The COVID-19 pandemic has had a significant impact on the world.

The weight of the pandemic turned societal norms on their heads for months, and the world is trying to regain its footing.

The fintech industry was no exception. Reports have already been released outlining rising digital adoption rates, investment in fintech, and crypto investments’ wild ups and downs in the past two years.

Today, the Cambridge Centre of Alternative Finance (CCAF), the World Bank Group, and the World Economic Forum published their extensive Global COVID-19 fintech Impact and Resilience Study.

The report explores the effect of COVID-19 on the fintech sector, including data from 1448 fintechs over 192 countries- the most extensive panel data available to date.

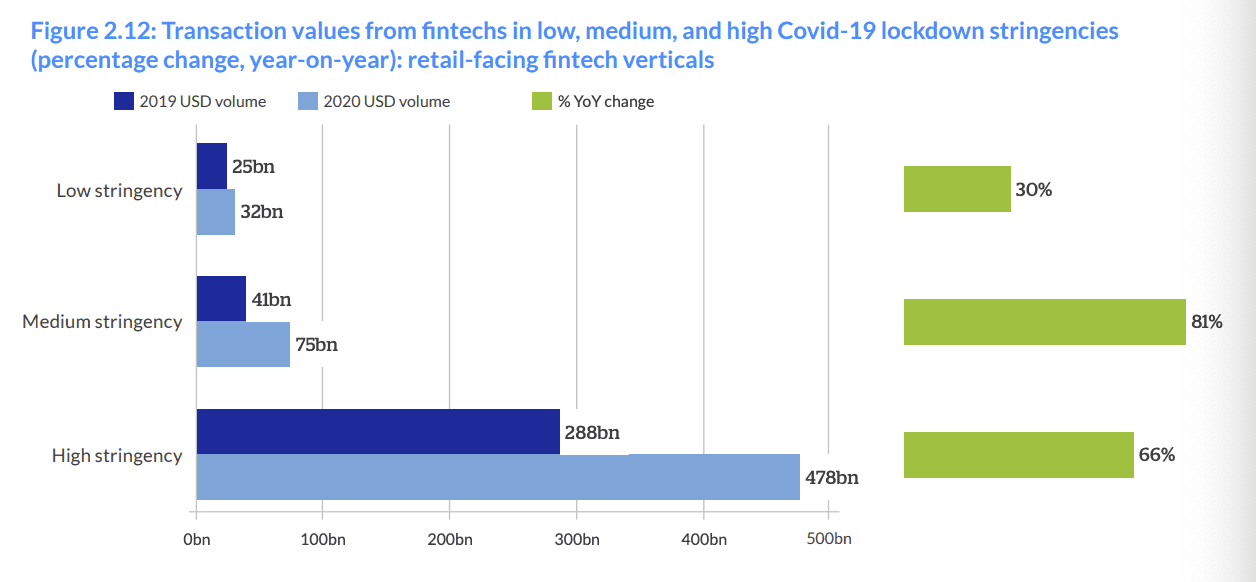

The verdict? Although fintechs were affected according to the stringency of lockdown measures, there was increased growth in all areas except data analytics.

CCAF representatives Executive Director and co-founder Bryan Zhang and Lead in Global Benchmarking, Tania Ziegler, stated, “The year 2020 was a pivotal point for how financial services were accessed and used. The Covid-19 pandemic necessitated an accelerated shift toward remote financial services, proving both challenging and rewarding for the fintech industry.”

“Thus, 2020 became a crucial base for much-needed time-series research to inform best practices and governmental and regulatory interventions.”

The report follows The Global Covid-19 FinTech Market Rapid Assessment Study, published in 2020 under the same collaboration.

This earlier report assessed the short-term impacts of the pandemic on an already flourishing fintech ecosystem.

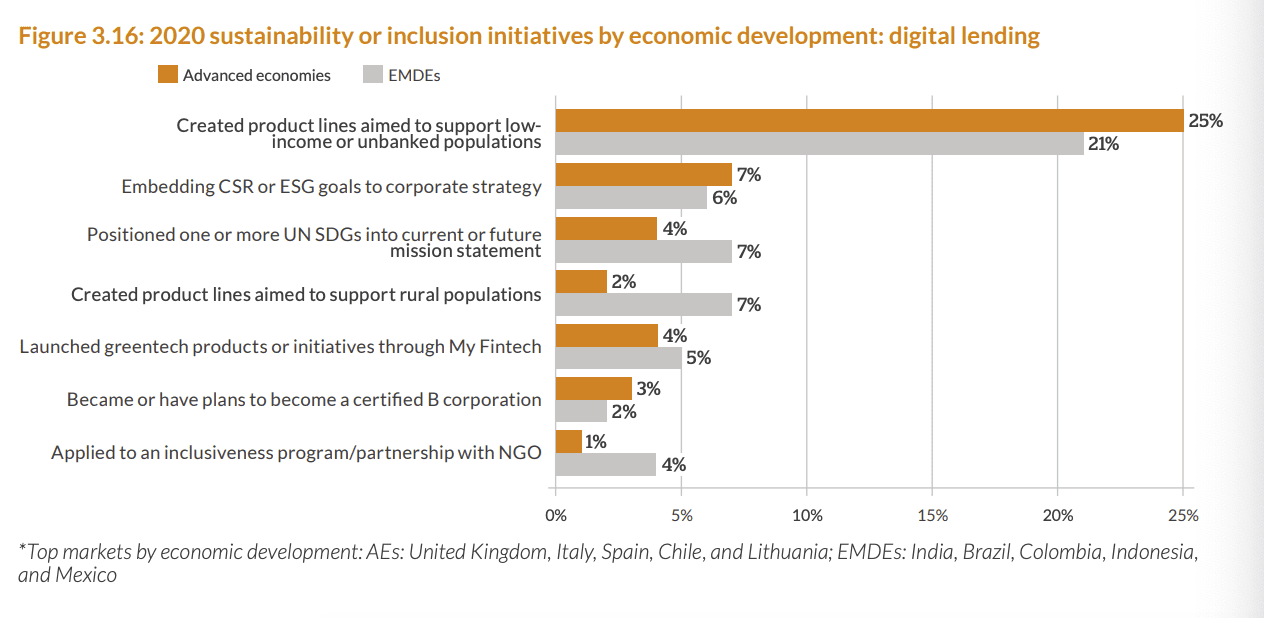

The newly published Fintech Impact and Resilience Study assesses the longer-term implications and includes areas that were not previously regarded. A particular focus was the customer base of fintech firms and their potential impact on financial inclusion.

Huge potential to improve financial inclusion

“Fintech firms are transforming the financial sector by driving innovation, introducing more competition, and expanding access to financial services,” said Jean Pesme, World Bank global director, finance, competitiveness, and innovation.

“The survey indicated that fintech firms have served women, SMEs, and low-income households—people who have traditionally faced challenges in accessing financial services.”

Fintechs reached many new demographics previously underserved by traditional financial institutions. In many analyses, low-income households and women comprised over 50% of the total client base.

Digital payments firms reported that globally low-income consumers made up 55% of their customers; this shifted to 73% in EMDEs. A similar trend was observed in the digital lending and capital raising sectors.

There was also a significant prioritization within fintechs regarding price setting. Firms implemented fee reductions and waivers as well as payment easements and plans during the two years, most of which have remained in force.

The use of digital assets in fintechs was lower in Advanced Economies (AEs). Fintechs in Emerging Markets and Developing Economies (EMDEs) were reported as much more likely to integrate digital assets, focusing on electronic money and stablecoins.

This data could indicate the growing list of initiatives focused on financial inclusion in developing countries, many of which include the use of digital currencies and mobile phones.

Study will aid future growth

The study’s results were positive, showing strong growth and resistance to changing external factors. As well as showing fintech’s effectiveness in improving global financial inclusion, the CCAF hopes the study will inform future responses to crises.

“Overall, the results from this study show that the global fintech industry has been more resilient to the pandemic than initially reported in The Rapid Assessment Study, albeit with important differences at a country and vertical level,” stated Zhang and Ziegler.

“We hope that the insights from this study are a valuable addition to all fintech ecosystem players. We aim to contribute to the fintech community by illustrating the challenges and opportunities of fintech and how digital financial services can play an increasingly key role in mitigating the impact of future crises, broadening access to finance, and contributing to financial inclusion.”