MIAMI, Fla. — With more than 20 years of knowledge in payments, Romina Seltzer, SVP of Products and Innovation at Visa, manages innovation strategy across Latin America and the Caribbean.

Driving Visa’s digital processing portfolio, she led a talk on the Fintech Nexus LatAm keynote stage about the convergence of cultural and behavioral forces with technology, causing changes in how consumers transact.

“Many of you here today know how of the innovation that is happening, and it’s creating a new era of financial services,” she said. “The changes in consumers… we can see many new trends took shape over the past two years.”

The proliferation of payment options

The first trend is the different ways to pay that consumers and business pay.

“The continued acceleration of payment options will require greater flexibility and interoperability. Mobile developers have become payment developers,” Seltzer said. “We don’t go out with our plastic in wallets anymore to pay; we accept QR codes.”

She presented a presentation of a payment vehicle at a future of payments convention when she visited Qatar for the World Cup and a Visa future of payments presentation. The point-of-sale vehicle scanned a user’s face in a second to approve a transaction.

“Money has changed; it is smarter now. It has morphed from a physical into an intelligent entity,” she said. “At the end of the day, we want to create the best experience. We want to provide consumers and businesses with the ability to pay how they want.”

Open data

The second major trend is open banking. The open data economy is changing collaboration, opening up new and better service opportunities.

“Every person creates 1.7 MB of data each second. In two seconds, each of us creates a kindle book of 300 pages,” she said. “The usage of technology all hinges on the importance of consent in the community and the storage of our data.”

Only 43% of those consumers know that they are using open banking daily, she said.

Embedded commerce

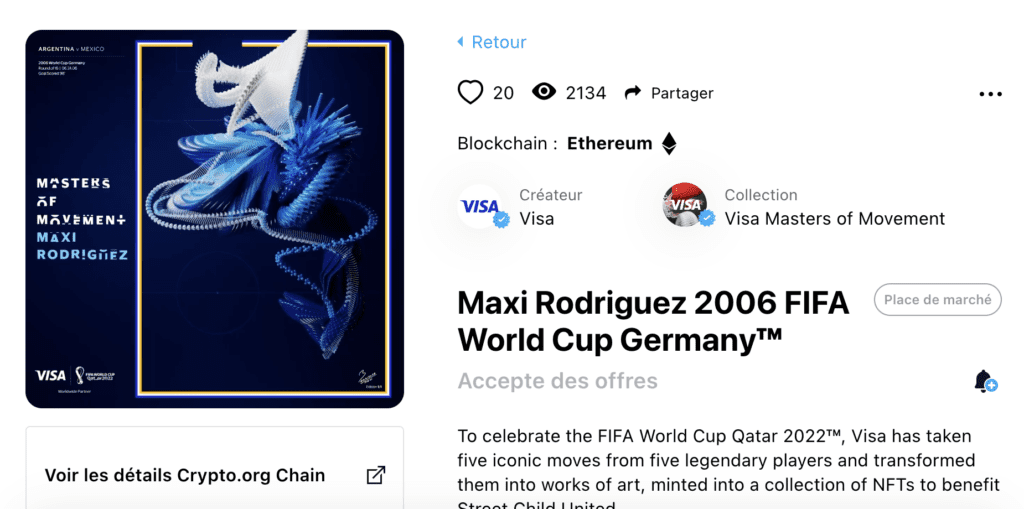

The third major trend Seltzer highlighted was embedded products. Embedded Commerce transforms every form of social interaction, consumption, and transportation activity. At the Qatar future of payments showcase, she demonstrated a metaverse art project that uses famous soccer plays to paint images.

She said at the end of the day, transform every social interaction, the communication apps in social media, and transportation for potential commercial opportunities.

“Today in the U.S., every one of us spends four and half hours on mobiles, 45 minutes more than in 2019,” she said. “Gen Z spends an average of five hours on TikTok daily.”

If only we knew what was coming; she said the size of the social commerce market is expected to be $2.9 trillion by 2026. The metaverse is expected to be a $1T marketplace annually, and Seltzer said the direct-to-consumer model would become direct to an avatar.

“Demand for embedded commerce is only expected to grow; the goal at Visa is to enable the movement of money to be easier and frictionless. Regardless of the platform, you are using,” she said. “We all need to meet users where they actually are. That is what we are hoping for creating an environment at Visa, one that is more inclusive, that supports digital and financial inclusion.”