Migration features significantly in the modern global economy. The global estimate is 281 million international migrants, making up 3.6% of the population. Although seemingly small, it means one in every 30 people live and works outside their country of birth.

The past few years have disrupted migration. First, the COVID19 restrictions limit international travel, followed by conflict and economic instability, causing significant global displacement. The International Organisation for Migration (IOM) stated in their 2022 World Migration Report that growth had continued at a reduced rate.

Remittance growth resilient despite challenges

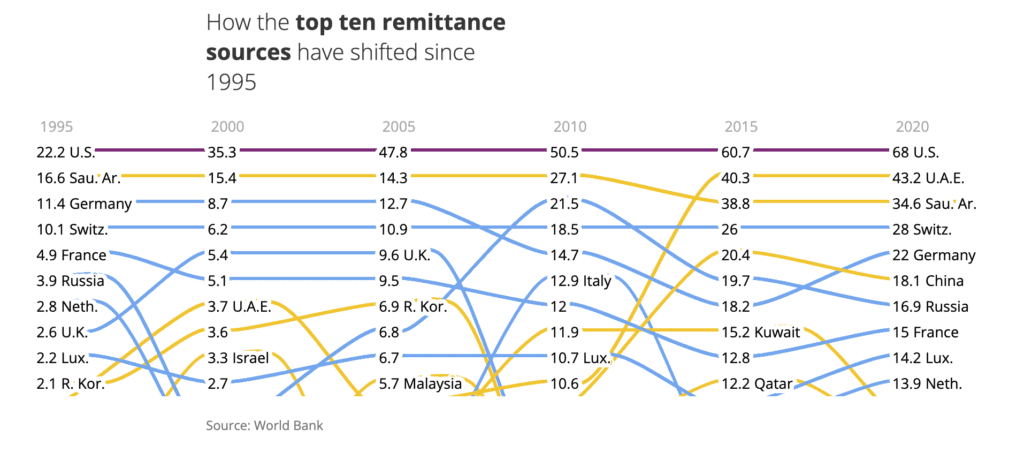

Within this landscape, remittances play a significant role. Available data reflect an overall global increase in international remittances, increasing by 457% between 2000 and 2020.

The market has shown resilience too. Despite predictions of significant declines in remittances due to COVID19, there was only a slight drop of 2.4% from the 2019 total.

As markets have continued to face challenges, remittances remain strong, with the US at the forefront, showing a total outflow of $68 billion in 2020, according to The World Bank.

According to a recent survey from Remitly, despite 8 in 10 of their customer base experiencing negative financial changes in the last 12 months, very few said they were likely to send less money or less frequently. “This demonstrates the incredible resilience and determination they have to provide for their families overseas,” they stated.

Remitly, digital financial services and remittances provider for immigrants and their families, have been building services for over 11 years aimed toward the demographic.

“We’re all around really improving and transforming the lives of immigrants and their families by providing the most trusted financial services on the planet,” said Matt Oppenheimer, Co-Founder and CEO of Remitly.

“Our systems are not built for immigrants. It’s little nuances like getting a bank account and not having a local tax ID or social security number in the US context. We can build systems that are fully compliant with regulations and very much tailored to our customers’ information. I think that there are huge opportunities there.”

An underrated impact on global and local economies

“I’d say the impact immigrants have on the global economy is twofold,” said Oppenheimer. “The first part is that people underestimate how large impact migrants make on the countries they move to. And it’s across all sectors. It’s across everything from the services sector to healthcare and nursing to the tech world. It’s all about making the pie a lot larger, right in terms of the economy larger, creating more jobs, creating more economic progress, having a higher tax base to invest and the societies we live in

“I think that it’s a key driver of not only economic growth, things like GDP, but also things like the amount of taxes immigrants pay. The amount that they contribute to the countries they move to is profound. It’s all about making the pie a lot larger in the economy, creating more jobs and economic progress, and having a higher tax base to invest in our societies.”

“Then the second part is the remittances they send home every year. It’s unbelievable in terms of its impact on the global economy. Most of those are sent for basic living expenses, healthcare, and tuition; really important things.”

“They send back to the families they’ve made the sacrifice to leave thousands of miles away to create a better life for. It’s profound when you think about the actual impact of addressing big global issues, like inequality. These are addressed in a very personal, connected, and sustainable way, given that people are supporting their families.”

The CBPP stated that migrants could bolster the workforce, counterbalancing the record lows of birth rates seen in the US in recent years. About 78% of US migrants are of working age compared to 59% of American-born citizens. In the face of an aging population, working-age immigrants could increase the 2035 prediction of 2.4 working-age Americas per adult over 65.

The fintech sector could be a key player

For fintechs, the opportunity for development within this sector could be significant.

Rigid structures within host countries could create barriers to entry into the traditional financial industry, potentially limiting the contribution migrants can make to the global economy.

For Oppenheimer, the potential customer base of financially underserved clients within the migrant population is much more than the estimated 280 million.

“It’s important not to underestimate the size of the customer base we’re talking about. It’s not a small niche. It’s a very large customer base that can be served.”

“You have the 280 million migrants that live and work outside the country they’re born, but if you start to include their families, you’re talking about close to a billion people. It’s an important component because people are often working, so they can support their families.”