SoFi reported earnings today for Q4 2023 and it was a blowout quarter despite the challenging macroeconomic environment. The big story was the company achieving profitability (officially GAAP net income profitability) in Q4, a first for SoFi. There was also a 35% year-over-year increase in adjusted net revenue, reaching $2.1 billion, and a significant boost in adjusted EBITDA.

Here are some of the highlights:

1. Financial Performance: SoFi reported a record adjusted net revenue for the full year of $2.07 billion, surpassing their guidance, up 35% from 2022. Adjusted EBITDA for 2023 was $432 million, also beating their expectations and up 201% from 2022.

2. Member Growth: The company saw a 44% year-over-year increase in membership, reaching over 7.5 million members. It was remarkably steady growth in the number of members with year-over-year growth between 44% and 47% each quarter.

3. Product Expansion: SoFi separately accounts for the total number of products being used by members and that number was 695,000 in Q4, taking their total to 11.1 million, a 41% year-over-year growth. This reflects just under 1.5 products per member.

4. Technology: SoFi acquired the technology platform Galileo back in 2020 and this division powers some of the leading fintechs such as SoFi, DailyPay, Bluevine, Dave, MoneyLion and Digit. SoFi then reports on the total number of accounts open through the Galileo platform and that number today is 145 million, this was 11% year-over-year growth.

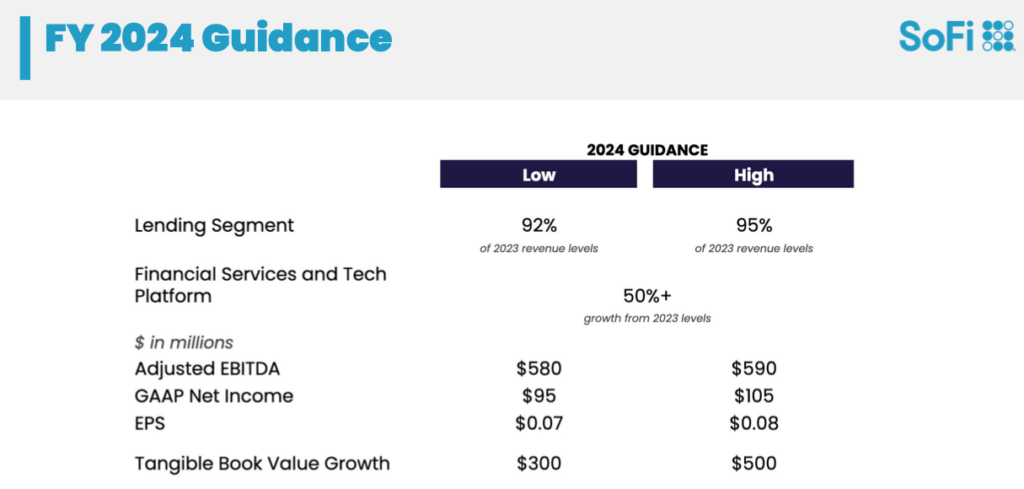

5. 2024 Outlook: SoFi projects a balanced growth between its Tech Platform and Financial Services, expecting over 50% growth compared to 2023. They anticipate the Lending segment to maintain up to 95% of its 2023 revenue levels, with a forecast of $95 – $105 million in GAAP Net Income and $580-590 million in Adjusted EBITDA.

In the Q&A with analysts, the discussions focused on SoFi’s conservative approach to economic projections, growth balance between lending and non-lending segments, credit performance expectations, and revenue outlooks for different business segments. Additionally, there were detailed discussions about factors influencing loan sales, fair value marks, and interest rates. The SoFi leadership provided expectations for future growth and their approach to managing different aspects of the business in today’s evolving economic landscape.

Any way you slice it this was a great quarter for SoFi. After talking about it for the last few earnings calls, they finally reached profitability in Q4. Given the challenging macro environment that was quite an achievement. The stock market agreed and SoFi was up more than 20% today.