Rates of digital fraud have returned to pre-pandemic levels, but the numbers of them have risen remarkedly in volume, according to a TransUnion report on fraud released on Wednesday.

Insights from proprietary information and a consumer survey have found that the switch to more digital transactions since the COVID-19 pandemic shows that individual and organizational risk is even greater now.

The 2023 State of Omnichannel Fraud Report from TransUnion, one of the big three credit bureaus globally which has expanded its profile in recent years as an information and insights hub, showed that 4.6 percent of all customers’ transactions in recent years were suspected of fraudulent, a rate in line with what was found in 2019.

However, considering the number of digital transactions has risen significantly in recent years, particularly during the pandemic, the number of frauds has grown.

Number of fraud attempts globally rises 80 percent

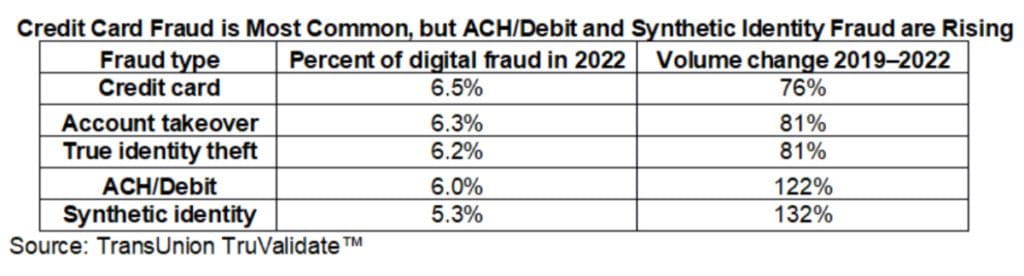

Globally, such attempts have increased by 80 percent from 2019 to 2022 while rising 122 percent for digital transactions originating in the US during that time.

“The pandemic crystallized the fact bad actors focus their efforts on organizations and institutions that have direct access to money, products or services with easily transferable monetary value,” Shai Cohen, senior vice-president and global head of fraud solutions at TransUnion, said in a media release.

“While government-funded pandemic relief programs experienced headline-grabbing levels of fraud, digital fraud trends pointed to industries that saw significant growth in consumer digital engagement.”

Overall, the gaming industry saw the highest rate of attempted fraud at 7.5 percent, followed by the retail sector at 7.2 percent, video gaming at 5.4 percent, financial services at 4.2 percent, online dating, and forum communities at four percent, and travel and leisure at 2.1 percent.

However, regarding the highest rate of suspected digital fraud growth since 2019, the travel and leisure industry experienced the most by far among the industries most affected. The global travel and leisure sector saw a 117 percent increase in suspected digital fraud as people trekked to their favorite destinations.

More than half surveyed targets of fraud attempts

The study also found that more than half of those who responded survey had experienced fraud attempts across various communications methods.

In a TransUnion-commissioned survey conducted across 18 countries and regions, 52 percent of respondents said they were targeted by fraud via email, online, phone call, or text messaging in the three months beginning September 2022. In the US, 58 percent of respondents said they had been targeted over the same period.

“The explosion of digital transactions, the accelerated adoption of digital technologies, and increasing appetite for faster access to funds/credit have led to an increase in fraud losses, particularly in digital channels,” said Naureen Ali, vice president of product management at TransUnion. “Consumers expect organizations to protect their identities and online accounts, and those companies that do not adequately honor those preferences may lose business as a result.”

Rise in volume, severity of data breaches

The study also looked at the volume and severity of data breaches using public data. It showed the number of them rose 83 percent from 2020 to 2022 while the severity of them climbed six percent according to a breach risk score assigned by Sontiq, a TransUnion company that offers identity security solutions, including identity monitoring, restoration, and response products and services.

These breaches have helped fuel an explosion in identity engineering. Outstanding balances attributed to synthetic identities for auto, credit card, retail credit card, and personal loans in the U.S. were at the highest level ever recorded by TransUnion, reaching $4.6 billion in 2022.