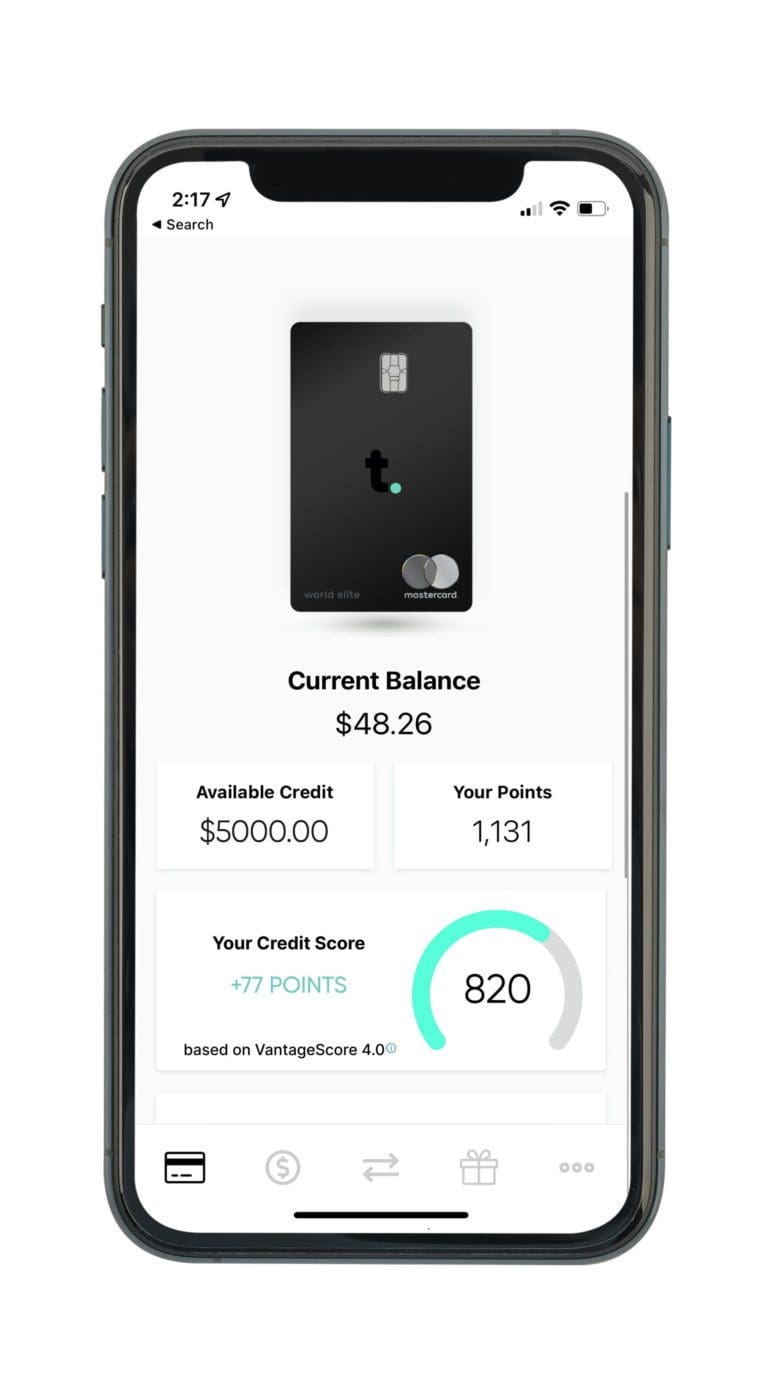

Fintech TomoCredit aims to help young adults who are in good financial health but have no credit score.

Read the full article at: techcrunch.com

Fintech TomoCredit aims to help young adults who are in good financial health but have no credit score.

Read the full article at: techcrunch.com