Four fintech entrepreneurs spoke about a relatively unexplored topic at a LendIt webinar on Tuesday.

We hear plenty about neobanks from Brazil and Mexico, but what about fintechs in Guatemala?

Enrique Galdamez, the Executive director of Fintech Guatemala, led the talk as a 28-member trade association leader.

He began with a short investor presentation: it’s not every day Guatemala gets eyes like LendIt’s international community. But, before he was finished, a user was in the chat asking for help with their plan to bring VC money toward Guatemala and what steps they could take.

“The association would be a great place to start,” Galdamez said. “Get in touch with us; what we are doing is hosting different projects and events to connect entrepreneurs and people who are interested in getting investment options.”

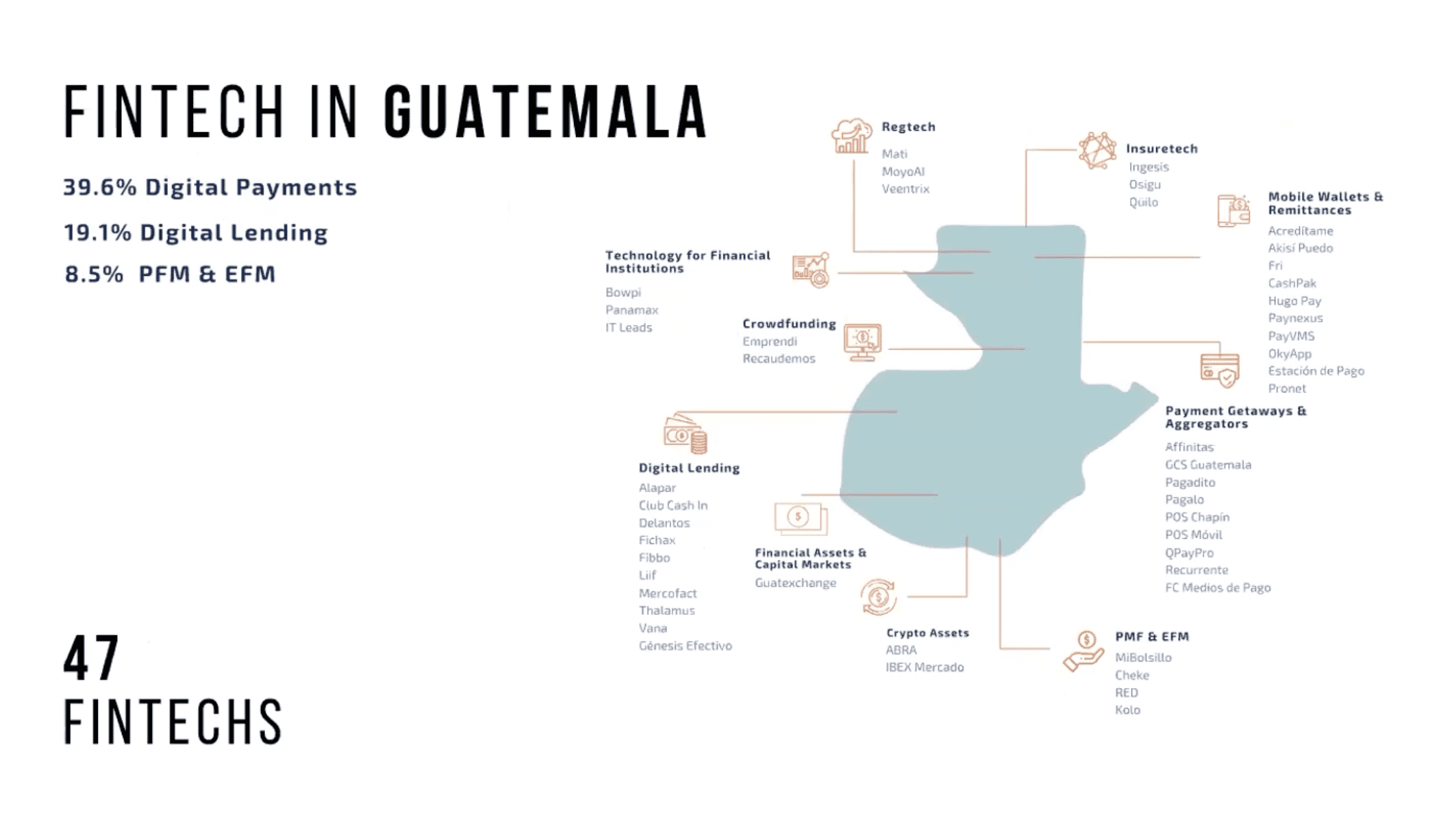

It turns out, like many Central American countries, Guatemala is a hot market for fintech, with a GDP of $77.6 billion in 2020, making it the second-largest economy in Central America and the Caribbean. In that time, the Bank of Guatemala recorded about $905 million in foreign direct investment; 70% went right into financial and insurance start-ups.

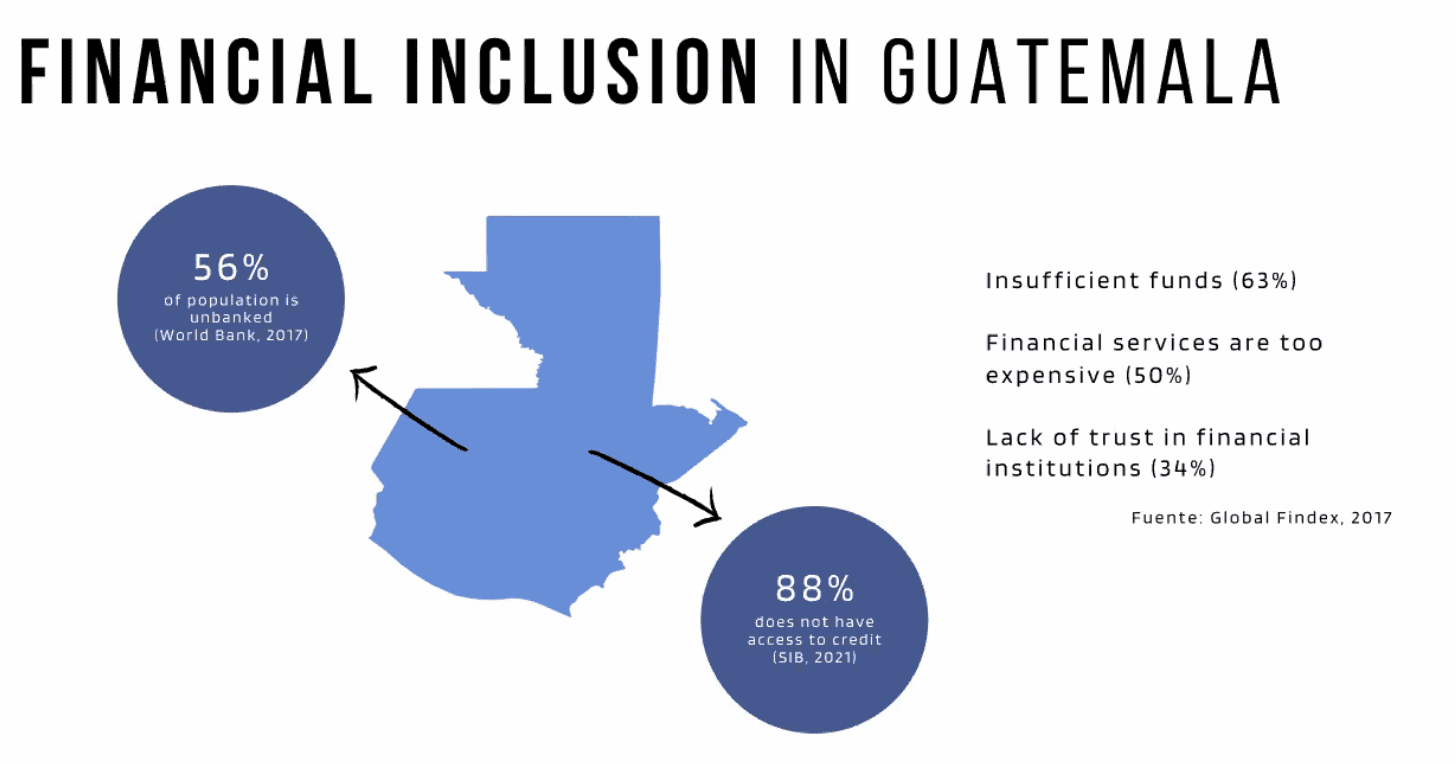

Why is so much fintech coming out of LatAm in general? Galdamez said Central American is the region with the second-lowest banking population numbers- only 48% of people have accounts.

“In Guatemala, 56% of the population is currently unbanked; that’s more than one in two,” Galdamez said. “Also, 88% of the population does not have access to credit.”

Lump-sum a barrier

The main reason is that even when people have the cash flow to uphold a financial relationship, Galdamez said the lump sum required to open a line of credit is “way too large.”

That’s where fintech comes in. Galdamez introduced Piero Coen, CEO and Co-Founder of online lender Osmo, who also works as the head of business development for the online crypto exchange CashPak. His firm is currently navigating the regulatory waters to create an online wallet built for international remittance and crypto.

“Having grown up in Central America and seeing that international fintech companies overlook us is very frustrating,” Coen said.

Next up was CEO and Founder of online lender Vana, Christobal Ibarguen. “We provide credit access to anyone with just a smartphone and national ID to access the credit throughout the entire country.” According to Galdamez’s data, that’s big news; over 69% of the population has access to smartphones despite credit gaps.

When it came to a question about significant challenges his firm faced, Ibarguen said the banking infrastructure in Guatemala had held him back.

“The other one, at least for Vana, in particular, in the beginning, was the customers believing in what we are offering,” Ibarguen said. “There was a discrepancy in terms of a user knowing that with just a smartphone, they were able to access credit.”

Ibarguen said it has been all about education and facing a generational divide in knowledge and learning infrastructure.

Last was CEO Carlos Lopez of Moyo AI, an automated banking-as-service fintech that focuses on credit scoring and onboarding. Lopez said Moyo AI is built toward serving underbanked and underserved populations and helping them trust their financial providers.

Myth or Truth

In the myth or truth question section, Lopez said financial inclusion was a significant factor and opportunity area in fintech.

“We send out impact surveys to end customers, and we saw people who don’t have access to financial credit in the past have a lack of financial history,” Lopez said. “For me, it really thrills me, not only one person but a group of people: That’s what thrills me. It pushes me to work harder and make better products.”

The group was asked what they thought about Guatemala’s neighbor El Salvador, known recently for adopting bitcoin as legal tender, and plans for more.

Coen, an expert in the remittance and global payments that El Salvador attempts to capture with the move, said that the adoption of bitcoin as legal tender would not likely spread to other countries in Central America.

“My position on bitcoin in El Salvador, it’s very tricky. From a country standpoint, I think it is a great PR stunt. It has put El Salvador on the map; people six months ago couldn’t point out El Salvador on a map, and now they can. It puts the region in the spotlight and president Bukele in the spotlight,” Coen said.

“So, in short, I think it was a great PR stunt for his personal brand and his legacy, and the country. Whether it will permeate to other countries in the short term, I don’t see it happening. Maybe it will create more openness toward creating regulations and pay more attention to bitcoin and crypto.”