MIAMI, Fla. — Mexico is a notoriously difficult credit market. Aside from heightened levels of fraud in the area, most citizens do not have access to a bank account.

According to the World Bank, over 60% of people are still unbanked.

Despite over 90% of consumers registering for mobile payment services, cash dominates payments.

It is here, in one of the most underbanked countries in the world, that Kueski formed, providing credit and BNPL loans.

Since its founding in 2012, the company has addressed the market, watching its competitors come and go. They have become one of Latin America’s largest BNPL and consumer credit firms.

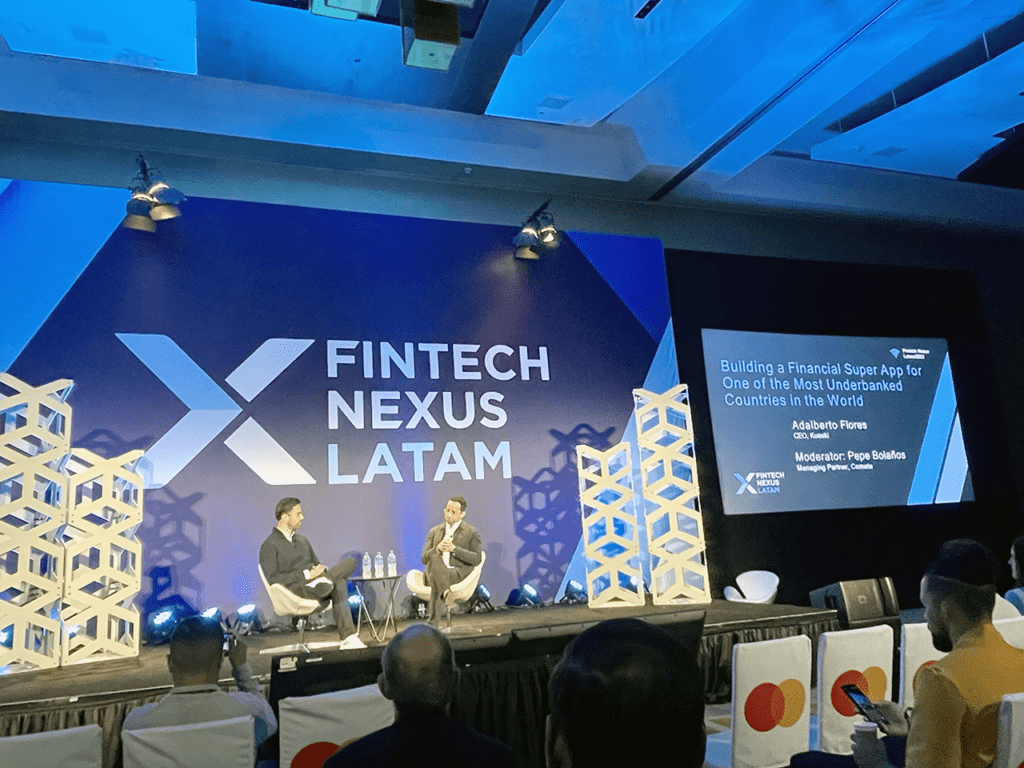

“(In Mexico) We didn’t have people experiencing credit until something like 2016 or 2017,” said Pepe Bolaños, Managing Partner at Cometa, while moderating a fireside chat with Kueski’s CEO, Adalberto Flores, at Fintech Nexus’ LatAm 2022 event.

“It’s a very challenging market,” said Flores. “We started with credit in a credit-starved economy. In our case, most people are unbanked…. We doubled down on the most difficult part, which is underwriting.”

Flores explained that Mexico is one of the markets with the highest levels of credit risk and fraud worldwide.

“One of the reasons is that the first credit bureau in Mexico was built less than thirty years ago. So there’s limited credit and credit division, and it’s a very challenging market.”

“One of the first things we looked at is the ability to underwrite unbanked and underbanked…the first thing is building those credit data models.”

Credit risk and cash payments

Armed with a team of PhDs in particle physics from the CERN accelerator in Switzerland, they approached the data infrastructure circuit.

“They came in and said, with lightning particles, we can see how the matter of physics work. We believe it’s the same thing for credit underwriting,” said Flores. “You need to have the DNA and culture in your company for testing products.”

Instead of using credit bureau data to underwrite, Kueski uses thousands of data points. From device information to real-time behavioral and sociodemographic data, the information is then analyzed by AI algorithms to determine credit risk. The result was a product that could give people across demographics access to credit.

In this setting, Flores explained that they had to approach two significant challenges in building the products.

The first is the ability to control credit risk.

“It’s extremely tough to build for, especially as you start going to the different segments of the population with limited access to credit.” The second was focused on cash as a form of payment which he explained was a unique product that required an assessment of different monetization methods.

“If you leverage data as well, which is a core competency of this company, there’s a bunch of things you can offer this cash economy.”

“Our mission is to become the financial operating system for the people of Mexico,” concluded Flores. “We want to treat finance in a sense that we make people’s financial lives exciting and calm.”