As the world progresses further into a year of economic challenges, small SMEs are feeling the strain.

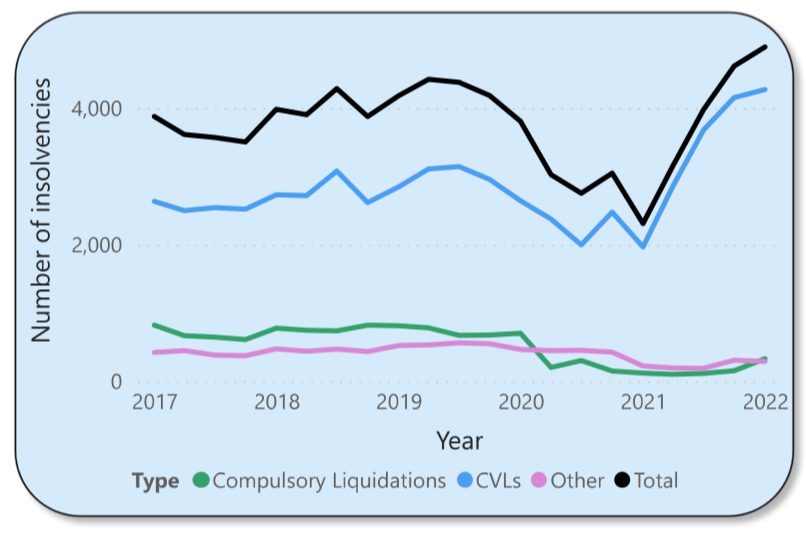

In April 2022, the Insolvency Service reported 4,274 company insolvencies in Q1 2022 in England and Wales, double that of 2021. Insurance company Euler Hermes predicted UK insolvencies will be 32% higher than 2021 by the end of 2022.

Although medium-sized SMEs have shown resilience, small SMEs have suffered and, as a result, are turning to external funding sources.

On average, 56% of businesses have sought external finance, 20% higher than years before, and 43% of these businesses have already used up all of their funding.

SME owners optimistic and turning to growth

Despite these figures, SME owners seem optimistic. Data has shown over 56% remain hopeful for the future of their business in 2022.

In a recent study conducted by iwoca, the lending firm found that demand for loans over £200,000 had risen by 8% since last year. For the past three quarters, they also saw a shift of purpose for loans. In Q1 and Q2 2021, loans were primarily used to manage the day-to-day cash flow.

However, while cash flow management remained a priority, in the second half of 2021 and moving into 2022, businesses were turning to loans to support business growth.

In addition, they found that 30% of brokers believe the market has already returned to pre-pandemic levels of loan requests.

Iwoca continues support of SMEs

Iwoca has been a strong supporter of small SMEs for some time. During the COVID19 pandemic, they played a pivotal role in the success of many, having distributed £400 million through the government’s Coronavirus Business Interruption Loan Scheme (CBILS).

Additionally, through their embedded lending technology, which allows access to loans through various platforms, they continue to reach 1.8 million businesses across the UK and Germany.

Their core lending product, the Flexi-Loan, is their most popular product. Previously capped at £200,000, iwoca is raising the maximum size to meet the growing appetite for higher-value loans. Small business owners will now have access to loans of up to £500,000.

From today, small SMEs will be able to use the Flexi-Loan’s application and decisioning process to apply for loans from £1,000 to £500,000.

Applicants can choose repayment periods of as little as one day to two years and can cater to their varying needs. Iwoca has stated in many cases; money can be delivered to accounts in as little as 24 hours from application.

“With loans up to £500,000, we now cover an ever larger portion of the SME market,” said Christoph Rieche, Co-Founder and CEO of iwoca. “We serve the smallest micro-business that just got started all the way to established medium-sized enterprises — regardless in which industry they operate.”

“I am proud that we’ve already helped more than 70,000 businesses to access finance over the last 10 years, and we won’t stop innovating to serve them better in the future.”