MIAMI, Fla. — Mastercard, a fintech before fintech was actually a thing, pioneered the most secure ways to pay.

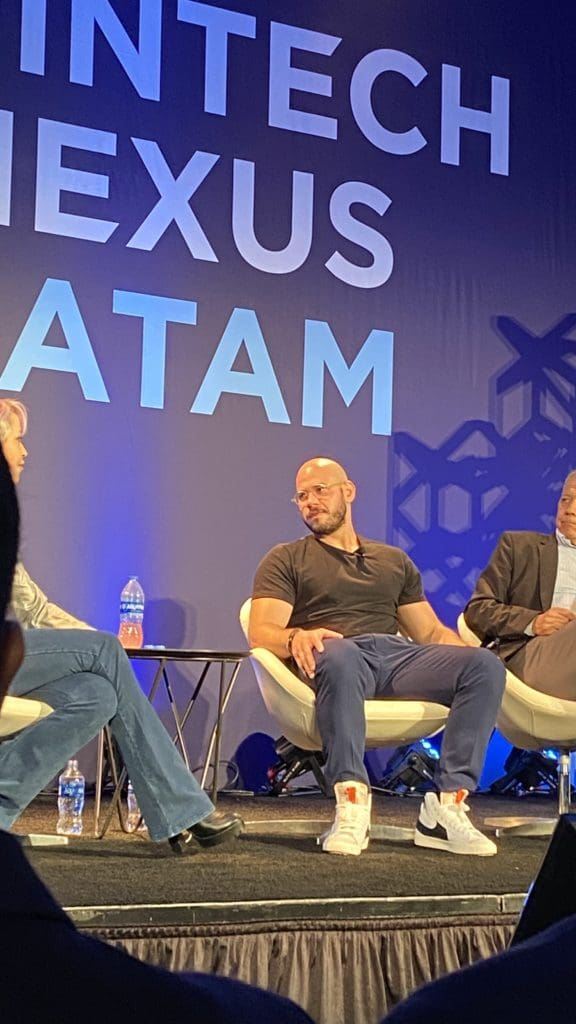

In a fireside chat on the Fintech Nexus LatAm 2022 Keynote stage Tuesday, fintech experts talked about Brazil’s contemporary Mastercard Identification ecosystem.

Mastercard’s Sarah Clark, Senior Vice President, Digital Identity, said she works on the ID network, a separate network for individuals who want to obtain a digital ID.

From the physical world to the metaverse and beyond, our identity solutions protect your identity and transform how people access healthcare, education, public services, and more. She said identity done right could set a company apart from the pack.

“It’s hard to think of anything more foundational to fintech than identity,” Clarks said. “Identity done right can be a competitive differentiator [for] security and protecting your customers. What we bring to market reflects a global shift in the identity industry.”

Building trust across the globe

Clark said Mastercard was building a decentralized shift away from siloed databases. The platform binds a digital and biometric identity to a customer’s mobile device on behalf of partner firms.

Caio Antonio, CEO of the Brazilian-based 2nd Market, said his firm is a blockchain ecosystem that offers a crypto bank exchange and provides blockchain tokenization. He said they use the Mastercard ID network because reusable ID provides compliance with regulators, which amounts to a real competitive advantage.

“Why? Many people use crypto platforms for money laundering, fraud,” Antonio said. “At the end of the day, the client is important, and protecting the shareholders is important to the business and overall market.”

Antonio said the real problem in crypto is visibility. He said many platforms have KYC, but you can’t get everyone.

“Many platforms have KYC; the big deal for crypto in Brazil is that 30% have some form of crypto,” Antonio said. “We have more investors and traders in crypto than in the stock market. Crypto’s ability is our focus; we just can’t provide this with KYC and AML.”

He said the significant opportunity in Brazil is in data infrastructure. Whoever figures out the API to collect and store customer and industry crypto data safely and efficiently for KYC will take over.

“This is the future, of course. If we had KYC and compliance, we could repair the market,” he said. “Improving visibility of custody and trading will protect clients and provide whole information.”

Once the market shifts to distributed ledgers and blockchain, it will never go back to the old market, he said; the kinks need unwinding.

ID verification for underwriting

Marcus Quintella, Founder & Partner of NETCREDITO, said he founded the Brazilian fintech in 2018 to help customers take out credit easily, with the best rates. Today, Quintella said they are opening a digital bank, physical stores, and 28 partner banks to lend money to people. He said they chose MasterCard as an ID provider is very important for credit.

“Our focus is the security of our customers, we have to deliver our benefits to real customers, and it’s essential,” he said.

With those moving parts, it’s vital that the right partner lines up with the right consumer. But when building new products with verification and KYC, NETCREDITO found customers were uneasy with sharing new types of personal data.

“The acceptance from our customers is exciting. We had to include a new mindset in our culture because they did not understand giving information on the day-to-day,” Quintella said. “But we decided to include this type of ID on our platform. We had to boost the communication with our costumers to get them comfortable to give information about their data.”

Data privacy

Clark said the first step in rolling out a new product is addressing the need for more customer communication. It might look like less privacy when rolling out more data privacy if painted incorrectly.

“As the industry shifts to a privacy-preserving paradigm for identity, or as an individual, you own your identity and give consent to share data: that is the new user experience in the market,” she said. “It’s also one that addresses the need for more data privacy. Due to rampant identity fraud, it certainly is something that more people understand and want, but need to be educated to when it’s rolled out.”

She said when Mastercard enters a new market, it’s important they have the most robust validation of identities possible. In that light, she said the network ID has “its eyes on” Mexico next without any promises and is decentralized but not blockchain-based yet.

“For ID network, we are not using a blockchain-based, but we are a decentralized network and follows the same principals,” Clark said. “In Web3, all this is converging, breaking down these honey pots and silos of databases that create fraud.”