As news of a sustained inflation rate in the UK surpassing much of Europe, the cost of living crisis becomes ever more front of mind.

Battling through months, which have turned into years of challenging conditions, UK households continue to struggle without much respite. The hardest hit is those with limited access to financial services.

In Plend’s recent Financial Inclusion Report, the company built on its findings surveyed in the wake of COVID to measure the impact of the cost of living crisis on the underserved.

“For what was already a difficult landscape for many of us with thin and inaccurate credit files (currently holding back over 20 million adults in the UK according to research by PwC), the situation has now been exacerbated by rising energy, food, and housing costs,” said Robert Pasco, Co-Founder, and CEO of Plend in the introductory notes of the report.

“These erode our ability to access affordable mortgages, green home improvements, and debt consolidation solutions.”

Worsening conditions and increased vulnerability

The report found that, unsurprisingly, there continues to be distress among respondents, with 49% reporting a negative impact on their physical and mental health. The worsening conditions since the pandemic has caused increasing numbers of people to struggle to repay loans and gain access to credit products.

Across UK households, average credit card debt had shot up, the report finding an increase of £1,774 in average credit card balance between 2022 and 2023. Almost 30% of respondents said they used their credit cards more than once a week. BNPL balance had also nearly tripled in the last year.

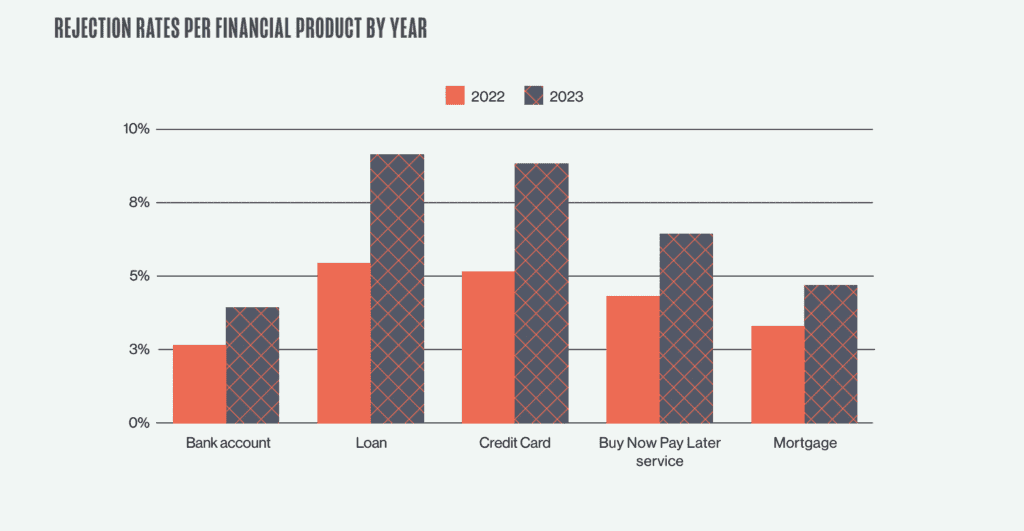

Despite the rising need for credit products, rising rates have made them less affordable. In addition, Plend found that overall rejection rates have increased over the past year for credit products, particularly for loans and credit cards.

“Recent StepChange research revealed that the cost of living crisis has led to more than two in five UK adults (43%) taking action such as rationing day-to-day necessities including energy, food, and housing costs, missing essential bills, or relying on help from friends or family to keep up with credit repayments,” said Richard Lane, Director of External Affairs at StepChange Debt Charity.

“For those relying on credit to make ends meet, it’s likely that borrowing to cover the basics will only exacerbate the financial difficulty.”

It was reported that at least 17.5 million people in the UK are considered financially vulnerable, with one in eight households estimated to experience at least one type of poverty premium. Rising levels of respondents felt “locked out” of the financial system, particularly those from black and minority ethnic backgrounds and younger generations.

Most of these groups said they have turned to sources of credit to tide them over the difficult period.

Due to their inability to access regulated credit, many have turned to friends and family and illegal sources such as loan sharks. Plend found that 3% of the UK adult population has used a loan shark in the last 12 months, and many are actively considering using one.

Loan shark usage is reportedly far greater among those who are already vulnerable to the effects of financial exclusion and the cost of living crisis. This can result in several issues, such as threats of violence and psychological manipulation, piling increasing pressure on these groups and exacerbating the issues posed by the cost of living crisis.

“In January 2023, the ONS5 found that 15% of UK adults reported that they had needed to use credit more than usual, with households with dependent children and those who pay for gas and electricity through prepayment meters even more likely to be doing so,” said Sara Davis, Senior Research Fellow at the Personal Financial Research Centre at Bristol University.

“Therefore, while addressing inadequate income and providing financial support is most important, ensuring that households have access to affordable and fair credit is an immediate concern.”

Cross-industry approach critical

Plend argues that in light of the findings, the UK population hangs in a critical position that could be eased by multiple stakeholders reviewing their approaches to credit products.

“Access to affordable credit is vital for an individual’s financial stability and mental well-being. However, this report exposes that large sections of the UK population are repeatedly being let down,” wrote Pasco. “Due to the cost of living crisis, institutions, lenders, and banks are wrongly taking advantage by charging rates in excess of the Bank of England base rate increases to date.”

The report concluded with an outline of a strategy calling industry actors and government officials to improve vital areas of accessing credit. Transparency on interest rates and reducing bias through “blind credit applications” greatly enhanced the public’s understanding of credit products and their ability to be approved.

The company also called upon government officials and policymakers to improve education about illegal lending and implement financial inclusion standards.

“A collective effort from both industry and the regulator is required to ensure a more equitable and accessible financial landscape for the UK population,” said Alice Tapper, Financial campaigner and Head of Impact at Plend.

“Critical to enabling this action is the prioritization of these issues by the government, followed by a strong legislative response. The compounding effects of the COVID-19 pandemic and the ongoing cost of living crisis threaten to scar the financial lives of countless individuals, making timely and decisive intervention all the more critical.”

RELATED: Cost of living crisis critical: UK fintech sector mobilizes