The New York Community Bank saga has occupied the headlines for much of the past month. But the bank may finally be seeing light at the end of the tunnel.

Yesterday, NYCB received a $1 billion infusion of capital from a group that included former Treasury Secretary Steve Mnuchin and former OCC head Joseph Otting.

Otting will become the new CEO, the third person to hold that title in the last few weeks.

The bank announced today that it has lost 7% of its deposits in the last month, a surprisingly low percentage after what we saw a year ago with SVB. NYCB is also slashing its dividend to 1 cent per share.

Investors were pleased with this development as the stock price is up over 100% from its low yesterday before the announcement of the capital injection.

As the one-year anniversary nears for the SVB debacle, stability at NYCB will help with confidence in the banking system.

Featured

> NYCB says it lost 7% of deposits in the past month, slashes dividend to 1 cent

NYCB had $77.2 billion in deposits as of March 5, NYCB said in an investor presentation tied to the capital raise, down from $83 billion it had as of Feb. 5.

From Fintech Nexus

> Digital lending leaders should always be prepared for a liquidity crunch

By Danielle Sesko

A liquidity crunch can be devastating for a digital lender. Here are some ways for lenders to prepare and combat these difficult times.

> The Lending Singularity Isn’t Near – It’s Already Here

By Shantanu Gangal

Generative AI has come to lending. This new technology opens up new avenues for success for forward thinking lenders.

Podcast

Mark Gould, Chief Payments Executive for Federal Reserve Financial Services on the rollout of FedNow

When FedNow launched last July there was a lot of pressure on the Fed to get this move into instant payments right. The head…

Listen Now

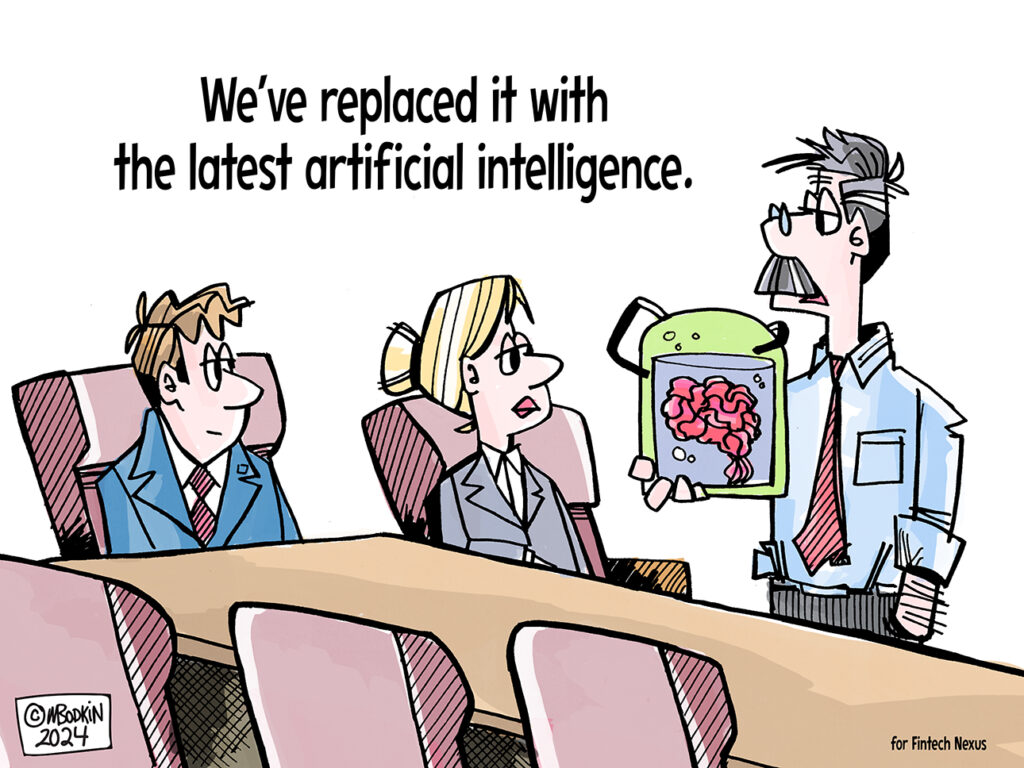

Editorial Cartoon

Also Making News

- USA: Musk says X could soon receive payment licenses in New York, California

Elon Musk said on Wednesday that his social media platform X could soon receive approval for a money transmitter license in New York, putting the platform a step closer to offering payment features.

- USA: Credit Karma embeds generative AI in overhauled app

The personal finance site is rolling out changes to its app that incorporate AI-powered chat and explanatory articles customized to each user.

- Global: How Klarna’s IPO Prep Got Tangled Up in a Boardroom Drama

The last thing Sebastian Siemiatkowski needed was boardroom drama.

- USA: How payments tech is helping farmers’ markets go digital

To serve an increasingly online audience, POS Nation has acquired agriculture e-commerce platform GrazeCart, an example of vendors joining forces to adapt to shifts in the agriculture industry.

- Global: Introducing the Dimonsaur

For the past decade, Jamie Dimon has regularly been decrying bitcoin as a scam. Here’s a few of his quotes: Jamie Dimon tells Davos that Bitcoin is a ‘pet rock’ that does nothing—except help with fraud and money laundering Jamie Dimon lashes out against crypto: ‘If I was the government, I’d close it down’.

- UK: Nationwide to buy Virgin Money for £2.9 billion

Nationwide has struck a deal to buy Virgin Money for £2.9 billion in a move that would see the building society expand into business banking and present a challenge to the might of the four big high street banks.

- USA: Citi Ventures invests in bank-to-bank loan marketplace Capstack

Capstack Technologies, a bank-to-bank marketplace designed to mitigate asset risk, has secured a strategic investment from Citi Ventures.

- Global: Revolut Launches Direct Crypto Purchase Into MetaMask Wallets in Bid to Simplify Web3

The digital bank continues to expand its crypto offerings with its new product “Revolut Ramp,” which aims to make it easier for customers to purchase cryptocurrencies.

To sponsor our newsletters and reach 275,000 fintech enthusiasts with your message, contact us here.