The venture capital firm F-Prime released their 2024 State of Fintech report today. It makes for some very interesting reading.

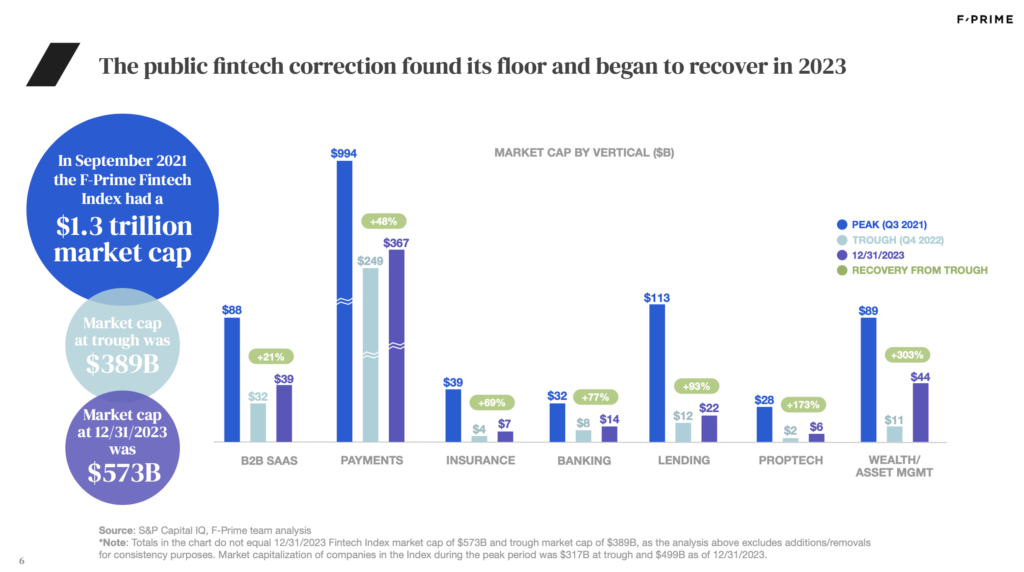

It takes us through the state of fintech today with a focus on valuations and funding rounds. The graphic below shows the correction in public fintech valuations across different segments. While we are a long way away from the peak of Q3 2021, we are above the trough of Q4 2022 in all fintech segments.

This correction has not really made it to the private markets yet where valuations are down and number of funding rounds are also down across all stages except seed.

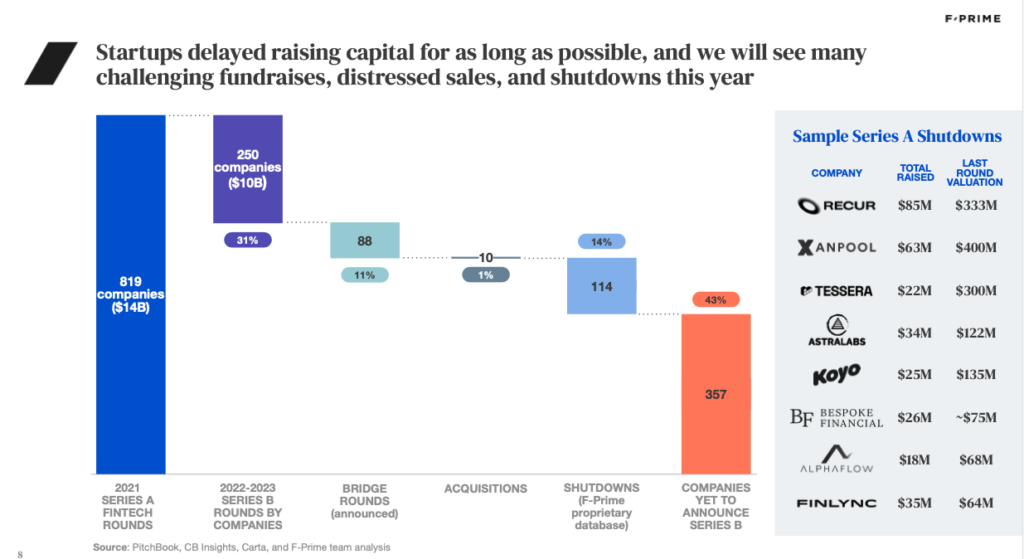

The most interesting chart of all is the one below. This shows 819 fintech companies raising a collective $14 billion in Series A funding in 2021. Only 250 of these companies raised a Series B in 2022 or 2023. Some raised a bridge round, some have shut down but almost half have yet to announce any kind of follow on round. This portends a lot of action in M&A and likely shutdowns in 2024, with hopefully a few successful Series B rounds.

If your company was on the market in 2023 you were likely out of luck with the least amount of M&A activity of the last five years. In 2023 M&A volume was down a staggering 72% from 2021.

F-Prime also looked at fintech disruption across verticals breaking each down into how much disruption has taken place. It chose mobile banking, business banking and open finance as the three areas where disruption has been embraced by both fintechs and incumbents. We are still waiting for meaningful disruption to happen in crypto, real-time payments and generative AI.

The six major fintech trends that F-Prime is tracking for 2024 are:

- Payments tooling

- Vertical APIs

- Digitization of the wealth tech stack

- AI for professional services

- Emerging markets fintech

- Stablecoins

F-Prime is also the creator the F-Prime Fintech Index, the leading index for publicly traded fintech companies. The index covers 49 global fintech companies with a total market cap of $561 billion. While the index is understandably below its peak of late 2021, it saw a rebound in 2023, with the index up 114% for the year.

We have not seen a major fintech IPO in the last two years but the tide could be turning with many large fintechs considering an IPO in the near future.

You can download the full report by providing your email address here.