“Europeans see DeFi as an alternative investment, complementary to their salary. In Latin America, it is survival,” said Diego Mazo, Co-Founder, and CEO of Tropykus, at ETH Barcelona.

Latin America has been plagued with issues surrounding finance. Both economic and political instability wreak havoc with the depreciation of local currencies to varying degrees.

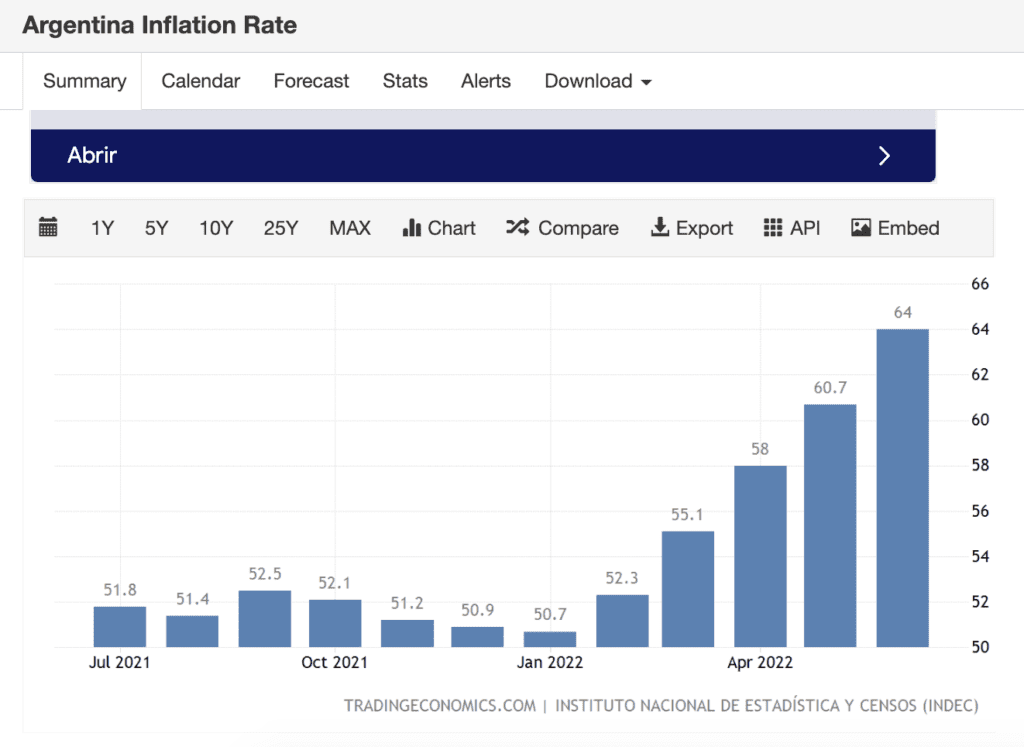

In 2021 the Argentine Peso lost more than 14% of its value against the dollar, and values throughout Latin America dropped, the least affected being the Mexican peso, losing just over 3% of value. High inflation rates worldwide exacerbate these issues.

In an International Monetary Fund (IMF) press briefing, higher interest rates as a response to increased inflation were mentioned as an attempt to curb the effect on the most vulnerable.

“Higher inflation is affecting real incomes in Latin America, especially among the most vulnerable,” said Ilan Goldfajn, Director of the Western Hemisphere Department at IMF. “Policymakers are reacting to this challenge by tightening monetary policy and implementing measures to soften the blow on the most vulnerable and contain the risks of social unrest.”

“Large central banks in the region have acted promptly and decisively to tackle rising inflationary pressures by raising interest rates ahead of central banks and many other emerging markets and advanced economies. These actions, together with the hard-won credibility, have allowed them to keep long-term inflation expectations anchored. This is important for stability and predictability. Central banks will still need to remain vigilant and continue taking decisive actions if needed to keep long-term inflation expectations in check.”

In March 2022, Reuters reported the average interest rates for loans in Argentina to be as high as 44.5%. Other countries have also experienced increased interest rates.

A decentralized alternative due to mistrust in centralized entities

“Latin America is extremely diverse, as is Europe,” said Mazo. “But there are many common problems that many of us have experienced firsthand, several of the problems related to finances.”

“Inflation — also experienced here in Europe — in Latin America hits very hard. Those of us who were saving with a weak currency, as in my case with the Colombian peso, realized that our savings were depleting. The currencies have devalued at an alarming rate.”

“This is not the only problem. Access to loans is minimal, the bureaucracy is vast, and there is a process that excludes a large part of the people from joining or having new opportunities. Things that should be normal are not in these economies.”

A strong mistrust and bureaucracy surrounding institutional banks make access to basic services such as loans and savings difficult for most of the population. Mazo explained that there is a reluctance to keep savings within banks as citizens do not believe in their solvency and the intentions of the entities behind them.

For him, increasing DeFi in Latin America could be the best solution.

“Just by having a crypto wallet, I am already accessing a new financial system. I have total control of my assets, totally flexible payments, and withdrawals,” he said.

“If you want to escape from the provenance of the local economy, you need to have a different solution. I think that’s the point; when inflation is high, you need to survive. You need to protect yourself from it and would buy any asset that helps you with that.”

Taking adoption mainstream

There is varying acceptance of cryptocurrencies across different governments. Mazo explained that although fintech is widely adopted, access to cryptocurrencies is restricted. Colombian regulators have implemented a sandbox for crypto trading which has taken three years to form, and in Bolivia, trading is illegal.

“Different projects are finding new regulations to work with and experiment,” said Mazo. “We are distributed around LATAM and understand the local needs to provide real solutions. We use DeFi combined with different technology, and we provide education.”

“When we are talking about the mainstream, the approach is completely different. They are looking for options for savings and loans that fit their needs. It is as simple as that.”

“To go from the early adopters to the majority, you have to go from the visionary ideas to the convenient, practical ideas, and that’s where the change is.”

The aim is to be as simple and convenient as possible. His company, Tropykus, has developed an app that provides options for savings and loans in bitcoin using the RSK smart contract network.

Three points of focus for DeFi adoption

According to Mazo, three points of focus are needed to achieve mass adoption:

- Focus on the basic needs of people

Although in the markets of early adopters, cutting-edge innovation is key, simplicity could be the critical element in reaching the mainstream. Issues such as access to savings and loans are experienced by citizens daily. Providing an alternative, convenient option to address these issues creates a low barrier to entry into the world of DeFi, providing a simple reason why people should use it.

- Think of systems that combine digital technology with analog methods. Gradually evolve to 100% DeFi

To improve inclusivity and adoption, an understanding of consumers differing digital capabilities could be critical.

Systems that combine analog and digital measures open the technology to a broader market, allowing for different levels of digital literacy. Tropykus conducts many in-person initiatives to improve understanding of their products, such as their education programs for community leaders.

- Gamified education as a pillar of the service

For Mazo, education is a cornerstone for the success of DeFi adoption. Using gamification and simple language in integrated DeFi education could enhance accessibility for a wider audience.

“All of us working on regenerative finance (ReFi) projects need a substantial educational component. If we do it with games, it will be much easier for a mainstream audience to understand what DeFi is,” said Mazo.

“If we get to the point of saying your finances can become better through an education, that is a game that changes the paradigm of personal finance.”