canny Co is building a global payments ecosystem to serve consumers and institutions with better cross-border options worldwide. Co-founder and COO Aaditya Rathod ran a top-notch pitch presentation for the young fintech.

“Canny is a b2b remittance marketplace as a service biz that helps any biz launch regulated remittance services anywhere in the world and monetize their existing international user base,” Rathod said. “With just a few lines of code.”

The product is both a marketplace that lets users compare payment options, but also a payment vehicle.

Founded in August, Canny already has eight industry partners that they are building remittance services for and seven more on the way. By the end of 2022, Canny expects to make over $2 million on their 0.2% transaction fee model.

“We are here to make everyone happy. On one side, financial institutions are saving time and cost,” Rathod said. “They make money on every transaction. The end consumers are getting better choices, enjoying lower prices, and using a one-stop-shop to compare prices.”

Turbocharging Fintech Startups

The day’s final panel explored the ecosystem for turbocharging fintech startups, with Sam Lawson from Crowdcube, Stuart Barclay at Trustly, and Rana Yared from Balderton Capital. Moderator Clive Rich helped guide a provoking discussion of how the pieces come together along the startup journey.

As the discussion was showing no signs of stopping, Peter Renton had to jump in to ask the audience questions. An anonymous viewer question stood out:

“Why is fintech so popular with investors today, It seems like it is trumping all other industries?”

Yared jumped in:

“Fintech is the only vertical that touches everyone every day. Whether they transact in the regular financial system or they transact online. The second reason they transact,” Yared said. “We are seeing my own poorly coined term: fintechisation of the consumer. Companies or applications that look like they are consumer apps are actually making their money through the financial system.”

Yared gave an example of a hair appointment service she recently worked with. On the outside, it appears to be a company that helps people make hair appointments, but it makes money through invoice financing through the beautician.

Thank you to our supporters

In closing out the speaker panel portion of the summit, Todd Anderson and Peter Renton thanked the supporters, the more than one hundred fintechs that applied to the pitch competition, and judges that helped choose a final winner.

“I just wanted to really thank not only the companies that were a part of the competition but also our judges,” Anderson said. “We have some really great VC firms who were able to join us not only for the finals, but we also had some others that joined us just for the semifinals.”

“It was a great day, and I think we feel the quality of the startup pitches today,” Renton said. “I think it bodes well for the future of FinTech and Europe. Thank you very much, everybody, for tuning in.”

The next time the LendIt community would be gathering for a conference will be in person Renton said, at the Latin America Miami Conference in just two weeks’ time.