Content Marketers know how it works: the attention economy is built on a pay-to-shill model. Set up a marketing fund, set aside a pile of change to pay influencers and algorithms for clicks, and DocuSign away when word of mouth starts flooding results.

The founders of Attrace believed that process had to be truly automated and trustless in a Web3 world and built a Word of Mouth marketing system that worked more like a Loyalty system for performance-based marketing.

As Nikola Stevanovic, head of product and strategy, described, the community-centric model of many coin projects and DAOs relies on a community-centric engagement model.

“Our mission is to capture the value of word-of-mouth marketing in web three; right now, most marketing related to Web3 is all done off-chain,” he said. “Using the traditional platforms, there is actually no way there was no way to measure the performance and properly reward.”

Start by measuring engagement

Stevanovic said Web3 enabled brands to measure engagement directly from advertising truly. Imagine if metrics from each ad placement or a link share were trustless and provable, with direct purchase data included, even from a Link on an Instagram story or email signature. That is the future Attrace is building toward, Stevanovic said, where every online brand, including e-commerce stores, has its token ecosystems to reward engagement and pay for services.

They are building the loyalty points for that reality, starting with simple coin projects that rely on a word to spread through discord chats and crypto Twitter.

“As you know, there are a lot of that many projects rely on communities and are looking to engage,” Stevanovic said. “Those are some of the issues we’re trying to solve because we think there is so much potential with marketing and web three, but it starts with measuring the contribution and value added to the project.”

How does it work?

The project has three main components, but it boils down to Etherium smart contracts that automate payment when a promotion works. Stevanovic said brands could set up cash pools to pay for influence in the Attrace native token. Influencers, advertisers, and anyone sharing a link can make money from that pot by getting the word out.

“The protocol consists of the three main components. So the first one is the smart contracts which are now on ethereum,” Stevanovic said. “The smart contracts on ethereum have different rewards, which essentially guarantee a piece of the marketing budget for successful referrals. So for those who engage in word-of-mouth marketing will be compensated for every on-chain user acquisition they bring.”

Slashing tool and oracle

When consumers and users follow the link and make a purchase, the influencer/ advertiser and the consumer receive a payback, as Stevanovic, a loyalty reward. Under the hood, this process includes Attrace blockchain oracles that verify transactions and purchases, basically the trust behind what Stevanovic called referral contracts.

“The second part, which is the most important part, is the oracles which are part of the protocol which observe the interaction between a token, the person who is spreading the word about that token, and a person who is buying,” he said.

Attrace runs the oracles now, but he said the project plans to launch on other chains and enable anyone to run an oracle to upgrade the decentralized solution. It is important to note that oracles also collect information about the three-part relationship between the funder, influencer, and buyer and include a “slashing mechanism” or a shut down for any false data or illicit activities.

Just like ethereum or any other blockchain, oracles are validators that vote on approving transactions. If a transaction gets a bad vote, it is slashed from the record. The strength of the blockchain network comes from that, Stevanovic said, that oracles and Nodes in the system are working with publically available information, and anyone in the system can see if they are telling the truth by reading what is there.

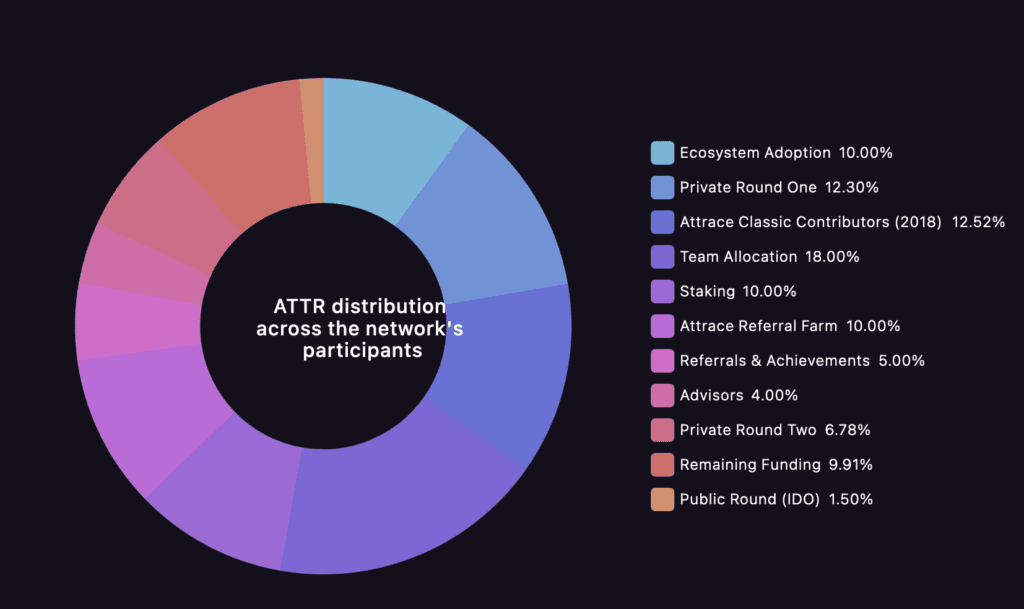

The third component is the Attrace token in itself, Stevanovic said, a layer two network and security measure in its own right.

Cash back before e-commerce comes to Web3

Stevanovic said Attrace believes not just in supporting affiliate marketing in Web3 but buyers’ rights as well. He said the protocol pays out to both the influencer and the target purchaser.

The idea sounds like cashback for credit cards in Web2, but instead of agreements between card providers and merchants for rewards systems, the rewards are a third thing that is separate and public.

Stevanovic said that was the original idea with Attrace, as he joined the project and left the banking and fintech world two years ago. Then, one of the co-founders brought him on the team that initially targeted a product or eCommerce with merchants and publishers. He said that the problem was you could not have a trustless solution in the old way. There is always the reliance on someone else’s numbers.

“You have to rely on the information that a merchant sends you, So we even built our own blockchain that would keep track of all these transactions,” he said. “But at some point, we realized that you can never be completely trustless because you always have to rely on someone’s centralized database. With our approach, you don’t have to trust the data source; we’re talking about blockchains like ethereum. We can trust transactions to happen there.”

He said that the team does expect more tokenization in the future of real-world products, physical products, and commerce in general.

“The moment that happens, we’ll be ready to track referrals and word of mouth marketing for that officially. So the plan is not to go after the traditional e-commerce but wait for them to tokenize it.”