Artificial Intelligence (AI) is set to impact all areas of financial services. A particular area of focus is the possible development of the chatbot to become a financial assistant.

RELATED: Navigating the Hallucination: GenAI’s Imperfection in FIs

While consumer-facing financial assistants seem a long way off due, in part, to issues with AI hallucinations, employee expense management could be one step along the way.

With hybrid working models becoming commonplace and business travel returning to pre-pandemic levels, financial teams are facing increased complications in tracking and budgeting.

In August, startup-focused fintech Brex released a report that showed financial teams were becoming increasingly concerned about available resources for tracking employee expenses. Respondents found current solutions difficult to use and lacking intuitive user interfaces, resulting in difficulties with employees submitting their expenses and time-consuming expense approval.

Today, September 19, Brex announced the launch of a financial assistant that may solve these issues.

Implementing Natural Language for Employee Expenses

Brex has long implemented AI in its expense management processes, using it to automate and enhance fraud detection, underwriting, and processes such as merchant categorization. However, over the past year, investment in AI has been taken up a notch.

Focused more on customer-facing applications, Brex’s investments have allowed startup teams to improve efficiency and compliance.

In March 2023, the company announced the launch of AI-powered tools for CFOs and their teams using the language processing technology from OpenAI. The tools, aside from improving efficiency, allowed the teams to “converse” with the tool, asking for insights in conversational language.

“The future of insights is more than just automated dashboards and charts that take time to analyze. To us, clear, tangible answers to business questions should be received in real-time, all through natural language,” said Henrique Dubugras, co-founder and co-CEO of Brex at the time. “Our goal with these new features is to empower CFOs and their teams to make more informed decisions and ultimately drive growth for their companies.”

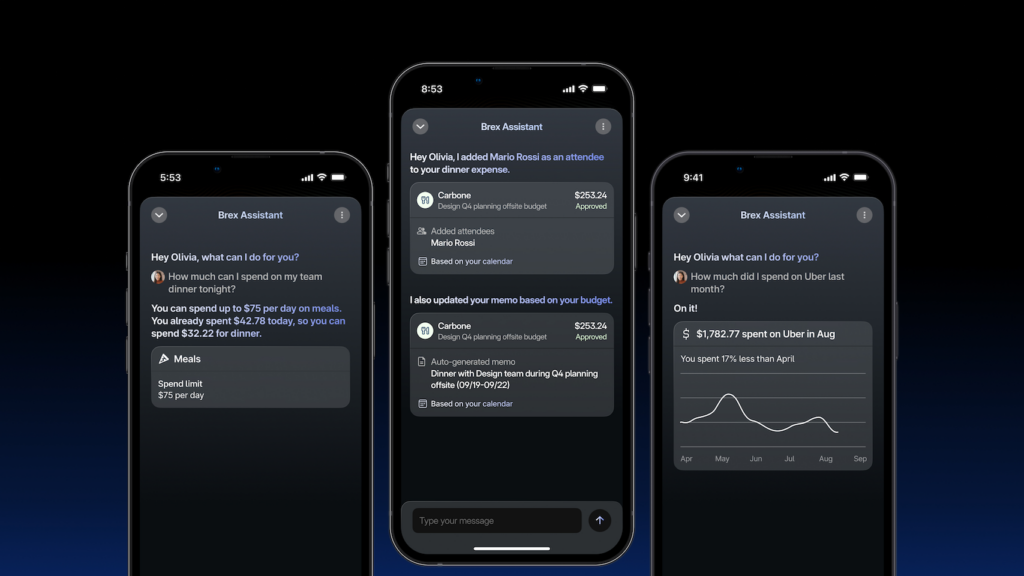

Brex Assistant, launched today, is stated to be the flagship product of a suite of tools titled BrexAI and opens out the technology to all employees of the startups they serve. Through integration into other applications, using data from employee calendars and past expenses, the tool automates employee expense management.

“Brex Assistant knows when an employee travels for work based on their calendar. When they book a flight, Brex Assistant automatically assigns the appropriate travel budget, fills out the business memo, and generates the itemized receipt. The expense is fully compliant with the company’s policies, all without any employee effort,” wrote the company in the launch announcement.

In addition, the tool implements the language processing software seen in other solutions created by Brex to simplify employee interaction with work expenses. Employees can direct questions and prompts to the assistant in conversational language as if they were speaking to their finance team.

“Brex Assistant has the ability to answer questions employees would traditionally ask their finance team, respond to and execute employees’ commands on how to best complete expenses, and answer questions about a past transaction to help employees remember the business context,” stated Brex.

The tool could improve efficiency for finance teams tracking expenses, as well as enhance employees’ understanding of the expenses they incur.