Fintech capitulation is feeding fear on the streets and a rash of hyper-growth enterprises and neo-banking brands are feeling growing pains.

In the latest white paper, a joint survey last year from Amount and LendIt Fintech came back with results from 1,000-plus international banks, fintechs, and financial service providers. Findings demonstrate how a Financial Institution (FI) struggles to compete with neobanks and trends in digital offerings.

Two hundred enterprises contributed to the white paper; respondents were individuals from the c-suite, product, or risk management at banks with under $50 billion to $300 billion under management.

Findings showed that for most FIs that partner with fintechs, fraud, and risk are top concerns in digital banking, and nearly half integrate new consumer credit products like BNPL.

FI and fintech partnership sentiment

According to FIs, 67% prefer fintech partnerships over building new digital products internally. Most would rather partner with fintechs, but many still see the situation as either many partnerships with multiple fintechs or none, with little in-between. The results still leave a third of leaders that said they would instead build than buy partners.

Thirteen percent of FI leaders also said working with vendors is a risk factor in the digital product space.

In an interview with Accenture, Chris Dervan, SVP Consumer Lending Products at Fifth Third Bank cautioned against this mindset: “Play to your strengths,” the study summary quoted.

“Banks have great balance sheets and customer relationships. Allow partners to help you deliver great digital experiences.”

The study pointed out why partnering is low on some FIs lists: respondents reported in-house was more accessible because “IT development bandwidth” was prohibitive to onboarding new products.

The study argues that banks feel pressure to spend IT resources on keeping the lights on and keeping customers in-house, increasing current product speed and flexibility, and not onboarding new fintech partners. Deravan said that FIs should rethink partnerships as all-or-nothing solutions instead of as cost-saving opportunities in the long run.

“The path forward is not binary; owning everything internally or having a fintech replace your enterprise,” Deravan said. He said banks go with partnerships for functions stuck in the past. “Traditional fraud-fighting tools like identity verification, transaction monitoring, and outlier detection is often blunt instruments — fintech partner expertise improves these.”

Fraud is the top scare for banks

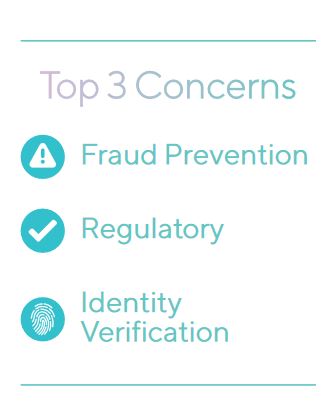

A sign of a new digital market, a third of FIs posed questions on their concerns put “Fraud Prevention” in the top spot.

Half put fraud prevention in the top three concerns, alongside “Regulatory” and “Identity Verification” as no one wants to be caught holding the bag. KYC is the name of the game when bank branches close, and the study found few put “Market Maturity” as a concern.

When prompted for additional concern insight, other comments about “credit concern” and “customer value,” with new credit-free products like bank-backed BNPL, FIs are worried end users are not up to the credit snuff.

In nearly half of FIs, the feeling is that new customers onboarded through fresh digital products like BNPL are “Outside of my target customer base from a credit risk standpoint.”

Related:

The study — written with the help of Amount, a Saas that helps build BNPL offerings for FIs — cited findings from McKinsey and found that 65% of total receivables at point of sale lenders are with consumers with credit scores higher than 700.

New consumer credit product activity is strong

And yet, despite the underwriting concerns, the Amount whitepaper found that many FIs are building BNPL offerings. Fourteen percent of providers surveyed already have a BNPL offering, and a fourth of the remaining expect to launch one in the next 12 to 18 months.

Not only that, when grouped by FI that manages over $50 billion in assets, 47% plan to launch BNPL in the next 18 months, the study found. Those that do not play the game will lose: the study cites McKinsey’s findings that banks stand to lose $10 billion in annual revenue to merchant-centric fintechs.

Still, credit worries and IT inflexibility keep those not building or partnering already from entering the fray.

When posed the question; “What internal constraint or conflict is prohibiting you from launching a BNPL or installment-credit product?” responses showed the light-footed approach of FI:

- “Market maturity, collection infrastructure, and regulations.”

- “The right technology or partner.”

- “Finding the right user experience.”

- “Resources and technology.”

According to Kapil Mokhat, MD at WestCap, meeting customers’ evolving needs matters. He said to think about lifetime value differently: the day may come when regular customers will be gone.

“Don’t wait until the majority of your customer base wants a product before launching,” Mokhat said.

“Those that want it will find it, and they’ll find it with someone else. This is a Trojan Horse moment — the competitor that just gave your customer a great BNPL experience will then offer them a deposit account, a loan, and a credit card.”