The credit bureaus are becoming fintech companies.

In an industry first, Experian is now offering a digital checking account and debit card called Experian Smart Money™ Digital Checking Account. It comes with Experian Boost built in, so that is the hook.

Experian Boost is an opt-in service that allows consumers to potentially get credit for paying regular bills on time such as rent, utilities, cell phone and streaming services.

It currently has 14 million people signed up. This new account from Experian will automatically detect transactions that are eligible for Experian Boost and add them to a consumer’s Experian credit file, potentially increasing their credit score.

The bank account is offered in partnership with Community Federal Savings Bank and offers the standard fintech features such as early access to your paycheck, free ATM transactions, bill pay and no monthly fees.

While the fintech bank account space is crowded this could attract those people who are highly motivated to increase their credit score.

FEATURED

Experian launches new digital checking account & debit card

SPONSORED

See Who’s Attending the American Fintech Council Policy Summit

Don’t miss the most important Fintech Policy Summit of 2023. Speakers include: Congressman French Hill, Congressman Mike Flood, Renauld Laplanche, Co-Founder & CEO, Upgrade, and many more.

FROM FINTECH NEXUS

The changing, customer-centric bank

Competition, regulatory pressure and changing customer preferences are driving banks to refocus on their customers.

PODCAST

Podcast: How to build a $60B volume global payments platform, with Rapyd CEO Arik Shtilman

WEBINAR

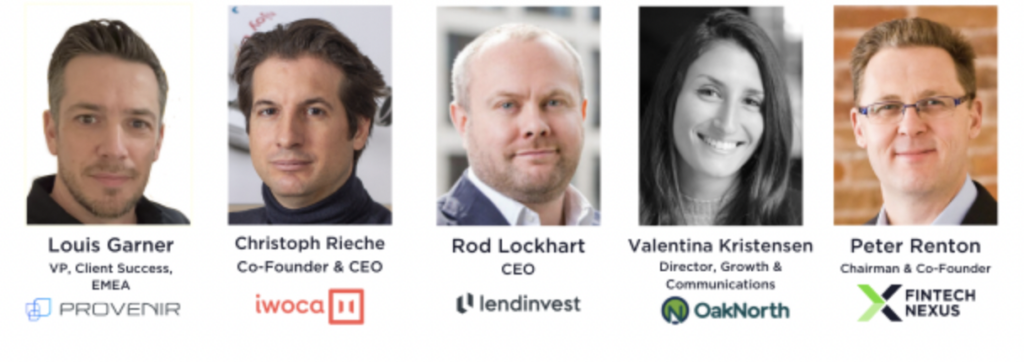

Trends in digital lending for 2024: AI, automation, embedded finance and more. After registering, you will receive a confirmation email about joining the webinar.

Oct 10, 9am EDT

As we begin to look to 2024, we can expect technology to continue to have a profound impact on consumer lending.

ALSO MAKING NEWS

- Global: Visa earmarks $100M to invest in generative AI companiesVisa announced today that it plans to invest $100 million in companies developing generative AI technologies and applications “that will impact the future The investments will be made through Visa Ventures, the card giant’s 16-year-old global corporate investment arm.

- UK: Apple Launches “Connected Cards” Using Open Banking (In The UK)The upcoming Apple iOS 17.1 developer beta shows the first services for the new iPhone Wallet app powered by the U.K.’s Open Banking API.

- USA: Silicon Valley Bank seeks to recapture lost ground in venture debtA remnant of the failed bank, now owned by First Citizens, is trying to reclaim its once-prominent role in venture-debt lending to startups. But competition from HSBC and JPMorgan Chase as well as fintechs has multiplied in recent months.

- USA: Ether ETF Debut Leaves Small Investors UnderwhelmedMost of the futures-based funds ended their first trading day in the red.

- USA: Bankrupt Crypto Lender Celsius Eyes Creditor Payback by Year EndThe bankrupt crypto lender’s restructuring plan includes the establishment of a new entity with $450 million in seed funding.

- Global: Blockchain Analytics Firm Chainalysis Cuts 15% of StaffThis is the second round of layoffs by the analytics firm in less than 12 months.

- Global: JPMorgan CEO Jamie Dimon says our children will probably only work 3.5 days a week thanks to AIAI is expected to change the way we work forever, but that has its perks. JPMorgan’s CEO predicts our children’s workweeks will be cut to 3.5 days.

- USA: Jerome Powell and the Fed are officially on InstagramThe Fed announced Monday that it would join Instagram and Threads, bolstering its social-media presence to seven platforms.