On Tuesday, San Francisco-based equity planner, Secfi, launched Secfi Wealth.

Startups can use the product to offer their equity employees personalized financial advice, investment management, and access to alternative investment opportunities.

Secfi became a registered investment advisor (RIA). The firm said the move allows it to expand its equity planning expertise to provide comprehensive financial advice and investment management specifically for the startup community.

Activity-managed portfolios

Frederik Mijnhardt, CEO and Co-Founder of Secfi, said in the past, access to this level of wealth management was limited to the founders alone, and Secfi brings it to all members of a growing team.

“Startup equity is an important gateway to future wealth, which is why it’s key that it be incorporated into financial planning,” Mijnhardt said. “The reality is that all levels of startup employees need it. We’ve been waiting for this day since we started Secfi to provide a holistic offering to our clients.”

Secfi said it brought John Morrison on to lead the design and management of client portfolios and educate clients on investing. John brings over a decade of portfolio management experience to Secfi.

Morrison said the product launched after listening to their customers.

“We listen to our clients and build a portfolio that suits them and their unique situation,” Morrison said. “Our goal is to save them money, make their money, and lower their risk by taking a systematic, data-driven approach to investing while controlling what we can control in the structuring and management of their portfolio.”

Before Secfi, Morrison was a portfolio manager of systematic active strategies at Dimensional Fund Advisors for several years. He also spent several years evaluating alternative investments from a risk management point of view at Goldman Sachs and consulted at Bain and Company.

“Many of our clients reached their current level of financial wealth by taking a chance at a startup, working hard, and reaping outsized returns,” Morrison said. “We help them grow that wealth in a way that avoids single points of failure so they can have the freedom to live the life they want and potentially take another chance on something with confidence.”

From daunting to not daunting

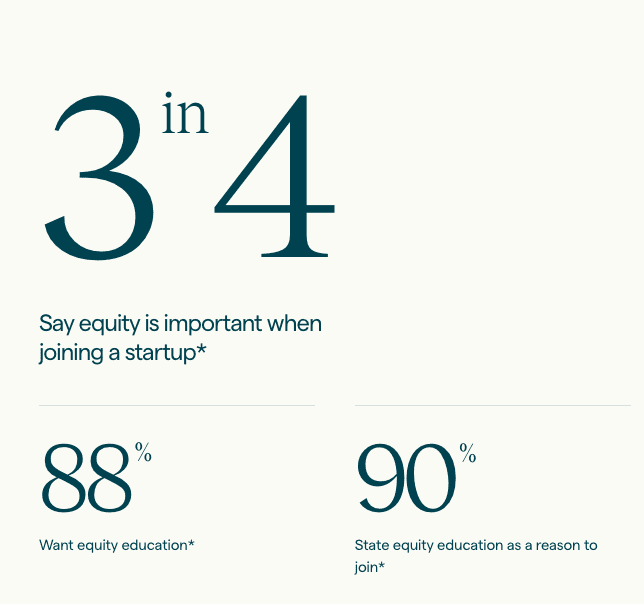

Equity is the most exciting yet daunting aspect of a startup employee’s financial life and requires dedicated expertise and guidance to get it right.

Secfi said the startup community is underserved by today’s wealth managers who lack extensive experience with stock options, advanced tax planning, and a deep understanding of venture valuations.

In addition, wealth managers often require clients to have at least hundreds of thousands of dollars in investable assets as accredited investors. Secfi said it provides investment levels for startup employees who need financial life advice — which is why Secfi doesn’t require a minimum amount of investable assets to work with an advisor.

Startup employees receive access to expertise in pre-and post-IPO equity planning, a one-stop shop for employees to understand their choices.

Since 2017, Secfi has been an advocate for employee equity in the startup community and has worked with employees from 90% of all U.S. unicorns, including Airbnb, Palantir, and Doordash. More than 30,000 startup employees have used Secfi’s platform for equity planning, representing $48 billion in equity.

Secfi said it is the first to provide a digital platform for equity planning, 1:1 financial advice, ongoing investment management, and financing products that enable employees to own a stake in the company they helped build.