While the rest of the payments sector developed to resolve issues posed by traditional methods, wholesale cross-border payments have been somewhat left behind.

RTGS.Global is creating a solution.

Issues of friction stemming from slow rates of transactions, settlement risk, high costs, and opacity within the system have plagued the sector for years, with slow steps to reduce them.

“If we look at how the market has changed over the past twenty years, settlement risk existed everywhere,” said Dave Sissens, CEO of RTGS.Global, who has dedicated much of his career to cross-border settlement and removing settlement risk within the market.

“Although now we have some solutions out there that remove settlement

risk, there is still over 60% of the world’s cross border settlements conducted with settlement risk, so it’s still a big problem.”

Alternative to develoment in CBDCs

For many, the next logical step is a development of a Central Bank Digital Currency (CBDC) within the blockchain or the use of Distributed Ledger Technology (DLT).

The use of DLT addresses the issues of slow transaction speeds and lack of transparency, although worldwide implementation of CBDCs does not appear to be a reality for a few more years. Many nations are in various stages of testing, with only a few releasing pilots this year.

The balance of introducing new systems while integrating into and maintaining traditional ones has been much discussed within CBDCs, involving extensive testing and regulation to encourage confidence.

Streamlining cross border settlement

“

“RTGS.global is on a mission to reduce the friction and much of the costs associated with cross-border settlement and liquidity management,” said Sissens.

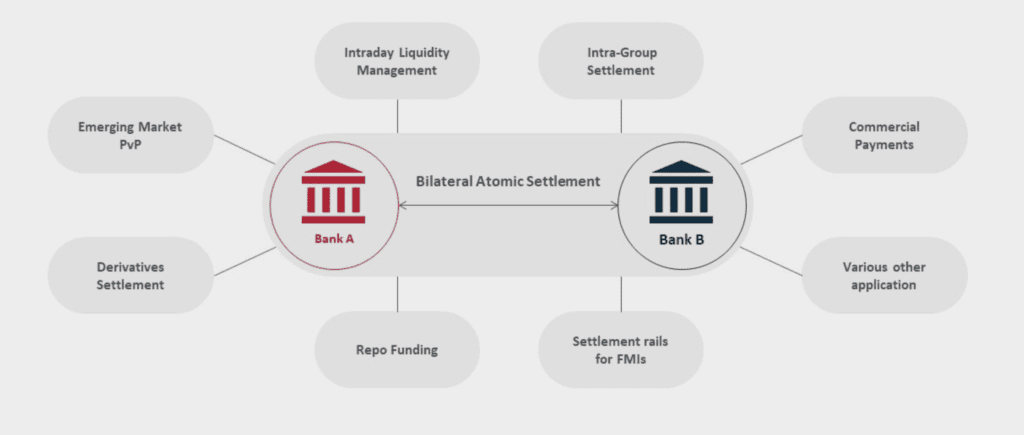

“We enable atomic bilateral settlement between commercial and central banks based on the real-time availability of liquidity, supported by ring fenced central bank reserves allocated to our global payments network.” Sissens explained. “This whole process can take milliseconds to complete.”

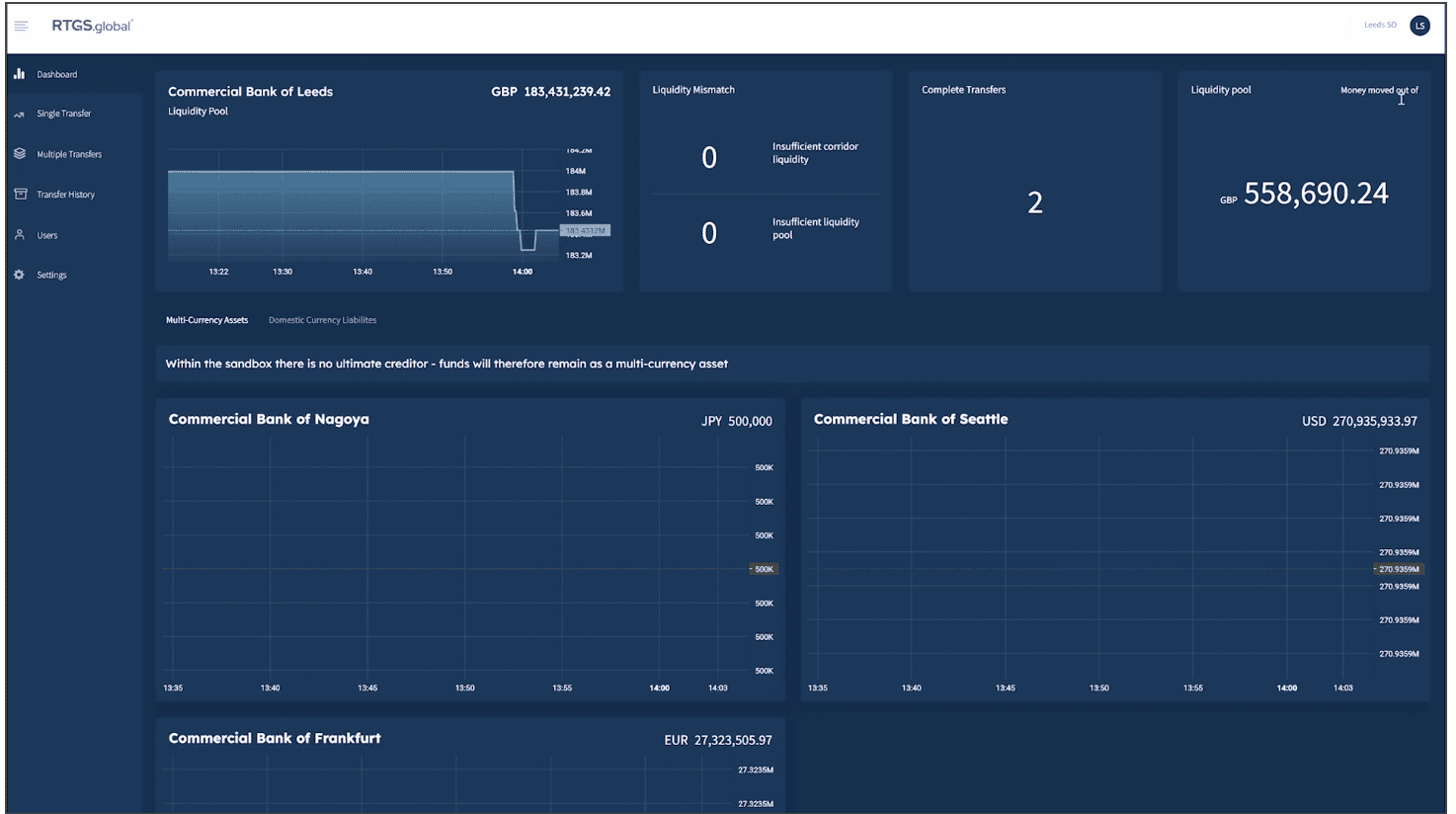

The use of a dashboard developed with Microsoft is integral to the system. The interface shows the available liquidity of the receiving bank, bringing transparency to each transaction. Using this solution, settlements can be conducted instantaneously, 24 hours a day.

Use of Payment versus Payment (PvP) terms also reduces settlement through the simultaneous transaction between entities on the network.

Integrating messaging

In addition, the system essentially integrates transactions with the messaging protocol associated with transparency.

“At the moment, money and messaging move in different directions. In order to conduct a cross-border settlement right now messaging passes through many hands while money changes hands elsewhere for ledgers to be updated,” said Sissens.

“We are bringing all of that together for the first time. The current system is based on a legacy way of working which started back in the middle ages, albeit the speed of transactional elements has improved over time, it still can take days to settle cross-border. “

“What RTGS.global does is to bring the money and the messaging all together in one, so when PvP takes place, any payment payload goes with it at the same time, instantaneously.”

Integration of the two provides a rethink for the current system, rendering the use of interbank messaging services such as SWIFT null within this context.

SWIFT, the industry standard for financial messaging, operates a massive volume of messages every day. On the day of writing, 44.17million FIN messages had been sent using the network. This is despite sanctions associated with the Russian invasion of Ukraine reducing the use of the service.

Tackling the problem of interoperability

While maintaining the use of fiat currency through developing a new digital system with Microsoft, RTGS.Global sidesteps the need for Blockchain and DLT.

Focused on creating a solution for the current market with plans to adapt easily to changing conditions, interoperability has driven the development of their product.

“We’ve designed RTGS.global to really work on the concept of “value versus value”. So that value could be fiat currency, it could be CBDC or even in the future it could be commodities. For the RTGS.global network it’s all about the exchange of the highest quality liquidity asset (HQLA) as possible, supported by central bank reserves.” explained Sissens.

One of the concerns with the introduction of CBDCs and Digital Currencies is its interoperability with existing systems and payment methods.

Currently, only 87 countries worldwide are exploring the use of CBDCs and are at varying degrees of development. As different jurisdictions develop a digital currency, the divide in system usage starts to pose problems for cross-border transactions.

“It is inevitable that they are going to be rolled out and in fact we feel like we have a role to play in enabling CBDCs to be exchanged wholesale across borders in the future. Interoperability will be key and we have designed our network with this in mind,” continued Sissens.

“Not everyone around the world will do the same thing at the same time so we need to have an interoperable system that enables the lowest common denominator to have access to that network.”

‘Creating solutions that offer value today and for the future’

Following their first phase rollout in 2020, RTGS.Global is still in testing phases, with a full release estimated for later this year.

The company is already in discussions with 100 banks worldwide, aiming to connect all international entities that conduct cross-border payments.

Although primarily focused on traditional banks, there is scope for expansion. The global network could connect sponsored challenger banks and corporate entities in the future.

The system also considers interbank correspondence, which they hope to facilitate even further.

New banks will be able to perform KYC checks digitally, and due diligence and data such as Environmental Social Governance (ESG) will be visible between entities. This is set to improve transparency and streamline decisions to enter into correspondence.

Additional features make use of the global network

Possible additional features for the future include systems that address issues with money laundering, terrorist financing, and sanction breaches—connecting a global network whose data insights can help with reducing illegal practices and cross-border payment safety.

“We are innovating a tangible and scalable FMI to deliver value today by making it easier to settle instantaneously, but future-proofed for the digital age,” said Sissens.

He states that the global network that RTGS.Global hopes to create could have far-reaching implications as it becomes a new global Financial Market Infrastructure (FMI).

“We are not yet sure what those future products will look like, but we have a long product roadmap already and we will be influenced by our clients on where they have pain points to see where we can make products for them”

“Knowing that innovation in banking is a shifting landscape, there’s a lot of impetus for change. We recognise that” concluded Sissens.

“What we’re offering is a tangible solution that can immediately solve the settlement issues today… but also a scalable and a resilient solution that prepares the financial market for whatever comes in the future.”