B2B payments are notoriously complex. Plagued by issues such as lack of interoperability, security breaches, and settlement delays (among others), 70% of payments are still conducted using paper cheques- B2B payments could be seen to be positively archaic compared

Despite its complicated nature, $120 trillion is currently driven by B2B commerce worldwide. According to Goldman Sachs, the B2B payments sector is predicted to grow to $200 trillion by 2028.

Given the sector’s size, many businesses are turning to the issues to streamline B2B processes further. One such business is Mazepay, a Danish B2B payments platform that offers solutions to medium and large-scale enterprises to deal with long-tail spending problems that arise from managing large amounts of suppliers and small invoices.

This month, on June 16, Mazepay was granted a pan-European payments institute license by the Danish Financial Supervisory Authority. The license will allow the business to handle transactions on behalf of companies to pay suppliers’ invoices directly, further streamlining the automated payments process.

As easy as B2C

Since founded in 2018, Mazepay has used custom SaaS technology with the “vision” to make B2B payments as easy as B2C.

“B2B payments are compliance heavy, manual, and generally an archaic experience compared to B2C payments, presenting a major opportunity for Mazepay to streamline and automate the process,” said Kevin Chong, Co-Head of Outward VC, which led Mazepay’s latest seed round.

“The issuing of the payments institute license is a critical step for Mazepay to deliver a transformative B2B payments experience for its customers.”

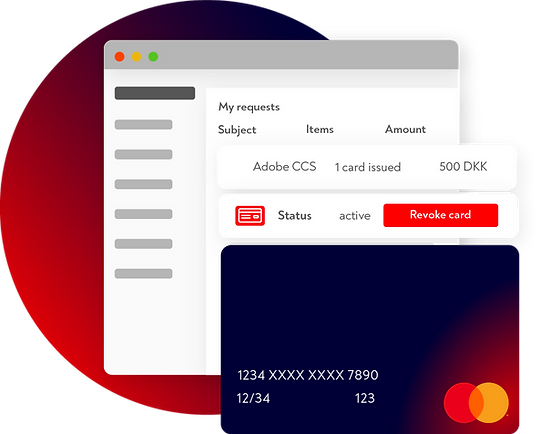

Through virtual cards and automated approval flows, Mazepay aims to reduce risk for their clients, saving them time and money. The platform improves transparency with the use of cloud services and has partnered in the past with Advania and Eurocard to enrich their offering further.

Mazepay’s partnership with Mastercard is most notable, allowing the firm to integrate into Mastercard’s In Control Commercial Payments Solution (ICCP), connecting 70 banks worldwide. The partnership enables a new bank to go live on the Mazepay platform within 30 days. A comparatively rapid turnaround has directly contributed to a significant rise in transactions on the platform over the last three quarters.

License comes at a critical time for B2B businesses

“When enterprises onboard and maintain long-tail suppliers within their complicated legacy systems, the cost, and resources required to operate increase exponentially as complexity grows,” said Founder and CEO of Mazepay, Søren Aabel Hammer. “This is exactly the problem that we at Mazepay are solving.”

“The license granted by the Danish Financial Supervisory Authority adds further legitimacy to our platform and means we can begin to operate as a payments institution in Europe. Our solution matched with the license will act as a springboard as, in the future, we look to expand globally and add several additional features and offerings to remove the needless complexity and cost out of corporate spending.”

Mazepay has simplified payments for businesses in 21 countries across five continents. The license will help them deepen their reach within Europe at a critically uncertain time for businesses, improving risk management and cutting costs.