So many choices and so little time. Consumers want the pay right now, not pay later option, or do they?

In our current days, the ways of self-service payments are growing. PayPal, Venmo, Apple Pay, Google Pay, bank accounts, credit/debit card, cash, or pay by ACH.

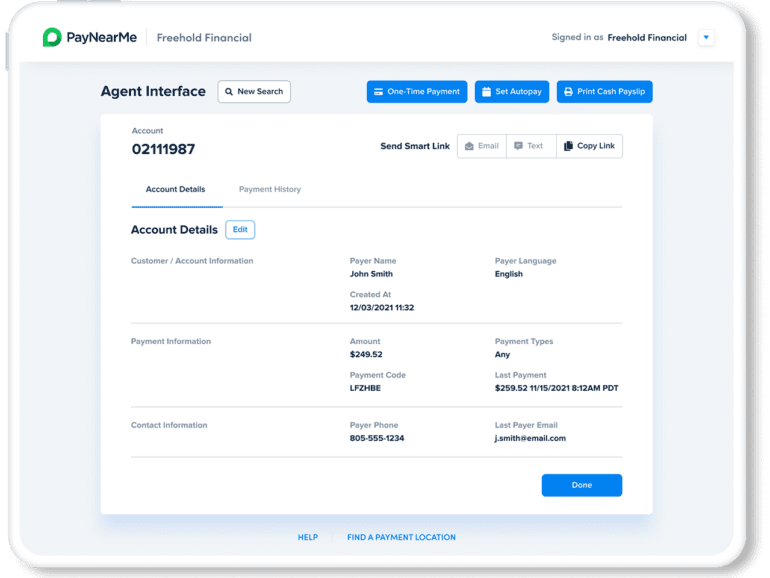

John Minor, SVP of Product and Support of PayNearMe, explains how this platform benefits businesses and consumers.

He says, “PayNearMe right now has a platform that allows us to sell to businesses on two different go-to markets. One is in bill payment with a focus on lending, and the other is in gaming in the jurisdictions where it’s legal.”

“As a platform that allows on the bill payment side, we can help them with all of their payment needs. And that includes multiple payment types and channels, helping them with business rules and operational aspects of what they need to do, engaging with their consumers.”

“We are really the extension of their platform to be their payments roadmap. As the payments world is constantly evolving, new channels are popping up, and new payment types are popping up.”

Related:

Approximately 5,000-plus businesses use PayNearMe’s platform.

These include:

- Consumer Lending

- IGaming & Sports betting

- Mortgage Services

- Buy Here Pay Here Dealers

- Financial Institutions

- Municipal &Utilities

- Property & Casualty Insurance

- Property Management Software Providers

Is paying now more effective than paying later cost-wise?

The potential cost savings for self-service customer touchpoints are fairly large for businesses. A recent Gartner poll showed that live service interactions (phone, email, or webchat) cost an average of $8.01 per contact, while self-service channels come in at $0.10 per contact. When you scale those statistics from one-time to annual savings, it becomes even more essential to find out if your customers are consistent in utilizing self-service bill payments.

Minor says, “If you think of a lot of businesses today, their payments depending on how they’re taken and processed, could be expensive if you don’t have a platform like PayNearMe.”

“And we have a push to get consumers to self-serve on the payment front. In the event a consumer has to actually call in and get a live individual on the phone to help them answer questions and process a payment…our platform is allowing the businesses we serve to push to self-service, which reduces their cost of payment.”

PayNearMe is used in over 40,000 retail locations, such as 7-Eleven, CVS, Walmart, Walgreens, etc. Typically, where a consumer can go in and make a cash payment. If you are a cash-preferred consumer and want to pay one of the businesses that use their platform, you will receive a barcode, scan it, and pay your bill in real-time integration.

“There are new payment types that are growing around us like new payment wallets and ways for people to fund that is occurring. From a payment side, we’re focused on ensuring we have the most modern and popular payment types to serve our consumers,” said Minor.

“And from an application perspective, continuing to help our merchants with the concept of self-service, which is helping consumers kind of self-cure and get the help they need in real-time.”