This week, embedded lending services provider Lendflow announced its new Credit Decisioning Engine that enables fintechs and vertical SaaS companies to build, embed, and launch credit products such as credit cards, buy-now-pay-later, and small business loans, in days, rather than months. The announcement was made during the Fintech Nexus event in New York City.

“Our Credit Decisioning Engine represents the natural evolution of Lendflow’s embedded platform,” said co-founder and CEO Jon Fry.

“By combining the new decisioning engine with our credit origination system and our strong marketplace of specialized lenders that understand industry needs, we are uniquely positioned to make sure our customers get an experience specific to them. Our mission is to enable every company to become a fintech that can quickly build and launch financial products tailored to their customer’s needs.”

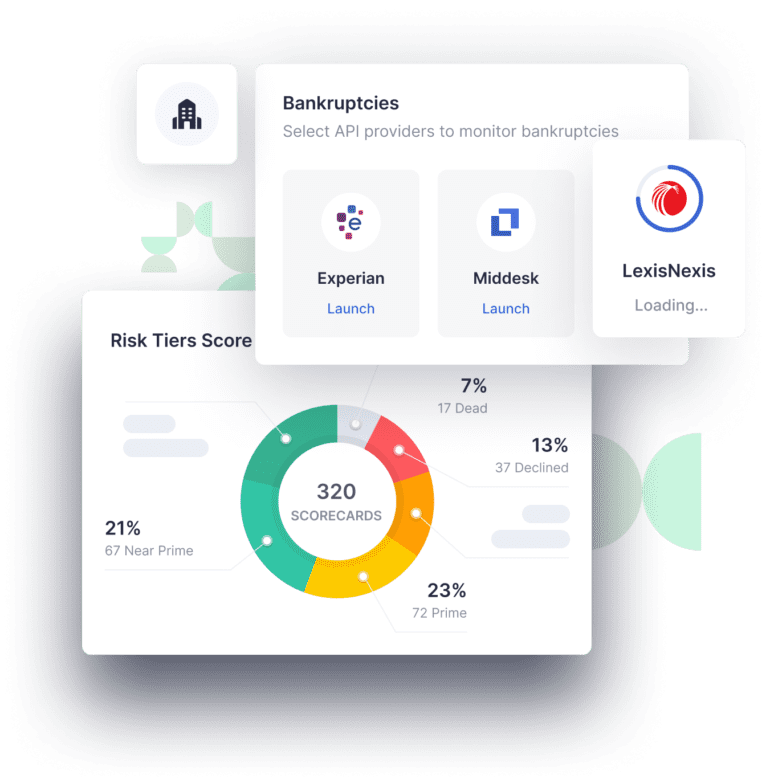

Lendflow’s expanded product offerings provide an end-to-end solution from credit application to decisioning and underwriting. Customers can access dozens of data services such as credit bureaus and other alternative underwriting data through a single API and contract to build a more complete picture of each loan applicant. The interface and low-code environment allow customers to customize decisioning workflows, which minimizes data costs and optimizes risk assessments in the order that satisfies their unique underwriting requirements.

“Lendflow provides us with the underwriting infrastructure that has allowed us to get to market quickly and scale up our fleet card operation at a 100% month-over-month pace,” said Vignan Velivela, co-founder and CEO of AtoB. “Their single API connection into multiple services, flexible pay-as-go pricing, and quick feature turnaround time makes their platform stand out from the rest.”

“Our ultimate goal is to verticalize fintech similar to what happened within the software industry,” added Fry. “It’s time for companies to be at the helm of their own fintech decisioning with the potential to launch consecutive fintech products. Lendflow has quickly grown and evolved from a Funder marketplace to a robust and growing embedded credit decisioning platform to become the only holistic decisioning platform on the market.”